The New Cold War Has Begun

Submitted by QTR's Fringe Finance

Over the course of the last year, I have been sounding the alarm about the growing divide between BRIC nations, like China and Russia, and the United States.

It started last year in August 2021, long before our current inflationary crisis and the war in Ukraine, when I predicted that China would try to concoct a gold backed digital currency that would put the U.S. dollar on its heels.

As Russia’s war in Ukraine has progressed, the country has allied itself with China further and I have written and talked extensively about the threat that I think their relationship poses to the United States and the West.

Reading not so subtle tea leaves - like the BRIC nations’ publicly stated intentions to create a global reserve currency (announced in July 2022, predicted by me in February 2022), and China’s all-but-certain plans to eventually try to take back Taiwan - I have been making the argument that the United States, with its $31 trillion in debt, is in possibly the most precarious economic position it has been in for decades.

As we experienced firsthand, Chinese supply chain interruptions during the Covid pandemic - which now looks to have all-but-certainly started due to a lab leak - have the ability to significantly impact quality of life in the United States.

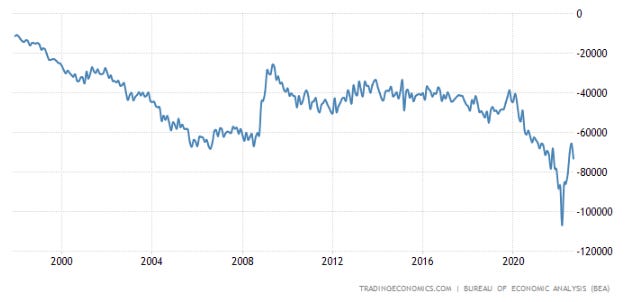

After all, we import a majority of the products that we use on an everyday basis from China. We’ve run huge trade deficits for years and have ignorantly believed that the dollar’s reserve status would allow us to continue this unfair deal, wherein we give China soon-to-be-worthless printed paper and they give us actual goods, for as long as we want.

United States Balance of Trade

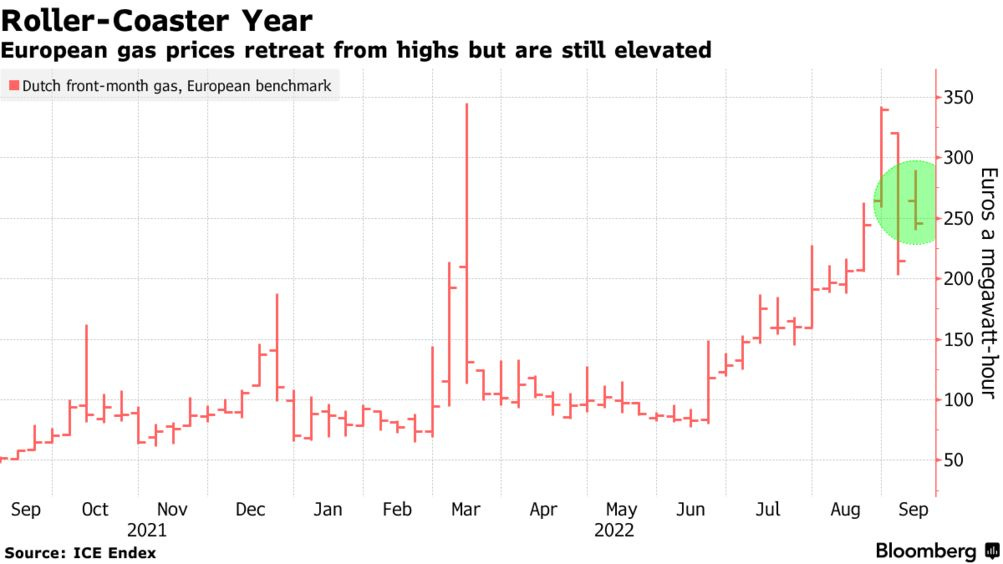

At the same time, lack of Russian energy resources has also had a negative impact on quality of life, not only in the rising price of oil in the United States, but in the soaring cost of energy in Europe.

