Futures, Global Stocks Jump On "Trade Hopes And Optimism"

It's time for some trade optimism again to lift stocks again, just in case we haven't had that every other day for the past year.

Rekindled U.S.-China trade hopes lifted share markets on Tuesday, while the pound spiked after the latest dramatic Brexit twist, when the UK’s top court ruled the government’s suspension of parliament had been unlawful.

And good thing algos had some positive trade news to trade on as one day after a disastrous German PMI print, there was more gloomy data from Germany to contend with too, including the worst German IFO Expectations print in a decade, and which would suggest a -6% GDP print is on deck.

That data, however, was ignored after Treasury Secretary Steven Mnuchin’s and Trade Representative Robert Lighthizer confirmed on Monday that they would meet Chinese Vice Premier Liu He in two weeks’ time, while a separate report that China had granted new tariff waivers for US soybean purchases indicated Beijing may be telegraphing some more goodwill ahead of the negotiations.

“The comments (from Mnuchin on China trade talks) gave a little bit of boost to sentiment, but markets are still not that optimistic, either,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui DS Asset Management. “It seems there have been a lot going on behind the scenes,” he said, referring to U.S. President Donald Trump’s questioning a decision by his top trade negotiators to ask Chinese officials to delay a planned trip to U.S. farming regions. That cancellation was seen by markets as a sign of trouble in the U.S.-China talks and sent stock prices tumbling on Friday.

As a result, U.S. index futures advanced with European stocks while Asian shares rose modestly as investors weighed renewed hopes for a trade deal - a catalyst for higher prices since the summer of 2018 - against increasingly recessionary economic data from around the globe. "A perceived lull in U.S.-China trade tensions has eased market fears about an economic downturn," BlackRock strategists wrote in a note.

Not everyone was euphoric however: “All eyes are on early October, although there’s not a lot of expectation that anything material is going to come out from it,” John Lau, head of Asian equities at SEI Investments Co., said of the trade talks in an interview with Bloomberg Television. “If we get some kind of deal, any kind of deal, that would actually move markets.”

The European Stoxx 600 index rose 0.3%, with the eurozone banking index up 0.6% after it had slumped 2.8% in the previous session. European auto stocks stumbled following news that Volkswagen's CEO and Chairman were charged with market manipulation over the emissions scandal, sending the company's stock sliding and hitting the broader auto sector.

Earlier in the session, Asian stocks inched higher, led by energy producers while MSCI’s Asia index rose 0.1%, led by 0.6% gains in mainland Chinese shares after the vice head of China’s state planner said Beijing will step up efforts to stabilize growth. Markets in the region were mixed, with Japan and Singapore leading gains and Indonesia retreating. The Topix climbed 0.4% to its highest since April, with retail giants among the biggest boosts, after a three-day weekend. The Shanghai Composite Index added 0.3%, driven by Kweichow Moutai and Foxconn Industrial Internet. China has an abundant toolkit of monetary policy instruments, the Chinese central bank said in a statement. India’s Sensex fluctuated following its biggest two-day rally in 10 years, as Reliance Industries advanced and HDFC Bank declined.

Also overnight, Japan’s Foreign Minister Motegi said trade deal negotiations with US finished and that he doesn't see much delay from goal of signing deal by end of the month, while a Foreign Ministry spokesman also said there is still have time to agree to a trade deal with US by end of the month. However, earlier reports suggested a deal may be delayed due to a disagreement regarding the auto tariffs and that an agreement will not be ready to sign when Japanese PM Abe meets US President Trump on Wednesday as it is still undergoing legal checks with the sides to sign separate documents confirming a final agreement.

Currency moves were mostly rangebound with the exception of the pound: traders had waited for a Supreme Court ruling on UK Prime Minister’s Boris Johnson five-week suspension of parliament — a move known as prorogation in Westminster speak — and when it came it was dramatic and blunt. The move was “unlawful”. Sterling initially climbed as high $1.2487 on the view it would help prevent the UK being bundled toward a ‘no-deal’ Brexit at the end of October. But it quickly ran out of momentum and retreated to $1.2460, up a modest 0.2% on the day.

