'What Lies Beneath'? Market Headlines Mask Mayhem Below The Surface This Week

At the macro level, strong PMI data today was the icing on the cake of a 'strong' economy, pushing the US Macro Surprise Index to its strongest since April 2022 As Fed Funds were hiked to fresh cycle highs. Financial Conditions appear to be back into decoupling mode from 'tight' monetary policy. Whether it's rate or credit-tightening, the transmission process is broken...

With more of a market focus, here are some facts from this tempestuous week that may surprise:

-

US Regional bank stocks unch on week

-

Gold unch on week

-

30Y Yield higher on week (2Y yields down notably)

-

Crude higher on week

-

US Stock Indices higher on week (led by tech)

-

Crypto small higher on week

-

Rate-hike odds plunged on week (recession)

-

EU Stocks up on week

-

EU bank stocks unch on week

-

EU bank credit risk lower on week

-

EU bank counterparty risk lower on week

But below the surface of these headline moves, there are some rather large fault-lines appearing...

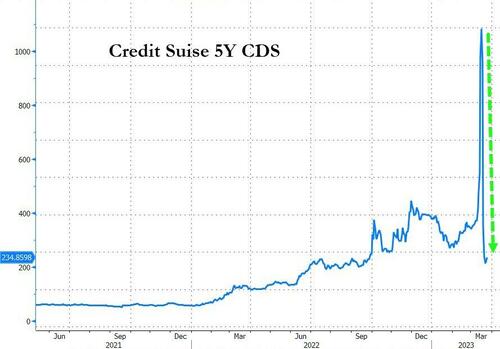

Let's start in Europe, because today's chaos started there. Deutsche Bank's credit risk exploded higher today...

The jawboning was magnificent - nothing to see here, move along!

“Deutsche Bank has fundamentally modernized and reorganized its business model and is a very profitable bank,” Chancellor Scholz said Friday at a news conference in Brussels when asked about the lender’s situation.

“There is no need to worry about anything.”

“We view this as an irrational market,” Citigroup Inc. analysts including Andrew Coombs wrote in a note.

“The risk is if there is a knock on impact from various media headlines on depositors psychologically, regardless of whether the initial reasoning behind this was correct or not.”

“We have no concerns about Deutsche’s viability or asset marks,” Stuart Graham, an analyst at Autonomous Research wrote.

“To be crystal clear - Deutsche is NOT the next Credit Suisse.”

“It is a clear case of the market selling first and asking questions later,” said Paul de la Baume, senior market strategist at FlowBank SA.

But the collapse in Credit Suisse CDS spreads helped put some lipstick on the EU banking system's pig...

Source: Bloomberg

Overall, European bank markets roller-coastered dramatically, rallying off the opening lows after the CS bailout then reversing weaker to end the week. By the close, EU bank stocks were only modestly lower while Senior EU bank credit was tighter...

Source: Bloomberg

European 'sub' debt ended better on the week with spreads modestly tighter...

Source: Bloomberg

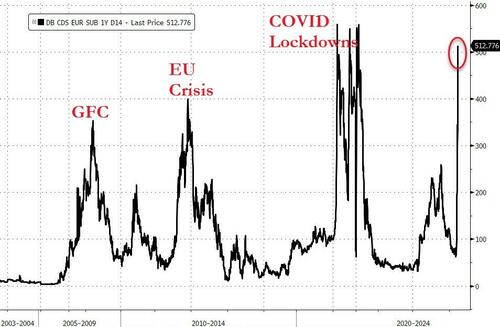

But while the index looked fine, Deutsche Bank's 1Y Sub CDS (classic derivative counterparty risk hedge) literally exploded...

