Can You Feel It?

Submitted by QTR's Fringe Finance

As is the standard disclaimer for my blog, just be on notice that I could be imagining things, delusional, or just plain old drunk off whiskey, but last week, I felt a little something shift in terms of market sentiment.

The key event that took place last week was Fitch’s downgrade of U.S. long-term debt from AAA to AA+. The response to what should have been a “historic” legitimate warning sign from an age-old ratings agency that the U.S. is on an unsustainable fiscal path was every analyst, sell-sider, bank, FOMC member, government official, investment advisor, Twitter user and financial media personality immediately explaining why Fitch was dead wrong and why its rating change was “arbitrary”, “meaningless” and “outdated”.

Even for the cesspool that is our financial industry, and the dildos contained therein, this was a stunning level of ignorance, the likes of which I haven’t seen in my time in the industry.

After all, Fitch’s reasoning for the U.S. downgrade was clear, with the agency citing “debt-limit political standoffs, an inadequate fiscal framework and a complex budgeting process”. James McCormack, Fitch Ratings’ managing director and global head of sovereign and supranational ratings, said earlier this year:

“It’s not just the debt limit. What we’ve seen in the United States is a steady deterioration in governance.”

Hell, even NPR understood why Fitch made the move, with Chief Economics Correspondent Scott Horsley laying it out plainly:

“The federal government is still running really big deficits. Of course, that wasn't surprising during the pandemic, but the red ink has continued to flow. The deficit nearly tripled in the first nine months of this fiscal year. And what's more, Fitch says the government has no real plan for fixing the situation. You know, the spending limits adopted as part of that recent debt limit deal barely scratched the surface. They addressed only a small fraction of the overall budget, and they don't deal with the longer-term challenges such as financing Social Security and Medicare for an aging population.”

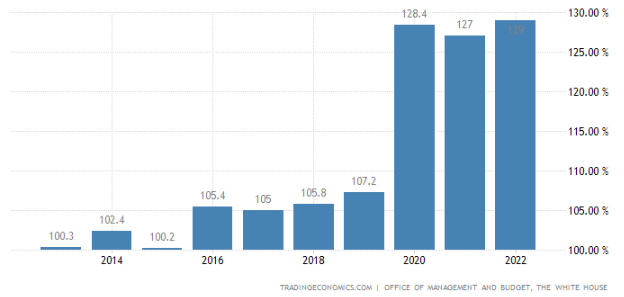

And, despite everybody in the industry’s inability or lack of desire to accept these basic realities, Fitch is making a lot of sense. You can see it not only in governance, but in basic financial metrics used to keep track of a country’s creditworthiness and credibility among its peers. Our money supply has expanded in alarming fashion, our economy feels like it’s about to hit a recessionary wall with rates over 5%, the BRICS nations are exploring the idea of a gold-backed reserve currency and our country’s debt/GDP has ballooned out of control the last 3 years:

TradingEconomics.com

In other words, Fitch is noticing the things that Austrian-focused analysts have been pointing out for the last few years, namely that the U.S. is embarking on an unprecedented experiment in arrogance when it comes to monetary policy. The further down this path we go, the less visibility we have on what the future will bring. In other words, the U.S. is simply becoming more of a risk.

Now don’t get me wrong, the downgrade isn’t devastating, but it isn’t something that should be ignored either. The very same American exceptionalism that has led us down the faulty path of Modern Monetary Theory is once again rearing its head in ignoring one of the world’s preeminent rating agencies, diluting what otherwise should have been a bold statement about the “untouchable” United States.

I put this video up on the morning of the downgrade, expressing my thoughts as I walked to go get my coffee.

The market finally sold off about 2% the day after the downgrade, but then rebounded Thursday before selling off to end the week, following Apple and Amazon’s earnings.

As you can see above, while the numerical values of the market indices weren’t much changed last week, it felt to me as though there was somewhat of a psychological sea change on the street and in the market, despite everybody’s best efforts to ignore the obvious and pretend our financial outlook is full of unicorns and rainbows.

My readers know that I already believe that the fundamental catalysts for a recession are well in place and moving already. I have been saying for months that the pipe bomb of quantitative tightening, hawkish Fed policy and a slowing economy is already making its way through the plumbing of the market. The only question is when it’s going to blow.

We’ve done well to ignore this idea over the last six months, with the main talking points in the financial media revolving around the idea of a soft landing. I continue to believe that a soft landing is a mathematical impossibility and will not happen.

The sentiment shift was most noticeable late in the session on Friday, when the market sold off more than 1% from its high of the day to finish the day red. The VIX moved slightly higher and, importantly, Apple (AAPL) broke its long-term technical trend, falling under its 50 day moving average for the first time in months. You don’t need to be a “technician” (whatever the hell that means), to see the trend break in Apple:

If you ask me, Apple has been an interesting part of this market.

