Global Stocks Tumble, Futures Sink As Traders Brace For Political Quake In Washington

World stocks fell to a two-week low, and US equity futures failed to sustain a modest bounce following a report of fresh "trade optimism" between America and China after U.S. lawmakers called for an impeachment inquiry into President Donald Trump, increasing the prospects of prolonged political uncertainty. The Dollar surged and interest rates were flat as traders braced for a "political quake" showdown between the president and democrats in Washington where Donald Trump is set to reveal both the transcript of his phone call with the Ukraine president as well as the full whistleblower complaint.

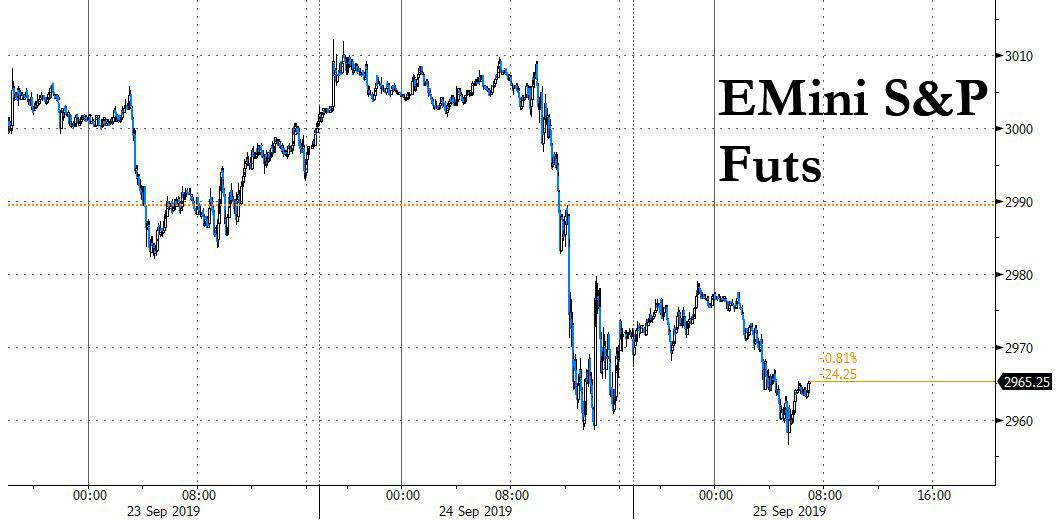

Despite a brief boost higher in the S&P EMmini future late on Tuesday night, when Bloomberg reported that China was preparing to purchase more U.S. pork - in what is supposedly another act of trade goodwill - as Beijing battles against domestic shortages and top trade negotiators from both nations plan to meet in Washington next month, the bearish mood prevailed and the "official" impeachment inequity launched by Democrats in the House of Representatives on Tuesday, exacerbated market anxieties running high over global recession risks. Of course, the impeachment inquiry will not actually lead to Trump’s removal from office: even if the Democratic-controlled House voted to impeach Trump, the Republican-majority Senate has said it will promptly kill the unprecedented motion.

Not helping sentiment was Trump stinging speech at the UN in which he delivered rebuke to China’s trade practices, adding to the pressure after more conciliatory tones in recent days.

Contracts for all three main equity gauges signaled more declines at the New York open as traders grappled with the impeachment investigation into President Donald Trump, seemingly getting little comfort from a Bloomberg report that China is preparing to buy more U.S. pork.

Meanwhile, adding to the China trade war concerns is the narrative that with impeachments proceedings now launched against Trump, China will delay its pursuit of any deal, hoping that either the president is removed or loses the 2020 presidential election. As such the next year will likely see no movement at all in the trade war between the two nations which has already sent Germany's economy into a recession.

“It is hard to imagine how long can the truce with China remain on trade and that is adding to the general cautious environment for stocks,” said Neil Mellor at BNY Mellon in London. “As soon as markets start worrying about trade, they look at central banks for help but there is increasing pushback from them too.”

Also adding to geopolitical tensions is uncertainty over the outlook for Britain’s Brexit chaos after the Supreme Court ruled Prime Minister Boris Johnson had unlawfully suspended parliament.

MSCI’s global stock index dropped 0.4% in a fourth straight day in the red - the longest losing streak since the end of July rout.

