The Longer It Takes The Fed To "Go Big", The Deeper The Damage Will Be, And The Bigger The "Big" Will Be

By Eric Peters, CIO of One River Asset Management

“They went big last weekend, which was the right thing to do,” said the Chairman, a veteran of financial crises, the two of us discussing the ongoing bank run, how policy can end it.

“But the market always tests statements of confidence, whether from companies or the government,” he continued.

“This week, at the first real test, policymakers mumbled.”

Treasury Secretary Yellen’s responses to Senator Lankford in Thursday’s Senate hearing gave a glimmer of light to the worst fears of small business owners and savers at America’s non systemically important banks.

The administration’s failure to dash these fears for depositors of $2, $5, $10 million has created a two-tier banking system in which the big banks are safe and most others are not.

“The American people should know that the banking system, which is at the core of our economy, is a safe place for them to keep their money. And this is particularly true for the middle class and small business owners, who generally do not have easy access to treasuries. The idea that their banks are unsafe for their day-to-day operations and needs is absurd.”

How we got here and how to prevent a repeat is a matter for another day. The fear and potential damage must be stemmed immediately.

“For regulators and policy makers in times of stress, silence is the reward for good work,” said the Chairman.

“In 2020, we went big on everything. The times called for it. For example, can you imagine if we had allowed the entire airline industry to be liquidated?”

The cost of restarting the world’s largest economy with a severely crippled airline industry would have been staggering.

“So, despite last weekend’s actions, deposits are flowing from small banks to large ones, and deposits at big banks are shifting into treasuries. The decisions that drive these flows are binary and irreversible. These are not tactical portfolio shifts of a percent or two, these are not moves to slightly trim exposure to small banks. These are zero-to-one decisions, all-or-nothing shifts,” said the Chairman.

“The market is testing whether they will go big again. And the longer it takes them, the deeper the damage, and the more aggressively they will need to go, the bigger the “big” in go big.”

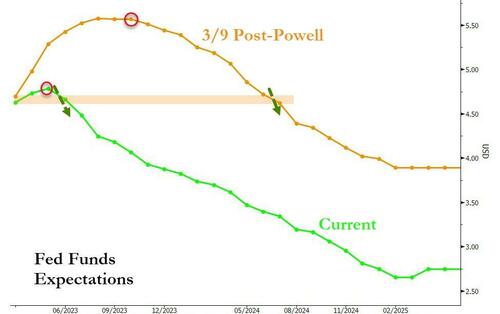

[ZH: the market is already showing The Fed the way in the short-term interest rate market - one more small token hike and then cut-cut-cut for the next two years!]

https://ift.tt/nx1i3Jq

from ZeroHedge News https://ift.tt/nx1i3Jq

via IFTTT

0 comments

Post a Comment