It has been crucial in helping drive the market indices higher. Apple has, for all intents and purposes, done everything 100% right for as many years as I can remember. The stock is on an unstoppable decade-long trend higher and it has famously become the first $3 trillion company to trade publicly on U.S. markets.

But Apple has overheated in several ways. First off, it no longer trades with the modest 10x multiple that once made it appealing to Carl Icahn back in the early 2000’s. Apple now trades closer to a forward multiple of 30x. This means that no only has the business grown, but so has the way the market has decided to value it.

While Apple’s financials are still as sound as can be (generating $100 billion in cash from operations per year with $100 billion-ish cash in the bank and less than 1x EBITDA in debt), the company did have itself a little reality check when it reported earnings last week, posting revenue that declined year over year for the third quarter in a row. The decline was expected, which befuddled Wall Street when the stock sold off, but it was still a decline.

If Apple is a barometer for the economy and, as I believe it to be, a barometer for the stock market, this earnings report may have been crucial in helping shift sentiment alongside Fitch’s downgrade.

I’ve been saying for months that this market is being driven by residual psychological sentiment leftover from the easy money policies that we’ve had in place over the last decade. Apple has been part and parcel with that fairytale. Now that those easy money policies are over, and now that Fitch is desperately trying to splash a little bit of cold water on the United States, while at the same time Apple is stuck at a place where it needs to innovate in order to sustain its aggressive multiple, we find ourselves at an interesting inflection point.

If Apple’s new Vision product doesn’t knock it out of the park completely, it’ll be the company’s first big consumer product dud in as long as I can remember.

Already, reviews don’t make it seem as though it’s going to be a grand slam. The Verge says the product is “still searching for a purpose”. Wired calls it “an alarming misfire” and asks if “Apple has lost its innovation mojo”.

When Apple came out with the Watch, it was a new slice of innovation for the company but hardly the game changer that the iPhone was. And, as anybody that has invested in Apple knows, iPhone pretty much has driven the business over the last 15 years. With iPhone starting to stagnate and the smartphone market starting to become saturated, Apple is going to need to look elsewhere for aggressive growth to continue to justify its multiple.

If the Vision fails to excite the masses, there is a serious chance that Apple could see its multiple contract. And because it is one of the most widely held stocks anywhere, and part of many major weightings and ETFs, if Apple goes, so goes the market.

Finally, among those who wrote off Fitch’s downgrade last week was none other than Warren Buffett.

“There are some things people shouldn’t worry about. This is one,” he said after the downgrade on CNBC.

He added that he had bought $10 million worth of U.S. Treasuries to the start the week and forecasted that he would continue to do so.

“The only question for next Monday is whether we will buy $10 billion in 3-month or 6-month,” he added.

Buffett has based his entire career on the idea on an “America First” PR spin. The last 20 or 30 years of his “strategies” have relied heavily on government bailouts and his own brand equity to “turn around” individual company carcasses. His equity investments are buoyed by the same flawed monetary policy that led us to last week’s Fitch downgrade.

For his strategy to continue to work, monetary policy in the U.S. is going to have to support it and the dollar will need to hold up. So far, this has not been an issue and its why I refer to Buffett not as simply the best investor over the last half century, but the best within the confines of the Keynesian system we are in.

A U.S. debt downgrade isn’t a single stock downgrade. It’s not a call to the top of the pyramid of the U.S. investment system. Instead, its a foundational crack of the bedrock where the entire market, as well as the dollar, sits.

Pardon my mostly pre-industrial revolution French, but if the Keynesian system starts to blow, Buffett’s comments about the downgrade and American exceptionalism won’t mean shit. And while I’m not saying Buffett is wrong here and now, I am saying that at some point he will be. This is why I continue to try to keep my finger on the pulse of market sentiment at the bedrock level.

I can’t remember the last time we had a Friday like last Friday, where we sold off into the close. In fact, Fridays have been affectionately named “free money Fridays” because the market generally does nothing but go up to end the week.

Could that trend breaking, combined with Apple’s trend breaking, combined with Fitch’s dose of reality finally have enough gusto to move the tectonic plates underneath U.S. market psychology? We’ll have to see.

I’d love to hear from my subscribers as to whether or not you felt a sentiment shift last week as well – or, if once again, I’m simply having a magic mushroom flashback.

--

50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

https://ift.tt/CpvYdX0

from ZeroHedge News https://ift.tt/CpvYdX0

via IFTTT

0 comments

Post a Comment