Bonds, Stocks, Bitcoin, & Bullion Battered As Yuan & The Yield-Curve Rally

An ugly JGB auction overnight was trumped by yuan intervention overnight saw futures drift higher into the US open...

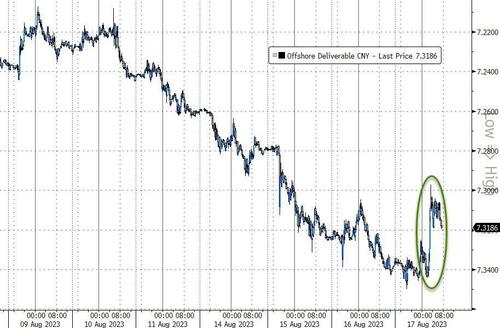

Yuan rallied after 5 straight down days...

Source: Bloomberg

Domestically, WMT beat (but cautious commentary), initial jobless claims fell, Philly Fed Manufacturing surged, but LEI was a shitshow for the 16th month in a row. However, the 'good' news dominated and Fed rate expectations rose hawkishly...

Source: Bloomberg

...which weighed on stocks. Small Caps and Nasdaq led the charge lower but everything was a one-way waterfall in the afternoon...

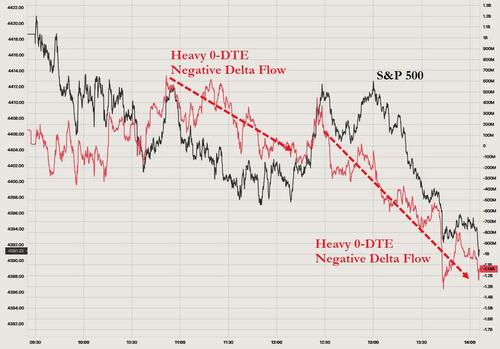

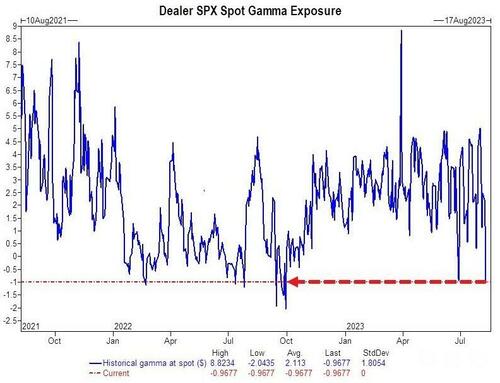

Once Europe was closed, the algos were in charge with 0-DTE traders running the show as a negative gamma accelerated the waterfall lower...

The Dow joined the S&P, Nasdaq, and Small Caps in closing below its 50DMA. Dow was last below its 50DMA in June. Small Caps are getting close to their 100- and 200-DMAs. The S&P closed below the key 4,400 level...

'Most Shorted' stocks are down for 12 of the last 13 days...[Pro subs would have know that was the day that the top was in]

Source: Bloomberg

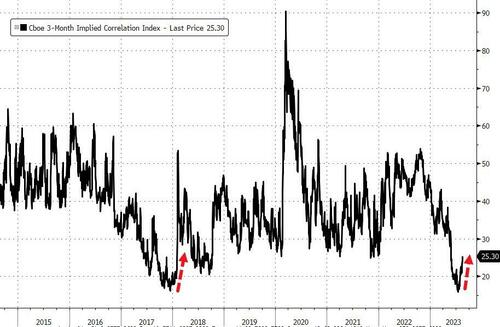

Implied correlation bounced - just like we said it would - right off those 2017/18 lows...

Source: Bloomberg

Regional bank stocks were down again today, back at the kneejerk lows from the SVB puke...

Bonds and stocks are tanking together (we explained why here)... Are Chinese banks selling USTs to 'fund' their yuan intervention?

Source: Bloomberg

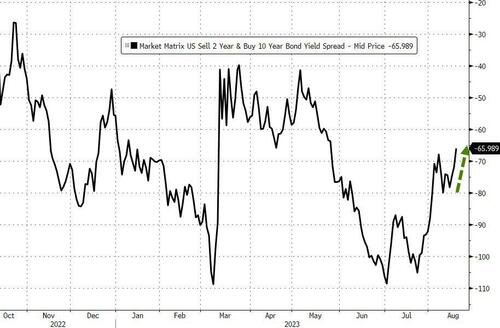

Treasury yields were mixed with the short-end outperforming (2Y -2bps, 30Y +5bps). On the week, the short-end is notably decoupled from the rest of the curve...

Source: Bloomberg

Which saw the yield curve steepen (dis-invert) further...

Source: Bloomberg

Some worry that USTs are being sold to fund yuan intervention...

Source: Bloomberg

The dollar was unchanged today - recovering its yuan-intervention-losses overnight...

Source: Bloomberg

...but is holding above its 200DMA...

Source: Bloomberg

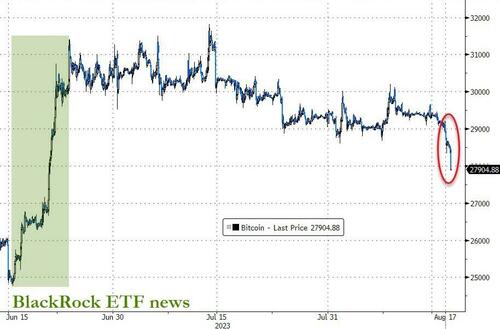

Bitcoin was clubbed like a baby seal, back below $28,000...

Source: Bloomberg

But if you are in Argentina, Bitcoin just exploded to a new record high after the recent primary...

Gold continued to slide lower (spot below $1900). If you squint you can see an intraday pattern around the London Fix...

Amid all that selling, we note that oil prices rallied, with WTI back above $80...

Finally, none of today's waterfall-like move in stocks should have been a surprise as we warned about fragility due to 'negative market gamma'...

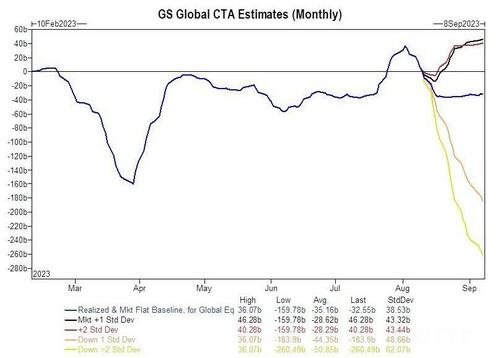

...and CTA thresholds crossed...

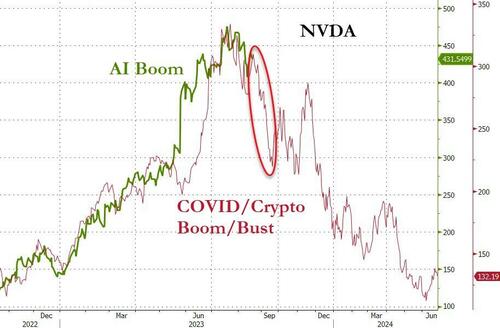

We wonder if NVDA's earnings next week will be the catalyst?

Source: Bloomberg

A little bounce after tomorrow's OpEx and then (will J-Hole puncture the bubble)...

Source: Bloomberg

Would that be the real pain trade?

https://ift.tt/Et08i7s

from ZeroHedge News https://ift.tt/Et08i7s

via IFTTT

0 comments

Post a Comment