Stocks Rally After Horrible Housing Data, Rate-Hike Odds Sink

TL;dr: Stocks and Oil up; bonds, bitcoin, dollar, gold unch...

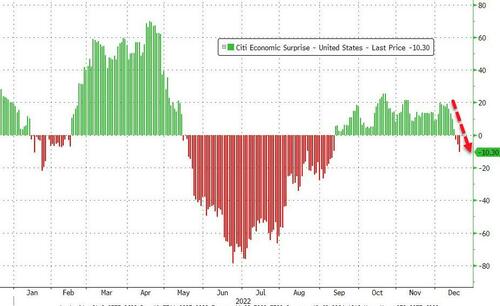

Ugly housing data was offset by positive sentiment (and inflation expectations) data today but overall the US Macro Surprise continues to sink (now negative at its lowest since early September)...

Source: Bloomberg

...and with liquidity dismal, the machines decided a run to the upside (and the S&P 500 50DMA) was in order...

...but when Europe closed, that buying panic faded but it was still a big up-day for the majors with Small Caps outperforming

(All of today's gains came between the US cash open and EU cash close)...

Overall, rate-trajectory expectations have drifted dovishly in the last two days...

Source: Bloomberg

A strong 20Y auction at 1300ET pushed yields lower but overall, the short-end outperformed on the day, as the rest of the curve was basically unchanged...

Source: Bloomberg

The dollar ended the day basically unchanged...

Source: Bloomberg

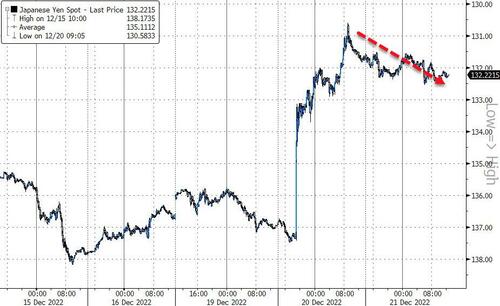

Yen weakened very modestly back from post-BOJ spike highs...

Source: Bloomberg

Bitcoin was also practically unchanged with just a small leak lower towards the end of the day...

Source: Bloomberg

Gold ended very modestly lower on the day (with futs holding above $1800) after hitting $1835 intraday...

Oil surged for the third straight day with WTI testing up toward $79...

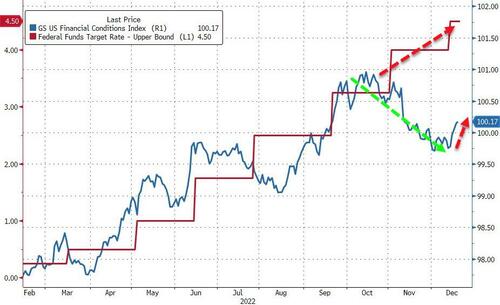

Finally, markets pricing in Fed rate-cuts for the second half of next year may be jumping the gun. Easing financial conditions since October despite a string of rate-hikes could give the Fed an excuse to maintain peak interest rates for longer than expected...

Source: Bloomberg

But the last few days - post-Fed - have seen financial conditions start to tighten as perhaps the market is starting to hear Powell's jawboning.

https://ift.tt/et2rOld

from ZeroHedge News https://ift.tt/et2rOld

via IFTTT

0 comments

Post a Comment