“I wasn’t surprised to see the currency hop higher but I also wasn’t surprised to see cable (pound vs the dollar) run out of steam ahead of $1.25,” said TD Securities’ European head of currency strategy Ned Rumpeltin.

Johnson is now likely to head to his Conservative party’s annual conference at the weekend and rally his troops in preparation for a likely national election which will be a bitter fight over Brexit.

“He is going to have to rally his base and he is going to do that around hard Brexit,” Rumpeltin said. “That will be a moment of clarity for the FX market. It will look at the polling and the Conservatives are leading in the polls.”

In geopolitical news, President Trump said we're getting along well with North Korea and maybe we will be able to make a deal or maybe not. South Korea spy agency said US-North Korea working level talks will take place in 2-3 weeks and a summit is possible by year-end, while it added North Korea’s leader Kim could attend Korea-ASEAN summit in Busan in November. Trump also said he will discuss Iran in his UN speech today, while he added the US have a lot of pressure on Iran and that he is not looking for a mediator on Iran – Trump is scheduled to speak at 10:15ET. In response, Iran President Rouhani said our message to the world is peace and stability, although there were earlier comments from a senior official that Iran will never yield to the US and the US should lift sanctions if it wants to reduce tensions.

Among the main commodities, oil prices dipped on expectations of subdued demand although uncertainty remained about whether Saudi Arabia would be able to fully restore output after recent attacks on its oil facilities. Brent crude futures fell 40 cents to $64.37 a barrel by 0624 GMT. West Texas Intermediate futures were down 33 cents to $58.31.

“The demand side of the equation is back in focus,” said Michael McCarthy, senior market analyst at CMC Markets in Sydney, pointing to sluggish manufacturing numbers in leading economies in Europe as well as Japan.

Boosting risk sentiment, on Monday, St. Louis Fed President James Bullard who now is clearly gunning for Powell's chairman seat by coming up with increasingly dovish proposals, said the central bank may need to ease monetary policy further to offset downside risks from trade conflicts and too-low inflation. Not all policy makers are on the same page, though. People’s Bank of China Governor Yi Gang said the country isn’t in a rush to add massive monetary stimulus, while Francois Villeroy de Galhau admitted he opposed the ECB’s decision to restart quantitative easing.

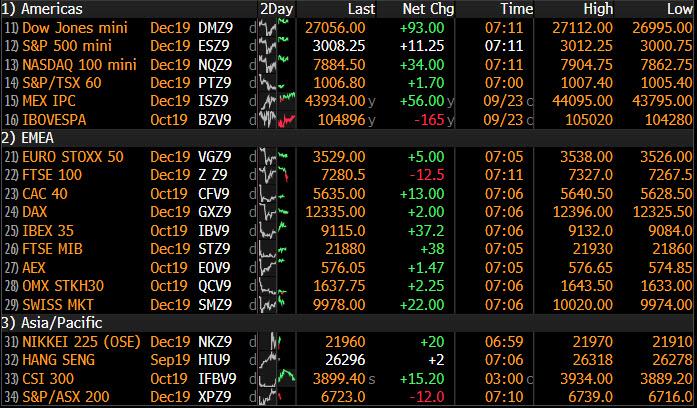

Market Snapshot

- S&P 500 futures up 0.2% to 3,003.75

- STOXX Europe 600 up 0.2% to 390.44

- MXAP up 0.07% to 159.32

- MXAPJ up 0.06% to 509.14

- Nikkei up 0.09% to 22,098.84

- Topix up 0.4% to 1,622.94

- Hang Seng Index up 0.2% to 26,281.00

- Shanghai Composite up 0.3% to 2,985.34

- Sensex down 0.1% to 39,043.39

- Australia S&P/ASX 200 down 0.01% to 6,748.87

- Kospi up 0.5% to 2,101.04

- German 10Y yield rose 0.5 bps to -0.576%

- Euro unchanged at $1.0993

- Italian 10Y yield fell 9.0 bps to 0.492%

- Spanish 10Y yield fell 1.8 bps to 0.131%

- Brent futures down 0.9% to $64.20/bbl

- Gold spot down 0.1% to $1,520.39

- U.S. Dollar Index little changed to 98.64

Top Overnight News from Bloomberg

- The U.K.’s top judges dealt an unprecedented legal rebuke to Prime Minister Boris Johnson, branding his controversial decision to suspend Parliament unlawful and giving lawmakers another chance to frustrate his plans for Brexit

