SoftBank's Arm Files For IPO

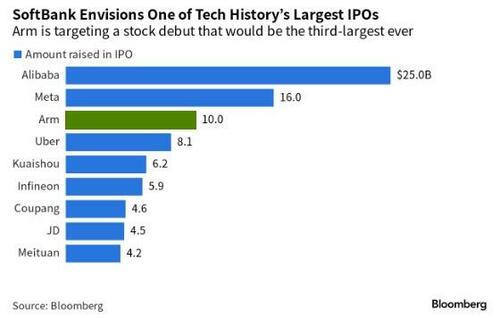

In what could be 2023's largest IPO, SoftBank Group's semiconductor unit Arm Holdings publicly filed a registration statement on Form F-1 with the SEC relating to the proposed initial public offering of American depositary shares representing its ordinary shares.

Arm has applied to list the ADSs on the Nasdaq Global Select Market under the symbol “ARM”.

The number of ADSs to be offered and the price range for the proposed offering have yet to be determined.

Barclays, Goldman Sachs, J.P. Morgan, and Mizuho are acting as joint book-running managers for the proposed offering.

The filing lists 24 other underwriters below that top tier.

Arm plays a pivotal role in the world of consumer electronics, designing the architecture of chips that are found in 99% of all smartphones, making it a key provider of technology to Apple, Google, and Qualcomm

Bloomberg reports that while Arm had been aiming to raise $8 billion to $10 billion in the IPO, that target could be lower since SoftBank has decided to hold onto more of the company after buying Vision Fund’s stake in it.

Bloomberg has previously reported that Arm was aiming for valuations between $60 billion and $70 billion, as the chip designer tries to cash in on investors’ frenzy for stocks that can benefit from the rise in artificial intelligence.

-

Arm reported $524 million in net income on $2.68 billion in revenue in its fiscal 2023, which ended in March, according to the filing. Arm’s 2023 revenue was slightly down from the company’s 2022 sales of $2.7 billion.

SoftBank Group Corp., which owns Arm, bought a 25% stake in the company from the Vision Fund at a $64 billion valuation.

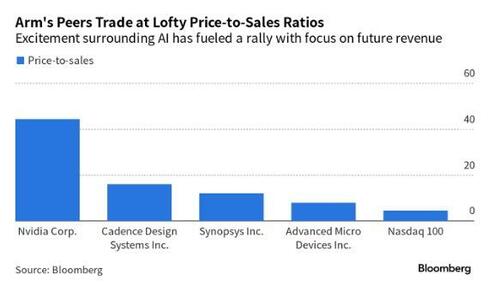

Those kinds of levels are high compared with the valuations that investors have awarded smaller Arm competitors like Synopsys Inc. and Cadence Design Systems Inc.

Using the price-to-sales ratios of those public companies for Arm would imply a value of between about $32 billion and $43 billion for the chip designer.

That’s based on the $2.68 billlion of revenue from Arm’s latest fiscal year. A representative for Arm declined to comment.

That range jibes with what analysts at Bernstein Research suggested in a July 23 note, when they said the company should be worth around $40 billion.

They added that there “could be upside” to that valuation on “the potential for more significant growth based on future AI applications and further profitability improvements,” as more information will be made public during the IPO process.

Arm is the clear market leader in the market for semiconductor design, Bernstein said.

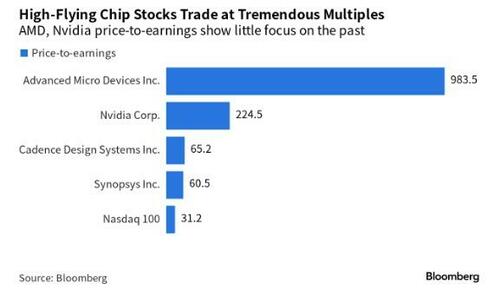

Comparables based on price relative to past earnings offers more upside potential to Arm's valuation...

However, if using an average blended forward price-to-earnings ratio across Nvidia, AMD, Synopsys and Cadence, then Arm would need to generate $1.1 billion of income to justify a $40 billion valuation or around $1.7 billion for a $64 billion value (more than 3x the current level).

Finally, we can't help but wonder - with all the exuberance around chipmakers and AI - whether Arm's long-anticipated IPO could ring the bell on this boom.

https://ift.tt/L19dwe6

from ZeroHedge News https://ift.tt/L19dwe6

via IFTTT

0 comments

Post a Comment