Source: Bloomberg

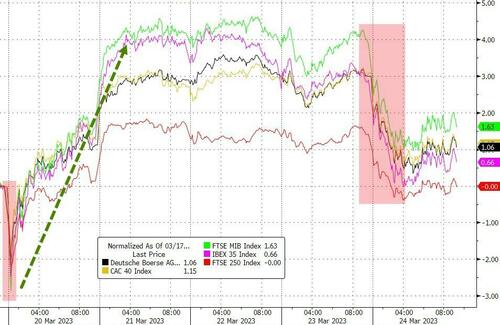

Despite today's carnage in European banks, Europe's broad stock markets ended the week in the green (thanks in large part to Monday's post-CS bailout panic-bid short-squeeze)...

Source: Bloomberg

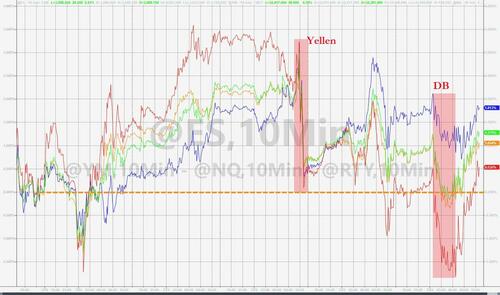

Back to the US, the major equity indices remained largely resilient this week (rising Fed balance sheet?). As today's Emergency FSOC meeting took place, stocks began to rebound... Small Caps ended the week in the red with Nasdaq leading (as MSFT, AAPL 'safe havens' soared). S&P and Dow ramped today

The S&P 500 was very technical again this week. finding support early in the week at the 200DMA, rallying up to its 50DMA and reversing there. Falling back down to find support at the 200DMA again before bouncing back above the 100DMA today...

Utes and Real Estate were ugly this week as Tech, Energy, and Materials outperformed. Financials were flat...

Source: Bloomberg

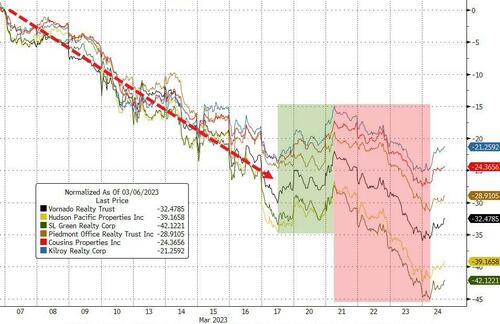

CRE/Office REITs continued to collapse this week...

Source: Bloomberg

Which shouldn't be a surprise as 'Big Short 3.0' CMBX crashes to fresh lows...

Source: Bloomberg

The Regional Bank stock index ended the week practically unchanged (after ramping up to unchanged today)...

But under the surface things were ugly for FRC, RILY, TCBI, COLB, and PACW plunged from early week gains...

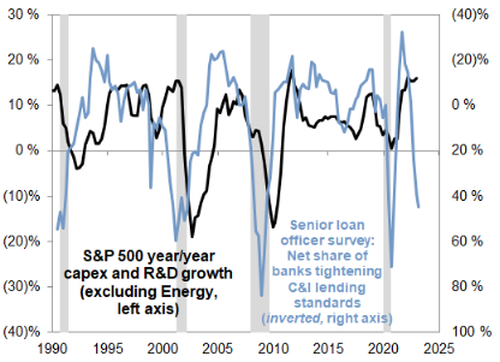

Before we leave equity-land, as Goldman's Chris Hussey points out, corporate investing activity was already poised to shrink before the recent bank stress, but the tightening lending standards coming out of the recent bank volatility is likely to further way on corporate investment spending...

Treasuries were mixed on the week with the long-end underperforming and the belly best. However, overall, it was another week of crazy vol in bond-land...

Source: Bloomberg

The 2Y Yield tumbled today to its lowest in almost 7 months, well below the 4.00% level...

Source: Bloomberg

The yield curve steepened notably this week (5s10s uninverted) with 2s10s back at its least inverted since October...

Source: Bloomberg

At the short-end of the curve, the yield curve collapsed from Powell's hawkish Congressional hearings...