- German businesses gave mixed signals on economy on Tuesday, a day after a report showed manufacturing stuck in an ever deeper slump; the Ifo institute’s key business sentiment gauge rose slightly more than expected in September, recording its first gain in six months; however, all of the increase was due to the view of the current situation, and a measure of expectations continued to plunge, reaching the lowest level in a decade

- The Chinese government has given new waivers to several domestic state and private companies to buy U.S. soybeans without being subject to retaliatory tariffs, according to people familiar with the situation

- Japan and the U.S. have finished talks on a trade deal with no indication yet on how the two sides responded to Trump’s threat to slap tariffs on the $50 billion in cars and parts shipped by Japan to the U.S. annually

- Anheuser-Busch InBev NV has pulled off the year’s second-biggest IPO the second time around, raising about $5 billion in listing its Asian unit in Hong Kong two months after scrapping the original share sale

- The U.K. government has ordered an investigation into the role of Thomas Cook Group Plc’s management in the collapse of the 178-year-old tour operator

Asian equity markets traded indecisively following a similar close on Wall St where the major indices spent the day steadily recouping the opening losses brought on by weak Eurozone PMI data. ASX 200 (U/C) was choppy as outperformance in gold stocks and resilience in financials were counterbalanced by losses across the broader market, while Nikkei 225 (+0.1%) remained afloat on return from the extended weekend but with gains capped by a choppy currency and as officials scrambled to finalize a US-Japan trade deal amid uncertainty regarding auto tariffs. Elsewhere, Hang Seng (+0.2%) and Shanghai Comp. (+0.3%) traded positively after continued PBoC liquidity efforts and as the central bank suggested there was still ample monetary policy tools, although advances were initially limited by the trade-related overhang as participants mulled over the recent ebbs and flows of the US-China trade saga ahead of next month’s high level talks. Finally, 10yr JGBs gained on return from the holiday closure amid the recent temperamental US-China trade headlines and indecisive risk tone in the region, while the BoJ were also present in the market today for JPY 810bln of JGBs in the belly to the short-end.

Top Asian News

- PBOC’s Yi Says China Is ‘Not in a Rush’ to Ease Policy Massively

- Global Investors Rethink India Stocks on Historic Tax Boost

- Xiaomi Unveils First 5G Phone for China in Challenge to Huawei

- The Danger When China’s Bull Market Owes So Much to So Few

Major European Bourses (Eurostoxx 50 +0.2%) are modestly firmer, albeit off highs, in tentative trade, following a mixed AsiaPac session. The FTSE 100 is the underperformer, under pressure from sterling strength after the UK Supreme Court ruled UK PM Johnson’s decision to prorogue parliament unlawful and, as such, prorogation voided. While stocks are mostly higher, the more defensive Utilities (+1.0%), Health Care (+0.9%) and Consumer Staples (+0.5%) sectors outperform, indicative of continued apprehension in wake of yesterday’s weak EZ PMI data, although the more risk sensitive IT and Financial are also higher. Materials (-0.5%) and Energy (-0.4%) are the laggards, with the latter pressure by lower crude prices. In terms of individual movers; Aviva (+0.8%) is higher on reports the Co. is looking to sell its Singapore and Vietnam businesses in a deal which could be valued at USD 2.5bln. Ryanair (+2.7%) is up, as the airline sector continues to gain in wake of Thomas Cook’s collapse and with the news that the co.’s cabin crew have voted in favour (approx. 80%) for a four-year Collective Labour Agreement. K+S (-4.3%) is lower after being downgraded at SocGen after the co. cut guidance yesterday, while Royal Mail (-2.8%) is under pressure after a downgrade at Liberum Capital. Finally, Volkswagen (-2.6%) sunk on the news thatGerman Prosecutors had indicted CEO Diess, Chairman Poetsch and the former CEO relating to the Diesel emissions scandal.

