"Concerned For His Safety:" Oil Trader In Hiding After Losing $320 Million On Wrong-Way Derivatives Bets

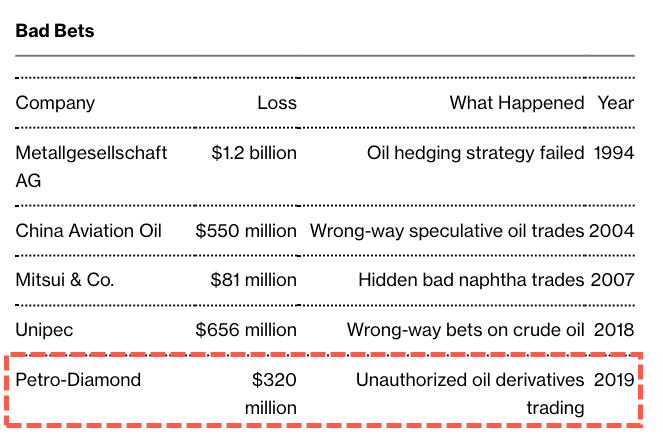

In a wrong-way derivates bet, we reported last week that a 'rogue trader' from Mitsubishi Corp. was fired after losing a whopping $320 million. Now Bloomberg is providing some clarity on what exactly happened after conversations with the trader's lawyer.

The trader, who worked for Petro-Diamond Singapore Pte Ltd, a wholly-owned subsidiary of Mitsubishi Corporation, incurred significant losses when a "premature" settlement of a derivatives positions had to be closed out, said Joseph Chen, the Singapore-based lawyer for the trader, Wang Xingchen.

"Our client takes the position that he had not engaged in unauthorized trades in crude oil derivatives," Chen said in a statement.

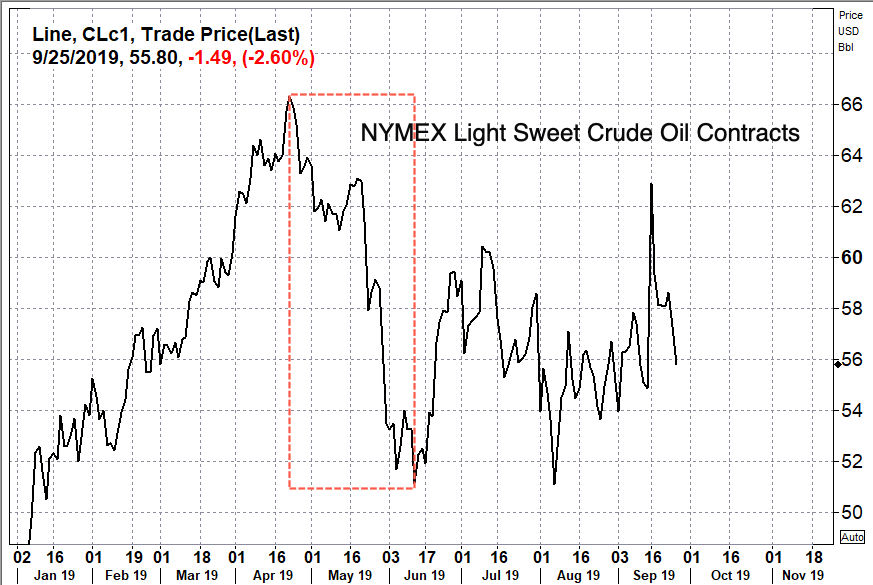

Mitsubishi Corp. and Petro-Diamond said the trader had been taking unauthorized derivatives positions since January, and suffered massive losses over the summer as oil prices plunged.

Xingchen reportedly occupied a relatively senior position, and was in charge of all transactions involving China for the subsidiary.

Mitsubishi Corp. said Petro-Diamond launched an investigation into Xingchen's trading logs while he was on vacation and sick leave in August. They found unauthorized positions, and decided to unwind them in August. The losses are expected to be about 6% of Mitsubishi's projected profit for the fiscal year.

Both companies allege Xingchen had manipulated its risk-management system, and was able to make it look like the derivative trades were associated with customer orders.

Chen told Bloomberg his client followed internal reporting procedures and policy at all times. "Internal controls were in place" throughout the period in question, he said.

Chen said his client is in hiding because of concerns for his safety, adding that Wang has given “appropriate responses” to Petro-Diamond.

Singapore Police Force officials confirmed to Bloomberg that they're investigating the matter, declined to give further details.

Mitsubishi and Petro-Diamond said after an internal review - all-sufficient controls were in place at the time. It added that new controls could be put in place to detect trading mishaps "at a much earlier stage."

The incident is a reminder of the destruction that a rogue trader can cause to a large financial institution.

* * *

Read Mitsubishi's announcement below:

Losses from Overseas Subsidiary’s Crude Oil Trading

This is to inform you that Mitsubishi Corporation (hereinafter “MC") can confirm that one of its subsidiaries based in Singapore has realized a previously unidentified loss from derivatives trading. Investigations are currently ongoing to determine all of the details, but what is known so far is outlined below.

MC recognizes the seriousness of this matter and shall be redoubling efforts throughout the entire MC Group to ensure that it does not happen again.

1. Situation at Present

Petro-Diamond Singapore (Pte) Ltd. (hereinafter “PDS"), a subsidiary of MC that engages in the trade of crude oil and petroleum products, has confirmed that it expects to book a loss of approximately 320 million USD from its trade of crude oil derivatives.

Although PDS has already closed the position in question and determined how much was lost on the underlying derivatives, we are now examining the total amount of losses.

2. Facts Determined Thus Far

An employee who was hired locally by PDS to handle its crude oil trade with China (hereinafter “the employee”) was discovered to have been repeatedly engaging in unauthorized derivatives transactions and disguising them to look like hedge transactions since January of this year. Because the employee was manipulating data in PDS’s risk-management system, the derivatives transactions appeared to be associated with actual transactions with PDS’s customers. Since July, the price of crude oil has been dropping, resulting in large losses from derivatives trading. PDS began investigating the employee’s transactions during his absence from work in the middle of August, and that is when the unauthorized transactions were discovered.

3. MC's and PDS’s Response

After recognizing that the transactions being investigated could result in a loss for PDS, MC and PDS immediately consulted with an outside lawyer and established an investigation team, including local outside experts, to gain an overall picture of the situation and identify the causes.

- PDS quickly closed the derivatives position in question and determined the losses caused by the transactions which were not associated with any crude oil transactions with PDS’s customers. PDS also has since prevented the commencement of any similar transactions.

- MC conducted internal investigation at PDS, which included inspections of PDS’s contracts, rules, risk-management system and internal controls. Based on its findings, MC has reconfirmed that PDS has sufficient internal controls in place, including a middle office responsible for risk management. MC also confirmed PDS already tightened its governance to ensure that any similar improprieties can be detected at a much earlier stage.

- MC also performed investigations at its other MC group companies and MC’s in-house business departments engaged in derivatives trading to determine whether or not any similar improprieties have been taking place. These investigations confirmed that there are no such problems or risks at present.

- PDS terminated the employment of the employee on September 18. In order to take a strong action in response to the violation of internal rules and laws committed by the employee, which has caused PDS this significant loss, PDS lodged a police complaint against the employee on September 19.

4. Impact on MC’s FY2019 Forecast

How the losses will impact MC’s forecast for FY2019 is under investigation and shall be announced if and when a performance review is necessary.

https://ift.tt/2nfjwxJ

from ZeroHedge News https://ift.tt/2nfjwxJ

via IFTTT

0 comments

Post a Comment