And additional recent revelations have supported my thesis that the United States could be on the precipice of a sea change in dollar hegemony, geopolitical strength and quality of life.

There’s been several alarming developments over the last several weeks that have furthered my case. Let’s review them and what I believe the situation means for investors.

Many of these developments feature China as a direct protagonist to the West.

While reading this, keep in mind that China isn’t alone, it is allied with Russia, Saudi Arabia, India, Brazil and many other nations. It’s also worth noting that China has a growing domestic crisis on its hands as its citizen have begun actively demonstrating and pushing back on Covid lockdowns in a way never thought possible for a country that doesn’t see much public outcry to government policy.

60% OFF: My subscribers had a first look at this piece several weeks ago. If you'd like to subscribe, for the holiday, I can offer you 60% off for life by using this link.

The first red flag is a concept I have talked about extensively with my friend Andy Schectman: the idea of the dollar no longer being the world’s key petrocurrency.

A key element to the dollar remaining the global reserve currency is its demand, much of which globally is driven by transactions in oil. This started back in 1974, when the U.S. promised the Saudi kingdom protection in exchange for the Saudis pricing oil in U.S. dollars.

“…Saudi Arabia, which had the world’s largest proven reserves of oil, was to price and sell its oil only in dollars and was also obliged to invest its surplus oil proceeds in US debt securities…”

But that four decade-old deal is starting to slip away, it appears. In March 2022, the Wall Street Journal first reported that the Saudis were considering stepping away from the dollar in exchange for - you guessed it - the Chinese yuan.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

Other countries are already beating Saudi Arabia to the punch. Russia is selling gas to China in roubles and yuan as of earlier this year. Debt laden Ghana, though not a powerhouse on the global GDP stage, has just agreed to buy oil with gold instead of U.S. dollar reserves to held secure its currency.

Elsewhere among BRIC nations and BRIC nation-candidates, Turkey and Qatar are tying themselves up financially. Qatar is sealing long-term LNG deals with China.

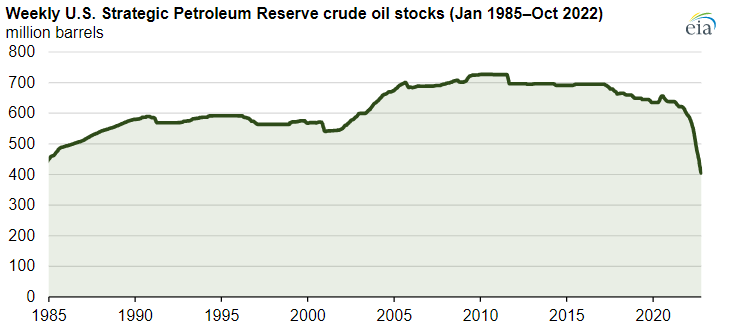

Over here in the United States, distillate stocks are running at their lowest in decades and we have depleted our strategic petroleum reserve.

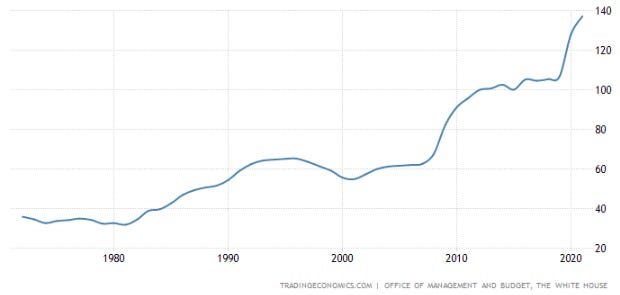

While at the same time, our national debt continues to run higher, faster. Our national debt currently stands at $31.3 trillion, but more alarmingly our national debt to GDP has scorched to 50 year highs and is now near 140%.

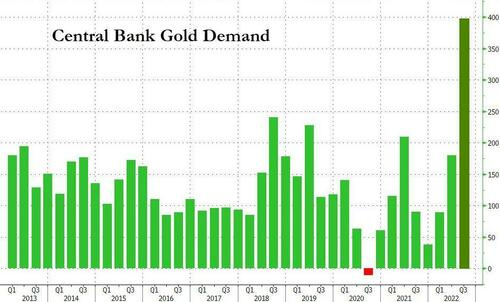

The second alarm bell that should be going off is that Central Banks elsewhere in the world are in a rush to stockpile gold and one “mystery buyer” has been confirmed to be China.