Top European News

- German Manufacturing Drags Business Expectations to Decade Low

- Scout24 Is Said to Kick Off Sale Process for Auto-Trading Unit

- Danske’s Ex-CEO in Estonia Has Gone Missing; Police Start Hunt

- HSBC Wins EU Court Fight Over $37M Fine for Euribor Rigging

In FX, GBP was firmer after the UK Supreme Court dealt a blow to UK PM Johnson after it ruled the decision as a court matter before announcing that the suspension was unlawful. With prorogation defeated, UK MPs will return to their seats and the parliamentary session will continue as Speaker John Bercow expectedly stated that the HoC should reconvene immediately. GBP/USD touched an intraday high of 1.2487 ahead of its 21 WMA at 1.2490, although the pair then returned to pre-announced levels of around 1.2450 amid unclarity regarding the next steps alongside some profit taking. It is worth nothing that, with parliament back in session, an anti-no deal majority could continue to frustrate government efforts to find a deal with the EU/try to force a no deal. Meanwhile, the Euro had relatively uninspiring day thus far as EUR/USD remains within a tight 1.0984-97 parameter with little impetus derived from the Ifo measures which mostly topped estimates (ex-expectations), although the institute noted that the outlook for the coming months has deteriorated and the domestic economy is likely to shrink in Q3 and stagnate in Q4, a similar comment mate by IHS yesterday. In terms of option expiries, EUR/USD sees 1.3bln at strike 1.10 and 1.1bln at strike 1.1025-30 for today’s NY cut.

- AUD - Governor Lowe has aided the AUD to gain a 0.68+ status after noting that fundamental factors underpinning the longer-term outlook for the Australian economy remain strong and economy has reached a gentle turning point, a comment made at the last speech which signals that the Central Bank could stand pat on at the next meeting on October 1st. The Governor reiterated that the Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, make further progress towards full employment, and achieve the inflation target over time whilst inflation is expected to pick up, but to remain below the midpoint of the target range for some time to come. AUD/USD immediately spiked higher from 0.6784 to 0.6805 ahead of resistance at 0.6810 before consolidating around the 0.6800 mark.

- SEK - The Swedish Crown currently stands as the G10 laggard amid slightly more dovish comments from Riksbank’s Governor Ingves who noted that rates are likely to increase at a “very slow” rate over the period ahead (vs. prior “should be possible to slowly raise rates”) whilst also acknowledging low interest rates and weaker sentiment abroad. First Deputy Governor Jansson added further to the dovish fire by highlighting low Swedish inflation numbers and worrying inflation expectations, whilst adding that he sees no appreciable upside for Swedish prices. EUR/SEK, in wake of the governor’s comments, bounced further from its 100 DMA (10.66) to an intraday high of 10.71 (ahead of resistance at 10.73) before retreating below the 10.70 mark.

- EM - The Lira is staging another recovery with strength attributed to media reports that the US is said to make a new offer to Turkey regarding F-35s and Patriots system after the two Presidents’ phone call over the weekend. USD/TRY fell from an intraday high of 5.7208 to a current low of 5.6782 ahead of its 55 and 50 DMAs at 5.6779 and 5.6705 respectively. Later, Turkish President Erdogan will make a speech at the UNGA before meeting with his French counterpart Macron and UK PM Johnson and UN Secretary General Guterres

