Bitcoin Flash Crashes More Than $2,000 Amid Stale Reports SpaceX Sold Its Stake

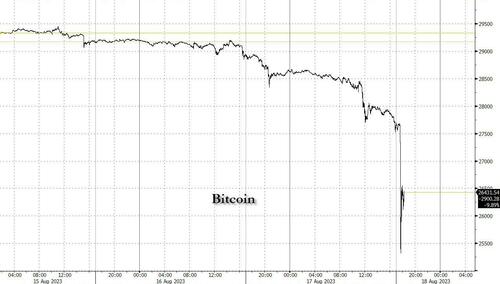

Call it the Bloomberg jinx. One day after the billionaire failed presidential candidate and media mogul's outlet published a report that "Bitcoin’s Extreme Volatility Vanishes Amid ‘Extreme Apathy and Exhaustion’," bitcoin's volatility has come back with a vengeance when what was already an ugly day - which saw bitcoin slump from above $29,000 on Wednesday evening to around $27,500 by Thursday afternoon - amid soaring nominal and real rates became a bloodbath when in the span of minutes, bitcoin tumbled another $2,000 to as low as $25,314 on a massive order dump which quickly took out all stops.

While it's not clear what the immediate catalyst is, 2nd hand reports that Elon Musk's SpaceX had sold out of its bitcoin stake began to circulate around the time of the liquidation...

BREAKING: Elon Musk’s SpaceX sold all its $373 million #bitcoin - WSJ

— Bitcoin Magazine (@BitcoinMagazine) August 17, 2023

... even though the original WSJ report hit three hours earlier, at 3:22pm ET...

... and basically confirmed what everyone already suspected based on what Tesla had done several weeks earlier:

The documents also show SpaceX wrote down the value of bitcoin it owns by a total of $373 million last year and in 2021 and has sold the cryptocurrency. Tesla has taken a similar approach with its bitcoin holdings. Musk has posted about cryptocurrencies frequently over the years.

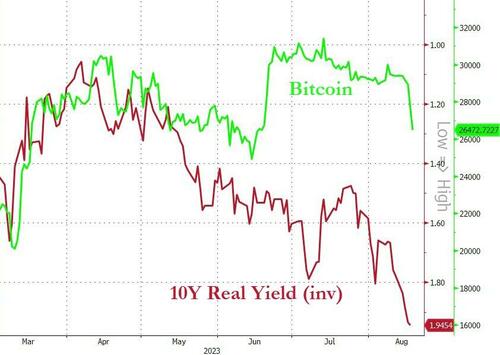

Others, such as Michael Safai, partner at quantitative trading firm Dexterity Capital, speculated that the reason for the dump was more mundante: “There aren’t enough good headlines coming out of crypto to get people excited,” according to Sadai. “Conversely, rising interest rates and weakened risk appetite are pushing non-crypto-native traders towards safer assets.”

Shiliang Tang, CIO at crypto investment firm LedgerPrime, said that “there was optimism earlier in the week that a resolution to the Grayscale Bitcoin ETF would come this week but that passed with nothing coming out.”

“Furthermore traditional markets have been weak all week with SPX and tech selling off, 10-year rates reaching highs and the dollar catching a bid, and China credit and econ data weakness, all of which are negatives for risk assets.”

Not helping downbeat sentiment, around the time of the flash crash Coinbase announced that its systems are "experiencing issues and they are working on a fix" adding that "funds remain secure."

Whatever the reason, the entire bitcoin spike since the mini Blackrock euphoria in mid-June has now been wiped out.

https://ift.tt/t7VvlUf

from ZeroHedge News https://ift.tt/t7VvlUf

via IFTTT

0 comments

Post a Comment