What China's Accelerated Reopening Means For The Economy And Markets

On the evening of 26 December, China released new guidelines to significantly relax its Covid control policy for domestic infections and inbound travelers, effective 8 January 2023. As reported previously, key measures include i) removing quarantine requirements for Covid cases, ii) abandoning the risk district classification system, and iii) shifting to a de facto “0+0” regime for inbound travelers. In a note from Goldman's China strategy chief, Hui Shan, he writes that while the new guidelines as a major step towards the full reopening, he cautions on the increased challenges to China’s medical system in the near term. He adds that the frontloaded China reopening timetable adds conviction to the bank's below-consensus forecast for Q4 GDP growth (+1.7% yoy) and above-consensus 2023 GDP forecast (+5.2% yoy)

1. Key takeaways from the new guidelines

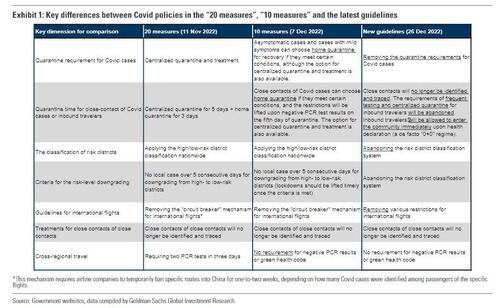

On the evening of 26 December, China’s National Health Commission (NHC) released new guidelines to significantly relax its Covid control policy for domestic infections and inbound travelers (Exhibit 1).

The new guidelines are as follows:

- On the management of Covid: China will immediately rename the term “Novel Coronavirus Pneumonia” (新冠肺炎) to “Novel Coronavirus Infection” (新型冠状 病毒感染). It will downgrade the management of the disease from the current top-level Category A to less strict Category B, effective 8 January 2023, after which China will no longer impose quarantine measures for Covid cases, will no longer trace their close contacts, and will no longer identify high/low-risk districts of Covid.

- On policies for inbound travelers: China will abandon the requirements of frequent testing and centralized quarantine for inbound travelers (although a negative 48hr PCR test result before departure to China is still required). Inbound travelers will be allowed to enter the community immediately upon health declaration, and various restrictions on the international routes of airlines will be removed. China also pledged to make it easier for foreigners to obtain inbound travel visas, and gradually normalize domestic residents’ outbound travel.

- On medical preparations: China pledged to further strengthen its medical preparations to cope with the reopening, including pushing up the vaccination rate for the elderly population, improving the supply of Covid-related medicines and test kits, expanding intensive care units (ICUs), and enhancing the supply of medical resources in the rural areas.

2. Another significant step towards full reopening

China has rapidly relaxed its Covid policies since November, featured by the Covid “20 measures” on 11 November, “10 measures” on 7 December, and the new guidelines on 26 December. China’s new guidelines, which will de facto reopen borders and abandon quarantines, are a significant step towards the full reopening (or, the “living with Covid” mode).

According to Goldman, the most important change in the guidelines lies with cross-border policies, which implies a de facto “0+0” regime for eligible inbound travelers starting from 8 January 2023 (vs. the current “5+3”). That said, on the domestic front, the downgrade of Covid management and removal of quarantine requirements appear to be an “after the fact” adjustment, as in practice many people who have tested positive have been allowed to go to work and enter public places in recent weeks.

However, amid the rapid reopening, the challenge to China’s medical system may have been significantly escalated, especially for less developed inland and rural areas amid the upcoming Lunar New Year holiday. This highlights the urgency of more and faster policy efforts to boost elderly vaccination and other medical resource supply (e.g., ICU beds, oral pills, and medical staff).

3. Implications for growth and markets

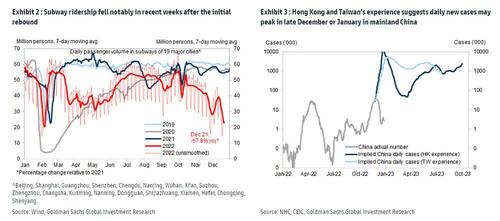

High-frequency mobility data (Exhibit 2) and December Emerging Industries PMI (EPMI) pointed to weaker growth momentum during the frontloaded "exit wave", on the back of surging infections, a temporary labor shortage and increased supply chain disruptions. Although the NHC stopped the release of Covid case data, experience from Hong Kong and Taiwan suggests daily new cases may peak in late December or January in mainland China (Exhibit 3). According to Goldman, this adds conviction to the bank's below-consensus forecast for Q4 GDP growth (+1.7% yoy) countered by above-consensus 2023 GDP forecast (+5.2% yoy).

Furthermore, Goldman also maintain the view that China reopening is positive for CNY, and that improved growth expectations in 2023 might outweigh unfavorable factors such as deterioration in goods and services trade balances. On FX, the bank expects small appreciation of the USDCNY over the 12-month horizon to 6.90.

On the spillover effects of China reopening, Hong Kong and Thailand may benefit the most from the international tourism channel if China removes visa restrictions and outbound travel gradually normalizes.

More in a full note from Goldman available to professional subs.

https://ift.tt/YVWAdeJ

from ZeroHedge News https://ift.tt/YVWAdeJ

via IFTTT

0 comments

Post a Comment