My readers will remember just days ago when I pointed out that a large “mystery buyer” was hoarding gold on a global stage. “They appear to have an insatiable appetite for the precious metal,” I wrote last week.

There Are Massive, Record Breaking "Mystery Buyers" In Gold All Of A Sudden

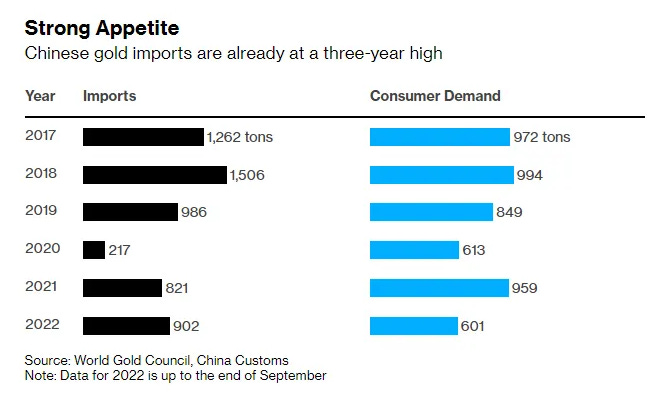

Bloomberg called the buyers “mystery whales” at the time and postulated that it was likely either China, Russia, Saudi Arabia or India. That buyer was revealed last week by Nikkei to likely be China, who was said to be buying gold to cut their dependence on the U.S. dollar. Nikkei wrote:

Central banks bought a net 399.3 tonnes of gold in the July-September period, more than quadrupling on the year, according to the November report by industry group the World Gold Council. The latest amount marks a steep jump from 186 tonnes in the preceding quarter and 87.7 tonnes in the first quarter, while the year-to-date total alone surpasses any full year since 1967.

The article continued:

"Seeing how Russia's overseas assets were frozen after its invasion of Ukraine, anti-Western countries are eager to accumulate gold holdings on hand," said Emin Yurumazu, a Japan-based economist from Turkey.

"China likely bought a substantial amount of gold from Russia," said market analyst Itsuo Toshima.

China has made similar moves in the past. After staying mum since 2009, Beijing stunned the market in 2015, disclosing it had boosted gold holdings by about 600 tonnes. It has not reported any activity since September 2019.

(Chart: Zero Hedge, who had a great writeup on China’s reveal as the mystery buyer)

And also noted that these purchases are coming while China dumps U.S. treasuries and strengthens its trade relationship with Russia:

China has been unloading U.S. bonds. It sold $121.2 billion in U.S. debt , the equivalent of roughly 2,200 tonnes of gold, between the end of February -- immediately after Russia's first attack on Ukraine -- and the end of September, according to the U.S. Treasury Department.

Chinese imports of gold from Russia surged in July, soaring more than eightfold on the month and roughly 50 times the year-earlier level, according to China's customs authorities.

Bloomberg noted in its original article about a week ago that the Central Bank purchases were nearly double the previous record.

This isn’t just a move by China you would make if trying to shore up your relationship with Russia. It’s also a move you would make if you were preparing for war, economic or otherwise.

It’s also not definitive proof that China is going to back its currency with gold, but it would certainly be a large step in the right direction, should China want to head in that direction.

60% OFF: My subscribers had a first look at this piece several weeks ago. If you'd like to subscribe, for the holiday, I can offer you 60% off for life by using this link.

A third red flag worth keeping an eye on is China’s constant espionage efforts in the United States.

Remember back in July when I wrote about how an investigation revealed that China spied on the Federal Reserve and even detained and threatened as U.S. economist? It turns out my “paranoia”, as many readers called it then, continues to be warranted.

It was reported last Wednesday that U.S. Senators were warned that “hundreds of Chinese-manufactured drones have been detected in restricted airspace over Washington, D.C., in recent months, a trend that national security agencies fear could become a new means for foreign espionage.”