Source: Bloomberg

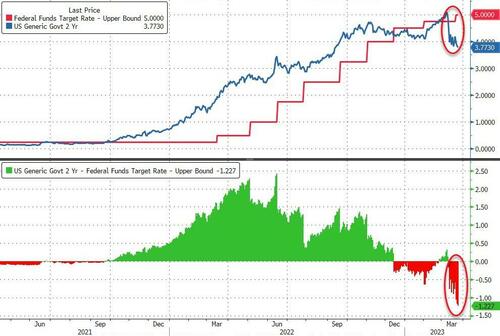

And the 2Y yield is now over 120bps below the current Fed Funds rate...

Source: Bloomberg

Jeff Gundlach says it all...

UST 2 Year versus 10 Year is now inverted 40 basis points.

— Jeffrey Gundlach (@TruthGundlach) March 24, 2023

Was 107 basis points just a few weeks ago.

All UST Yields two years and out are well below the Fed Funds rate.

Red alert recession signals.

The dollar erased all of the post-Powell plunge but ended the week lower (3rd week lower of the last 4)...

Source: Bloomberg

Crypto was modestly higher on the week with BTC and ETH both up around 5% at their best but giving back most of those gains today...

Source: Bloomberg

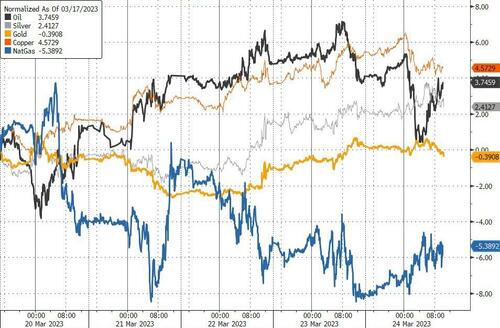

Copper, Oil, and Silver all rallied on the week (while NatGas tumbled)...

Source: Bloomberg

Despite gold's appeal, it ended the week basically unchanged, rebounding from the early week losses and topping $2000 twice intraweek...

WTI could not hold above $70...

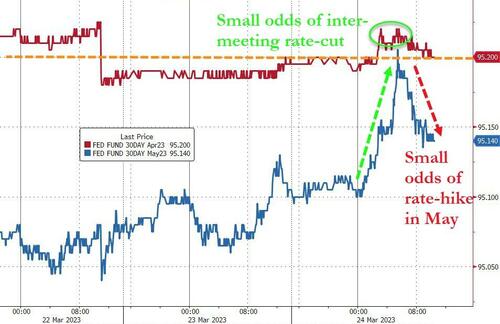

Finally, at one point today, the market priced for a small chance of an inter-meeting rate-cut (but overall has reduced the odds of a May hike to just 25%)...

Source: Bloomberg

Additionally, we note that the market is massively more dovish than The Fed's dotplot with regard to where rates will be at year-end...

Source: Bloomberg

That is 150bps! The market is clearly projecting a worsening financial crisis and/or a hard-landing recession... and stocks sure ain't pricing that in!

Additionally, options traders are dramatically betting on lower rates/yields down by year-end as SOFT Dec23 Skews show incessant upside demand (h/t Nomura's Charlie McElligott)

Source: Bloomberg

Larry McDonald perhaps summed up the situation best:

"Dear Central Banks - When you see suppress the true, market driven cost of capital for longer and longer periods of time. You incentivize the HTM yield reach across the banking system. Then you juice rates 500bps in 13 months to “fight” inflation and light it all on 🔥 fire"

It took The Fed's QT program 11 months to reduce its almost $9 trillion balance sheet by $625bn... and 2 weeks to retrace two-thirds of that!!

Source: Bloomberg

If everything's "fine" then why is The Fed balance sheet exploding higher again?

https://ift.tt/uD3XyWF

from ZeroHedge News https://ift.tt/uD3XyWF

via IFTTT

0 comments

Post a Comment