European shares were broadly in the red, with Europe's Stoxx 600 dropping 1.4% as technology stocks lead the losses, following Tuesday’s tumble in some of the biggest U.S. tech companies. France’s CAC tumbled 1.6% with export-reliant Germany falling 1.3%.

The downturn in Europe followed declines in Asia where Tokyo’s Nikkei suffered its largest loss in three weeks while China and Hong Kong dropped 1% or more. Nearly all markets in the region were down, with Hong Kong and South Korea leading declines. The Topix dropped 0.2%, snapping a three-day rising streak, with automakers and machinery firms among the biggest drags. The Shanghai Composite Index retreated 1%, driven by PetroChina and Kweichow Moutai. China’s economy in the third quarter was the weakest it has been this year, according to the China Beige Book, with manufacturing, property and the services sectors all worsening. India’s Sensex declined 1.2%, dragged by Housing Development Finance and HDFC Bank. Trump said he expects a trade deal with India very soon, while meeting Indian Prime Minister Narendra Modi at the United Nations General Assembly.

“Chinese shares were already exposed to downside risks. Trump’s comments likely increased those risks,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co in Tokyo. “There are worries about U.S. consumer sentiment. There are also concerns that China’s economic slowdown hasn’t stopped.”

As risk assets took a beating, China’s offshore yuan fell.

China Foreign Minister Wang Yi said US and China need to take their bilateral relationship forward with wisdom and conviction, while he added that the relations have come to a crossroads and the trade war has inflicted losses on both sides. Wang further commented that neither US nor China can move ahead without the other and that opening up, as well as integration represent the way forward. However, Wang also stated US reverting to containment policy on China is a wrong idea which cannot possibly work, and that China will remain on its own path, while he added US should not try to change China and that trade negotiations cannot happen under threats.

In FX, the Bloomberg Dollar Spot Index erased much of its Tuesday drop as the greenback advanced versus all its peers amid political uncertainty in the U.S. and the U.K. The risk-sensitive Swedish krona led losses in the G-10; the pound reversed its Tuesday gain as U.K. Prime Minister Boris Johnson returned to the country after Britain’s Supreme Court ruled that he’d broken the law by suspending Parliament.

“Predicting the ultimate outcome of Brexit remains difficult,” said Mark Haefele, Chief Investment Officer, UBS Global Wealth Management. “As a result, the longer-term risk-return outlook for UK equities looks uncertain. We still advise being nimble on sterling.”

The yen weakened for the first time in five days against the dollar. Yields on 5-year Japanese government bonds slipped to a record low of minus 0.4% after comments from central bank Governor Haruhiko Kuroda added to speculation of an interest-rate cut in October while euro-area bonds gained to outperform Treasuries. Semi-core European debt led the advance in the region. The yield on 10- year U.S. Treasuries fell nearer to a two-week low with the the yield on benchmark 10-year Treasurys rising to 1.6387%, while the two-year yield stood at 1.6076%.

In commodities, crude futures declined after Saudi Aramco said it was ahead of schedule in restoring output that was reduced by a drone attack earlier in September.

In gepolitics, Iranian government spokesman says that President Rouhani will make important proposals in New York to build confidence and break the current deadlock, Limited amendments to nuclear deal could be accepted in exchange for Washington's return to the agreement and Tehran is ready to reassure everyone that it is not seeking a nuclear weapon. US Secretary of State Pompeo tweeted that Iran must not be allowed to continue its destructive behaviour and suggested for the sake of the Iranian people and the world, the UNSC has a vital role to play in ensuring the UN arms embargo on the world’s top sponsor of terrorism

On today's calendar, we got mortgage applications which crashed 10.1% in the past week as rates modestly picked up, and new home sales. HB Fuller is among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.2% to 2,963.75

- STOXX Europe 600 down 1.3% to 384.87

- MXAP down 0.6% to 158.22

- MXAPJ down 0.9% to 503.19

- Nikkei down 0.4% to 22,020.15

- Topix down 0.2% to 1,620.08

- Hang Seng Index down 1.3% to 25,945.35

- Shanghai Composite down 1% to 2,955.43

- Sensex down 1.2% to 38,635.61

- Australia S&P/ASX 200 down 0.6% to 6,710.22

- Kospi down 1.3% to 2,073.39

- German 10Y yield fell 1.3 bps to -0.613%

- Euro down 0.2% to $1.1002

- Italian 10Y yield rose 0.2 bps to 0.494%

- Spanish 10Y yield fell 2.4 bps to 0.094%

- Brent futures down 1.5% to $62.13/bbl

- Gold spot little changed at $1,531.73

- U.S. Dollar Index up 0.2% to 98.53

Top Overnight News from Bloomberg

- Speaker Nancy Pelosi said the House is opening a formal impeachment inquiry of President Trump, saying he violated his oath of office and obligations under the Constitution. The U.S. Justice Department suggested it may defend Trump’s effort to block a subpoena to his accountant for tax records and other private documents