In commodities, WTI and Brent prices are weaker this morning on a rather tentative session thus far on a lack of specific newsflow for the complex, but notably ahead of the UNGA where US President Trump has stated he is to discuss Iran in his speech. He has also added that the US has lots of pressure on Iran, which does follow from the instigation of sanctions on the Iranian Bank by the US; as such, focus today will be on the remarks from Trump and if there is any reference to further sanctions or the prospect of more forceful action. In terms of scheduling proceedings at the UN are to formally begin at around 13:00BST with President Trump scheduled to arrive at the UN headquarters around 14:30BST. Elsewhere, focus turns to tonight’s API release where expectations are form a 0.6mln/bbl draw; though, ING note that the result may surprise market expectations due to the number of storm related refinery disruptions that have occurred recently. In terms of metals, Gold is little changed hovering around the USD 1520/oz mark within a tight USD 1.0/oz range for the session; ahead of risk factors including the UNGA and a number of Central Bank speakers. Separately, copper prices are overall little changed, retaining their non-committal tone from the Asia-Pac session; though the metal does remain comfortably above the USD 2.62/lb mark.

US Event Calendar

- 9am: FHFA House Price Index MoM, est. 0.25%, prior 0.2%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.1%, prior 0.04%; CoreLogic CS 20-City YoY NSA, est. 2.1%, prior 2.13%

- 10am: Richmond Fed Manufact. Index, est. 1, prior 1

- 10am: Conf. Board Consumer Confidence, est. 133, prior 135.1

DB's Jim Reid concludes the overnight wrap

Fiscal policy and money printing will inevitably need to be far more joined up in the future and yesterday’s European PMIs pushed us a very small way towards this realisation. The real problem came from the worrying declines in the services sectors in Germany and France, which had previously been the beacon of hope in the recent PMIs. Germany saw the services reading fall 2.3pts to 52.5 (vs. 54.3 expected). That is a nine-month low while there was no sign of improvement in the manufacturing sector, where the reading slumped another 2.1pts to 41.4 (vs. 44.0 expected) and to the lowest in the best part of ten years. That put the composite at 49.1 – the first sub-50 reading for Germany in this cycle and the lowest reading in 83 months, while it’s also worth flagging that the new orders prints were also very worrying including manufacturing new orders at 37.9 being the weakest outside of the peak of the GFC.

As for France, the services reading fell 1.8pts to 51.6 and the manufacturing 0.8pts to 50.3, while for the Eurozone as a whole the manufacturing reading slumped 1.4pts to 45.6 and the services 1.5pts to 52.0. Those are the lowest in 83 months and 8 months respectively. As a result, the composite Eurozone reading is now at 50.4 (vs. 52.0 expected) and the lowest in 75 months. So these services readings are clearly a very concerning sign for Europe and the end result is a barely positive run rate of growth in the Eurozone right now. Let’s see what today’s IFO brings.

Unsurprisingly, bond yields fell as soon as the data was released. By the close of play 10y Bunds finished -5.8bps lower at -0.583%, OATs -6.9bps lower and BTPs -9.3bps lower. Treasuries also rallied post the Euro PMIs but got an added kicker after the US services PMI printed at a weaker than expected 50.9 (vs. 51.4 expected) before reversing the day’s rally late to close unchanged and at the higher end of a 10bps intra-day range. In fairness the services PMI was a 0.2pt improvement from September but disappointed the market at the margin. On top of that, the fact that the employment component declined into contractionary territory at 49.1 (and to the lowest in 10 years) raised a few concerned eyebrows. In fact the two-month decline for services employment is the largest since the crisis. As for the manufacturing PMI, it rose 0.7pts to 51.0 (vs. 50.4 expected) – so a modest bounce but clearly still at low absolute levels.

The moves in equity markets, at least in the US, were more muted. The S&P 500 finished down -0.01% by the closing bell last night with the NASDAQ -0.06%. European equities suffered on the poor data releases however, with the STOXX 600 (-0.80%), DAX (-1.01%) and CAC (-1.06%) all closing lower. European banks led the declines, down -2.76% on the economic weakness and bond rally. Elsewhere, Gold (+0.35%) got a slight lift from the modest risk-off while Oil was +0.95%.

