Car Dealerships Hit With Profitability Squeeze As Auto Industry Cracks

Auto dealerships are encountering a major problem where auction (wholesale) prices are increasing while real book values stagnate, squeezing profitability.

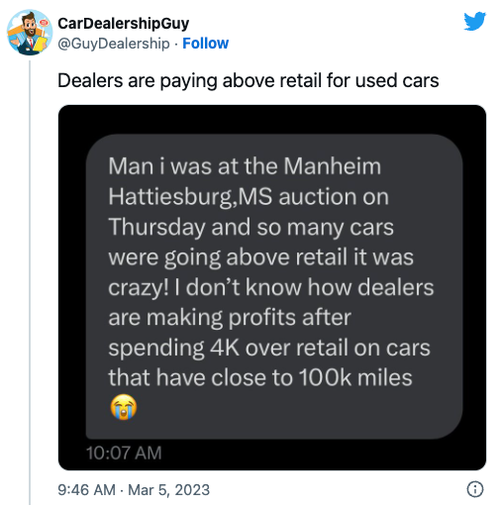

To make sense of this, auto-guru CarDealershipGuy expanded on our tweet, pointing out that Manheim wholesale auto prices are re-accelerating while other indexes tracking prices were flat.

Here's what was revealed in the conversation as per the auto expert:

Manheim is tracking auctions. Dealers ARE paying more for cars. A LOT more. But the issue dealers are running into is SELLING those cars.

JD Power - one of the industry's main sources of Vehicle Book Values that auto lenders rely on to value collateral - hasn't materially adjusted upwards.

This has left dealers high-and-dry and without a profitable outlet for all the inventory they just acquired for OVER book value.

And that is leading to lots of dealers selling cars to consumers at a front-end LOSS (meaning, lose money on actual cars) while hoping to make it up on the back-end (with value-added products like warranties).

Speaking for myself, our vehicle purchase price has slightly RISEN but our ASP (average sale price) has barely budged.

Separately, CarDealershipGuy went even more in-depth about underwater auto dealerships in a recent blog post:

Cars are appreciating again and this presents problems for both dealerships and consumers. Here's why:

Ask any dealer and they will tell you that appreciating wholesale prices is a phenomenon we haven't seen since the craziness of 2021. There hasn't been a tax season where we've seen wholesale prices for mainstream, bread-and-butter cars at $3K above the "book value." [Book values are current wholesale and retail market price estimates provided by various publishers, such as NADA, Kelly Blue Book, Black Book, JD Power, and other companies]

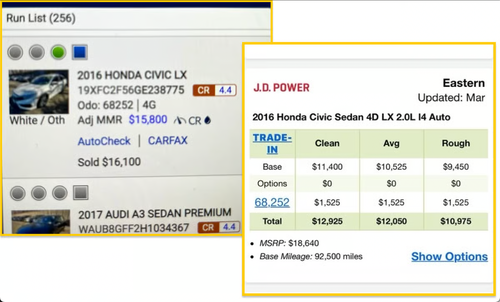

Look at this example from a recent sale at an auction:

A 2016 Honda Civic LX with 68K miles was listed with an auction value of $15,800 and sold for $16,100. The JD Power book value is listed at only $12,925 for clean and $12,050 for average conditions. This is a 7-year-old Honda Civic we are talking about. See what's wrong here? While wholesale prices have been increasing for 3 months, book values haven't caught up yet!

This is just one example, but as other dealers can attest, it is an increasingly common occurrence.

So what are the consequences?

Dealers struggle to make a profit, and thus, sell a car: There's no "water" (industry term for profit or 'spread') in the deal from the get-go. Lagging book values certainly hurts dealer margins, but there's another issue:

Inaccurate book values hinder dealerships' ability to secure financing for consumers because lenders use book values to underwrite loans(!)

Even if a lender is willing to accept the 120% loan-to-value ratio, it would still require a large down payment of ~$5K to secure a loan. Faced with increased delinquencies, lenders want to take less risk and charge dealers more for each loan, further squeezing dealer margins.

Consumers in the prime credit segment don't need to worry, but those in subprime and deep subprime should expect it to become increasingly difficult to get into cars.

He presented an outlook similar to ours about the turmoil ahead:

We are in for a bumpy ride: the outlook for subprime shoppers is bleak, and dealers are facing additional headwinds from higher wholesale prices, lack of inventory, and inaccurate book values.

Aside from the issue of auto dealerships experiencing losses from selling vehicles, subprime borrowers are also having difficulties meeting their monthly payments that exceed $1,000.

https://ift.tt/UP7BeFq

from ZeroHedge News https://ift.tt/UP7BeFq

via IFTTT

0 comments

Post a Comment