- Chinese companies are preparing to purchase more U.S. pork, according to people familiar with the situation, with top trade negotiators from both nations set to meet in Washington next month

- A defiant Boris Johnson hit back at the U.K.’s top judges and vowed to take the country out of the European Union next month, despite suffering an unprecedented legal defeat over his Brexit strategy in the highest court in the land. Labour rules out election until no-deal risk over

- China’s economy in the third quarter was the weakest it has been this year, according to the China Beige Book, with manufacturing, property and the services sectors all worsening, even as borrowing picked up

- Japan’s five-year government bond yield slipped to a record low after comments from central bank Governor Haruhiko Kuroda added to speculation of an interest-rate cut in October. BOJ’s Masai says FX could exert negative effects on Japan prices

- The leaders of France and the U.K. urged Iranian President Hassan Rouhani and President Trump to meet on the sidelines of the UN General Assembly in what appeared to be rapid-fire shuttle diplomacy aimed at easing tensions

Asian equity markets tracked the losses seen across global peers amid headwinds from the US where sentiment was dragged by weak Consumer Confidence data, increasing impeachment concerns and after President Trump kept a hardline tone on China and Iran. ASX 200 (-0.6%) and Nikkei 225 (-0.4%) were lower with Australia pressured by losses in the mining-related sectors and after optimistic comments on the economy from Governor Lowe placed some doubts regarding a rate cut next week, while Japan trade was dampened by recent flows into its currency and ongoing uncertainty regarding a trade deal with the US. Hang Seng (-1.2%) and Shanghai Comp. (-1.0%) were also negative after US President Trump kept a hawkish tone on China during his UN speech in which he alleged China has not adopted promised reforms, uses heavy state subsidies, steals intellectual property and manipulates its currency. This was later followed by comments from China’s Foreign Minister Wang who responded with a more conciliatory tone in which he suggested the sides need to take their bilateral relationship forward with wisdom as well as conviction and that neither countries can move ahead without the other, although he also added the US should not try to change China and that trade negotiations cannot happen under threats. Finally, 10yr JGBs were higher amid the negative risk tone and as the pressure on yields resumed with the 10yr yield below -0.25% and the 5yr yield touched a record low which has spurred speculation BoJ may be forced to reduce is regular purchases, while weaker results at the 40yr JGB auction did little to dent the rally in Japanese bonds.

Top Asian News

- BOJ’s Masai Offers New Reason for Sitting Tight Amid Easing Talk

- Kuroda Gets a Steeper Curve as Five-Year Yield Sets Record Low

- Thailand Holds Interest Rate as it Downgrades Growth Outlook

- Philippine Central Bank Cuts 2019 Inflation Forecast to 2.5%

Major European bourses (Euro Stoxx -1.3%) are lower, with sentiment weighed by a number of factors. Prior to the cash open, fresh concerns regarding US/EU trade relations were stoked; reportedly the US, in retaliation for illegal EU subsidies for Airbus (-0.5%) (as ruled recently by the US), is mulling hit EU imports with tariffs that randomly rotate, so as to hit as many industries as possible and create higher levels of uncertainty. 2) US President Trump impeachment. Additionally, the possibility of the impeachment of US President Trump adds further uncertainty to the macro backdrop. Further negative ticks were seen across equities (most pronounced in the DAX) on the reports that China is to accelerate the public listings of chip companies on Shanghai’s STAR stock market in the latest initiative by Beijing, as China counter US technology sanctions and speed the development of its semiconductor industry. Sectors are all in the red, with Tech (-2.0%) and Consumer Discretionary (-1.7%) leading the decline, while more defensive Utilities (-1.0%), Health Care (-1.1%) and Consumer Staples (-0.8) are lower but faring better. In terms of individual movers; Adidas (-0.8%) was higher at the open, in sympathy with Nike, who are higher in premarket trade after posting strong earnings, before succumbing to the broader market’s negative feel. Wirecard (-2.4%) is under pressure after a downgrade at UBS. EDF (-7.1%) sunk on the news of further delays to projects and a higher build up in associated costs that expected. Babcock (+4.3%) is higher, after posting a positive trading update.