Politico reported last week:

The recreational drones made by Chinese company DJI, which are designed with “geofencing” restrictions to keep them out of sensitive locations, are being manipulated by users with simple workarounds to fly over no-go zones around the nation’s capital.

Federal officials and drone industry experts have delivered classified briefings to the Senate Homeland Security, Commerce and Intelligence committees on the development, three people privy to the meetings said.

This comes at a time when the U.S. is mostly standing idly by while popular phone software TikTok, described as a “national security threat” by many analysts, continues to send information from the U.S. back to China.

FBI director Christopher Wray testified last week before the House that the FBI had a “number of concerns” about the software: "They include the possibility that the Chinese government could use it to control data collection on millions of users or control the recommendation algorithm, which could be used for influence operations if they so chose, or to control software on millions of devices, which gives it an opportunity to potentially technically compromise personal devices."

Meanwhile, as I have been pointing out for years, many of our government buildings, including the Pentagon, are littered with China-manufactured Hikvision cameras.

Taken cumulatively, these new developments paint the exact picture one would expect from a country that is actively battening down the hatches. In a worst case scenario it could represent coming aggression toward the United States and the West. In a best case scenario, it could simply be China preparing for a massive geopolitical rejiggering of economic power. Either way, taken collectively, I can’t help but think it’s a new Cold War that has already begun:

-

The U.S. is economically in its most precarious state in decades and has depleted a fair amount of its oil reserves

-

Saudi Arabia is openly floating the idea of stepping away from the U.S. dollar and switching the Chinese yuan for oil payments, pressuring a key item of support for the dollar as global reserve currency

-

China and Russia have openly floated the idea of challenging the dollar as global reserve currency

-

Other countries are buying oil in roubles, yuan and gold

-

Central Banks are hoarding gold to the tune of quadrupling purchases from the year prior, including China acting as a "mystery whale" with large purchases

-

China is also dumping U.S. dollar denominated treasury bonds

-

New espionage efforts may have emerged with Chinese-made drones flying in restricted airspace over the Capitol, following confirmed reports of China attempting to spy on the Fed and shake down U.S. economists

-

Popular Chinese software like TikTok has been called a "national security threat" by the FBI

I’ve never been more convinced that my thesis about BRIC nations looking to separate from the West is playing out before our eyes. As is typical, Wall Street and analysts have been unable to zoom out and see the larger picture here - either from recency bias or due to willful ignorance. But to me, it’s clear - and for those of you that haven’t yet, I encourage you to listen to this podcast with Andy Schectman, wherein he lays out more of the details of this thesis.

Then there’s the idea of how I would personally invest for a situation like this. Putting aside the fact that the Fed is “tapping out” our economy as we speak, I still think there are some growth names worth considering as we move into this new epoch globally.

First and foremost, I have been a large bull on cybersecurity names, including Palo Alto Networks (PANW) and have been gaining exposure to the space through the iShares Cybersecurity and Tech ETF (IHAK). When it comes to defense, I also think about names like Lockheed (LMT) which I have been bullish on for a year now and Raytheon (RTX). I also gain exposure to that space via the iShares US Aerospace & Defense ETF (ITA). Obviously, I also continue to like gold and silver, as well as gold (GDX) and silver miners (SIL).

When it comes to the market overall, I’ve been cautious.

There’s no nice way to say this: recency bias is a bitch. It’s easy to believe that because everything has been copacetic over the last decade or two with regard to both monetary policy and geopolitical volatility, that such a complacency will continue.

But to me, the news items that continue to trickle in do nothing but consistently and methodically lay bricks into the firm foundation of my long-held belief that we are in the midst of an unprecedented pivot the likes of which we’ve never seen before.

60% OFF: My subscribers had a first look at this piece several weeks ago. If you'd like to subscribe, for the holiday, I can offer you 60% off for life by using this link.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

https://ift.tt/Bj0ifwZ

from ZeroHedge News https://ift.tt/Bj0ifwZ

via IFTTT

0 comments

Post a Comment