Banks & Big-Tech Breakdown, Credit Calm, Bitcoin & Bullion Bounce

Yesterday's early exuberance gave way to reality today as macro data and politics were back.

Consumer confidence lifted modestly today despite weakening home prices (7 straight months of declines), wholesale and retail inventories on the rise again (maybe consumer not so strong after all), and plunging Richmond Fed Business Conditions.

That all pushed the market dovishly, pricing in a 54% chance of a 'pause' by The Fed in May...

Source: Bloomberg

Regional Banks were dumped today as the Washington hearings on bank failures offered nothing but more regulation and more laws and tighter credit and tighter margins... and no bailouts...

With First Republic and PacWest spanked again...

As Bloomberg noted, the $30 billion Financial Select Sector SPDR Fund (XLF), which holds the financial-related components from the S&P 500 Index, is testing its highs from nearly 16 years ago, along with its lows of the past 18 months...

Source: Bloomberg

“Triple bottoms are pretty rare, but the more times you test a given level, the more likely it is to break,” Jonathan Krinsky, chief market technician at BTIG, said.

“What has surprised a lot of people, including myself, is that the weakness in financials was a benefit to tech because a lot of funds went into technology. If you’re a long-only money manager with a cash mandate where you have to be fully invested and have been selling a lot of financials and cyclicals, you have to put your money somewhere. That’s part of the reason why tech has done well.”

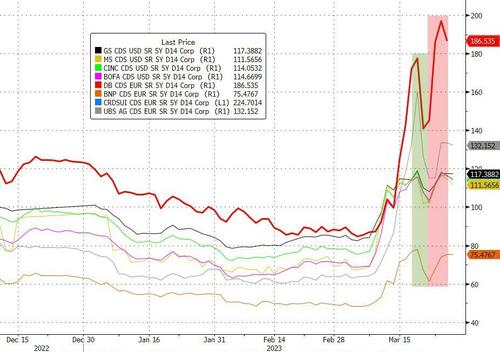

And in case you thought that Europe was fixed, bank credit spreads remain notably more elevated than immediately after the CS bailout...

Source: Bloomberg

Broadly speaking, the US majors were all lower on the day, with Nasdaq leading the drop. The S&P joined Nasdaq in erasing all of yesterday's gains. Small Caps remain the leader this week And The Dow is holding on to gains...

There was a last second jump in stocks on headlines (from Charlie Gasparino - so consider the source) that FRC is no longer for sale...

The S&P 500 fell back to its 100DMA...

The Dow was glued around its 200DMA...

No real attempt at a squeeze in the indices today as 'most shorted' stocks faded most of the day...

Source: Bloomberg

Interestingly, while banks were monkeyhammered, Office REITs/CRE stocks squeezed notably higher this afternoon...

Source: Bloomberg

Value has outperformed Growth for 3 straight days... but note where the reversal happened (this is Russell 1000 Value / Russell 1000 Growth)...

Source: Bloomberg

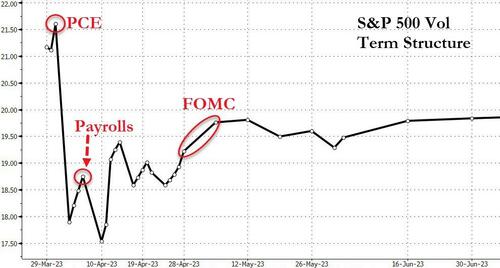

The market is pricing in a lot of uncertainty around this week's PCE print...

Source: Bloomberg

Treasury yields ended the day higher but it was a very different day than we have seen recently with the long-end very quiet relative to recent chaos. The short-end was uglier but the belly was worse today, also again not quite so much panic selling (or buying)...

Source: Bloomberg

One thing of note was that today 5Y auction was strong - as opposed to yesterday's ugly 2Y auction.

Also we note that while issuance has been non-existent since the start of March, yesterday saw a metric fuckton of European and US corporates issuing USD bonds (which helps explain the near vertical ramp across the curve from the middle of Friday's session) as windows opened... and why today, without that rate-lock flow and corporate supply, yields actually traded in a narrow range...

Source: Bloomberg

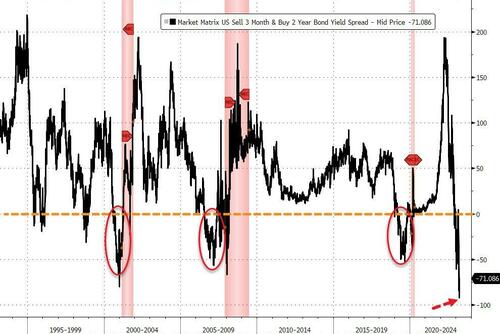

One stand out on the curve that we haven't discussed too much is the 3m2Y spread, which hit an all-time record low (inverted) this week at (-92bps)...

Source: Bloomberg

The dollar leaked lower for the second day in a row, back near post-FOMC lows...

Source: Bloomberg

After the Binance buggering yesterday, Bitcoin bounced back above $27,000...

Source: Bloomberg

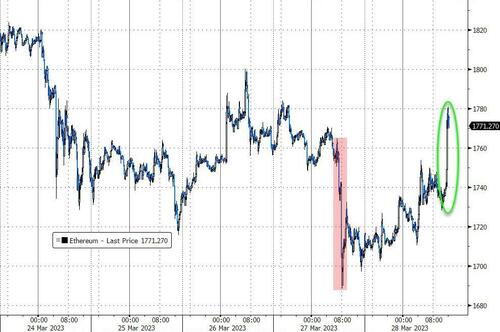

But Ethereum really jumped, back above yesterday's highs...

Source: Bloomberg

Gold gained on the day, finding support around $1950...

Oil prices rallied again today, with WTI within a tick of $74 ahead of tonight's API inventory data...

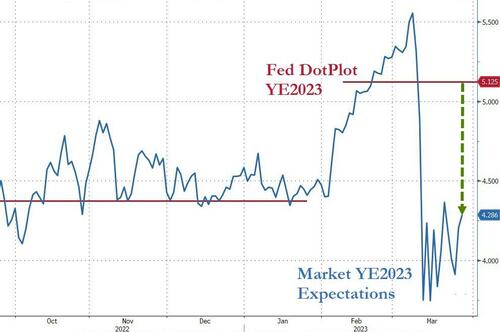

Finally, we note that the market remains dramatically decoupled The Fed's Dot-Plot (around 90bps more dovish)...

Source: Bloomberg

If The Fed is forced to cut rates that hard, it is not something to be 'buy buy buy'-ing stocks over - either 'hard landing' or 'banking crisis' or both...

https://ift.tt/vz4ZmDQ

from ZeroHedge News https://ift.tt/vz4ZmDQ

via IFTTT

0 comments

Post a Comment