Top European News

- TeamViewer Makes Drab Debut After IPO Priced at Upper End

- Did ECB Accidentally Tighten Policy? Analysts Won’t Let it Drop

- Europe’s Funds Are Hunkering Down in Bonds for Coming Recession

- Aston Martin Sells Bonds to Bridge Cash Gap Ahead of SUV Launch

In FX, the broad Dollar and Index is staging a recovery following yesterday’s losses after DXY briefly dipped below 98.30 due to a combination of further Fed repo operations, downbeat US consumer sentiment and strength in G10 peers. DXY now treads water just above 98.50 ahead of yesterday’s high of around 98.70 with participants keeping an eye on events State-side as the House is to open a formal impeachment inquiry into US President Trump (analysis on the RANsquawk headline feed) whilst Fed’s Evans (Voter, Dove) is due to speak at 1400BST on the economy and policy.

- GBP, EUR - Sterling is on the backfoot today ahead of Parliament’s return at 1130BST (analysis on the RANsquawk headlines) with initial downside in Cable coinciding with reiterations from Labour leader Corbyn, who stated that the earliest he would call a general election would be October 17th after the PM has requested a Brexit extension, although a firmer Buck somewhat influenced currency action. GBP/USD has reversed a bulk of yesterday’s gains with the pair back below the 1.2450 level after breaching its 10 DMA (1.2462) ahead of support between 1.2410-15. Meanwhile, EUR/USD remains around the 1.10 handle (where 740mln in options expire at today’s NY cut) , off its high of around 1.1023 (amid a firmer Buck) ahead of resistance and 1.1025, also where offers have been reported, whilst to the downside, EUR/USD sees resistance at 1.0980.

- NZD, AUD - The Kiwi has given up most a bulk of its post-RBNZ gains in which the Committee agreed that developments since the August Statement had not significantly changed the outlook for monetary policy. The RBNZ reached a consensus to keep the OCR at 1% and that, if necessary, there remains scope for more fiscal and monetary stimulus. CB also maintained a neutral stance despite some calls for an easing bias to be reintroduced. NZD/USD resides around 0.6325, having visited a high of 0.6350 (on the decision) and vs. a pre-announcement low of 0.6305. Meanwhile, the Aussie has faded yesterday’s Lowe-induced gains with some potential pressure from weaker copper prices and as the AUD/NZD cross falls further below 1.0750 having earlier tested 1.0700 to the downside.

- EM - The Lira continues to strengthen in European trade, this time amid comments from the CBRT Governor who reiterated the Central Bank’s “cautious” stance, in turn providing some relief to investors who fear that the Bank may be jumping the gun following two back-to-back deeper than forecast rate cuts. The Governor also acknowledged the continuing improvement in inflation whilst also noting an economic recovery in H2. USD/TRY is back below the 5.7000 level (low 5.6784) having declined from an intraday high of 5.7100.

- RBNZ maintained the Official Cash Rate at 1.00% as expected, while it stated the committee agreed new information did not warrant significant change to the policy outlook and that a steady OCR is needed to ensure inflation increases to the mid-point of its target range. RBNZ added there remains scope for fiscal and monetary stimulus, that domestic rates can be expected to remain low for longer but also noted that low rates and government spending is expected to support demand in the coming years. (Newswires)

In commodities, the crude complex is lower on Wednesday morning, seemingly in line with equities, although bearish supply side news doing the rounds is also likely a factor in the downside; reportedly, Saudi Aramco is recovering faster than expected form the recent attacks on its oil facilities, with total daily production capacity likely to be restored to over 11mln BPD roughly one week ahead of schedule. On the topic of bearish impulses; more reports focusing on the fact that the US drilled-but-uncompleted wells (DUCs) count is declining, possibly an indication that companies have started completing unfinished wells, which could foreshadow elevated US crude output, have been doing the rounds. Elsewhere, the complex has taken little impetus from geopolitics; Iranian President Rouhani has indicated a willingness to make some concession if the US eases sanctions (which remains a big if, especially given US President Trump’s slightly hawkish UNGA speech yesterday), and may unveil some proposals at the UN later today. WTI futures are again below the USD 56.50/bbl mark, consolidating for now around USD 56.50/bbl figure, meanwhile Brent remains near the USD 62/bbl level. Spot Gold futures are fairly flat, seemingly unable to take advantage of woes in the equity market, and is blanketed by support and resistance at USD 1520/oz and USD 1536/oz respectively. Elsewhere, copper is lower, in line with general sentiment.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -0.1%