Meanwhile after the US close yesterday, Treasury Secretary Mnuchin said that Chinese Vice Premier Liu He would be visiting for talks next week. Mnuchin also said that “The good news” is that the Chinese have started buying U.S. agriculture products again; “it’s a sign of good gesture,”. He also added that US farmers are important in the China trade negotiations with intellectual property “the most important issue.” The visit can be seen as a slightly positive signal as the Vice Premier was originally scheduled to visit Washington the following week. Also, as we go to print Bloomberg has reported that the Chinese government has given new waivers to several domestic state and private companies to buy US soybeans without being subject to retaliatory tariffs. For now this is likely to increase hopes that trade progress is being made.

Talking of trade, the US and Japan have finished talks on an initial trade deal with Japanese Foreign Minister Toshimitsu Motegi saying after the talks that he would explain more about the tariffs in two days’ time after a meeting of Trump and Japanese Prime Minister Shinzo Abe at the sidelines of the UNGA. He also said that he didn’t think that auto tariffs would be a cause for concern.

This morning in Asia markets are largely heading higher with the Nikkei (+0.14%), Hang Seng (+0.32%), Shanghai Comp (+0.77%) and Kospi (+0.19%) all up. Elsewhere, futures on the S&P 500 are up +0.24% while the 10y UST yield is down -2.1bps. In terms of overnight data releases, Japan’s preliminary September PMIs came out on the softer side with manufacturing standing at 48.9 (vs. 49.3 last month), marking 7 months of contraction this year, while services stood at 52.8 (vs. 53.3 last month) bringing the composite PMI to 51.5 (vs. 51.9 last month).

In other overnight news,the PBoC Governor Yi Gang said in a press briefing, with Finance Minister Liu Kun and National Bureau of Statistics head Ning Jizhe, that China must avoid massive stimulus, keep debt levels sustainable and maintain a prudent monetary policy stance while reiterating the central bank’s policy stance. The statement comes as concerns over China’s growth slowdown are mounting.

Back to yesterday, where ironically, both Draghi and Lagarde spoke post the weak PMIs although neither of their comments were particularly market moving. Draghi mostly repeated his ECB message, including suggesting that EU fiscal rules should be revisited, while Lagarde was asked on the limits of central bank policy but didn’t mention anything particularly ground-breaking. Over at the Fed, we heard from St Louis Fed President Bullard, who was alone in voting for a larger 50bp rate cut at last week’s meeting. He said that “instead of creeping down slowly I would prefer to get to where we need to be”, and voiced support for a further 25bp cut this year. Elsewhere, Williams spoke on the recent repo turmoil and said that it is “important that we examine these recent dynamics and their implications for the liquidity needs in relation to the overall amount of reserves held at the Fed”. Former NY Fed President Dudley also said he thinks the Fed will “strongly consider” a standing repo facility.

As for Brexit, sterling fell –0.39% as chief EU negotiator Michel Barnier made negative comments on a possible deal being reached, describing the UK’s current proposals on the backstop as “unacceptable.” Meanwhile the Labour Party conference rejected calls for the party to back remaining in the EU in a second referendum, instead supporting Jeremy Corbyn’s policy of a wait-and-see approach which translates as 1) get a better deal, 2) put it to a referendum, and then 3) decide whether to back the new Labour deal or remain. It’ll be interesting to see whether their position is a big political gamble or smart sitting on the fence. Given the European election results, I would have more thought the former. At their conference they also pledged to commit the UK to a 32-hour four day week within the decade. If successful I haven’t yet decided which day the EMR will cease to be published.

Looking at the day ahead, data out in Europe this morning includes September confidence indicators in France, the Sept IFO survey in Germany and August public finances and public sector net borrowing numbers in the UK. This afternoon in the US the highlight will likely be the September consumer confidence report, while the September Richmond Fed survey, July S&P CoreLogic house price data and July FHFA house price index are also to be released. Expect there to also be focus on comments from the ECB’s Villeroy and Guindos, while here in the UK the Supreme Court will be ruling this morning on PM Johnson’s suspension of Parliament.

https://ift.tt/2kMhYuf

from ZeroHedge News https://ift.tt/2kMhYuf

via IFTTT

0 comments

Post a Comment