- 8am: Fed’s Evans Discusses Economy and Monetary Policy

- 10am: New Home Sales, est. 658,000, prior 635,000; New Home Sales MoM, est. 3.62%, prior -12.8%

- 10am: Fed’s George Speaks to Senate Banking Panel on Payments System

- 10am: Fed’s Brainard Speaks Before House Panel on Financial Stabilit

- 7pm: Fed’s Kaplan Speaks in Moderated Q&A

DB's Jim Reid concludes the overnight wrap

Although nothing seems that abnormal these days, yesterday was pretty remarkable as two of the most powerful leaders in the world faced serious misconduct/legal charges and accusations. After the US closing bell the day’s speculation that Mr Trump would face an impeachment inquiry materialised as Nancy Pelosi formally announced the start of the process in the US House of Representatives. This followed an unprecedented Supreme Court hearing in the U.K. which found that PM Johnson’s decision to prorogue Parliament was unlawful. They will reconvene today some three weeks ahead of the PM’s prior wishes.

The impeachment inquiry regards a phone call between President Trump and Ukrainian President Zelenskiy from July. An anonymous individual in the US intelligence community, who was apparently listening to the call as part of his job, issued a whistleblower complaint to his superiors alleging that a senior US administrator had improperly interacted with a foreign official, possibly by asking for political assistance in a US election. The Trump administration has refused to release the complaint to Congress, which Pelosi argues is illegal since the law requires all complaints to be forwarded to the legislature. Per Pelosi’s announcement, both the alleged misconduct on the call and the withholding of the complaint are two separate but parallel grounds for the impeachment inquiry.

Equity markets in the US and Europe had already pared earlier gains after slightly more negative trade comments from Mr Trump at the UN General Assembly (see below). The S&P 500 then took another leg lower after the European close as media outlets reported that the impeachment inquiry may happen. The S&P 500 traded as low as -1.14% after those unconfirmed press reports and the NASDAQ fell to -1.74%. However, both indexes pared part of their declines in mid-afternoon after Trump announced that he will release the full transcripts of the relevant phone call by later today. The S&P 500 and NASDAQ ended the session -0.84% and -1.46% lower, respectively.

Mr Trump’s earlier trade comments suggested that “hopefully we can reach an agreement that will be beneficial to both”, but that China hadn’t adopted the reforms they’d promised. He also spoke positively about the “massive tariffs on more than $500 billion worth of Chinese-made goods” and lauded that “supply chains are relocating back to America (…) and billions of dollars are being paid to our treasury.” Trump also pivoted directly from talking about trade to discussing the situation in Hong Kong, which would be a confrontational step if he starts to link the two topics.

Overnight Bloomberg has reported that Chinese companies are preparing to purchase more US pork. The story further added that the volume of the purchases hasn’t been finalised but may be around 100,000 tons, some of which will be for state reserves. This comes ahead of meeting between top trade negotiators from both nations next week and points to continued improvement in mood music ahead of the talks; however, one needs to be cautious given the uncertain nature of these talks and above mentioned comments from Trump at the UNGA. Elsewhere, Chinese Foreign Minister Wang Yi has said that both the US and China have shown good will with recent tariff moves while adding “Conflict and confrontation can lead nowhere and neither country can mould the other in its image.” He also said that China also expects the US to remove its own restrictions on Chinese trade and investment.

Asian markets are trading down this morning with the Nikkei (-0.47%), Hang Seng (-0.95%), Shanghai Comp (-0.57%) and Kopsi (-0.80%) all lower. However, most of the indices have pared deeper declines after the trade story above hit the wires. S&P futures which were flat after Pelosi’s announcement, are also up +0.22%. 5yr JGB yields are trading down -3.3bps this morning at a record low of -0.399%, surpassing the previous low reached in July 2016. 10y JGB yields are down a more limited -2.4bps to -0.271%. The moves comes after the BoJ Governor Kuroda said yesterday that he was closer to adding stimulus now than he had been earlier in the year while adding, “I don’t think we need to rule out cutting negative rates as a policy option at this point.” Overnight, the White House has also listed a 4pm press conference with President Trump in New York in the President’s daily schedule. So one to watch for. In terms of overnight data releases, Japan’s August services PPI came in one-tenth above consensus at +0.6% yoy while previous months read was also revised up by one tenths to +0.6% yoy.

The sharp US equity moves yesterday snapped the recent stretch of lower vol trading conditions. Indeed, on a closing basis, the S&P 500 had traded in a 0.59% range over the last 9 sessions, the tightest such range in just over a year. That had placed it within roughly +/-0.5% of the symbolic 3,000 level every session over that period, before snapping out to the downside last night. As mentioned above European equities closed below their earlier peaks but before the main part of the US’s afternoon selloff. The STOXX 600 ended flat while the DAX retreated -0.29%. The FTSE 100 (-0.46%) also fell thanks to sterling’s appreciation.

Indeed sterling rallied +0.50% yesterday as the UK Supreme Court ruled in a unanimous judgement that Prime Minister Johnson’s advice to the Queen to suspend Parliament “was unlawful, void and of no effect”, and that Parliament “has not been prorogued”. Furthermore, the President of the Supreme Court said that “The effect upon the fundamentals of our democracy was extreme”, and that “No justification for taking action with such an extreme effect has been put before the court.” The ruling is a massive setback for the government, who had planned that Parliament wouldn’t return until 14th October. After the ruling was announced, the Speaker of the House of Commons, John Bercow, said that Parliament would return this morning, and MPs would have further opportunities to scrutinise government ministers and apply for emergency debates.

In response to the decision Prime Minister Johnson, who had also been at the UN General Assembly in New York yesterday, changed his plans to fly back to the UK for Parliament’s resumption. He said he “strongly disagrees” with the ruling but that he’d respect the court’s decision. The developments from the Supreme Court rather upstaged the opposition Labour Party’s annual conference yesterday, with the resumption of Parliamentary proceedings leading Jeremy Corbyn to bring forward his speech by a day to be back in Parliament. Corbyn reiterated his stance in favour of a second referendum, pledging to implement whichever option the public decided. Notably, he said that he wouldn’t support another election until no-deal had been taken off the table, opposing Johnson’s attempts to call one for the time being. In terms of other proposals from the speech, which on another day would have been newsworthy in themselves, the highlights included proposals for: creating a state-owned drug manufacturer to produce low-cost generic drugs; nationalising rail, water, and postal companies; zero carbon emissions by 2030; and state-provided personal care for senior citizens. Perhaps most impressively, he promised to deliver the suite of new benefits without raising the national debt. This follows news from the previous day that we’ll all work 4-day weeks within a decade here in the U.K. under a new Labour administration.

Back to markets and in Europe the post ECB sell-off in bonds is becoming more of a distant memory as sovereign recovered from earlier losses to end the session higher, with bunds (-1.9bps) and OATs (-0.8bps) rallying following slightly disappointing US data (see below). We did have some European data releases yesterday, but following the previous day’s underwhelming PMIs, the releases weren’t quite so bad. In Germany, the Ifo business climate index rose three-tenths to 94.6 (vs. 94.5 expected), while the current assessment reading rose to 98.5 (vs. 96.9 expected). The dampener was the expectations reading however, which fell to its lowest in a decade at 90.8 (vs. 92.0 expected). Looking at the sector balances in the Ifo, services saw an uptick to 16.6 (from 13.0 in August), but both manufacturing (at -6.4) and trade (-3.7) slid deeper into negative territory. Data from France was more positive at the top level too, with the INSEE’s business climate composite indicator rising to 106.2 (vs. 105 expected), the joint highest over the last year.

A particular area that suffered in Europe yesterday were automobile stocks, with the STOXX Automobiles and Parts Index down –1.36% after Volkswagen’s CEO and Chairman, along with a former CEO, were charged by German prosecutors with market manipulation from failing to disclose knowledge of the emissions cheating scandal that has since cost the company billions of dollars in fines. Meanwhile Daimler was also fined €870m over vehicles that didn’t meet emissions regulations. Volkswagen and Daimler closed down -2.16% and -1.68% respectively.

Oil was a further casualty, with Brent Crude down -3.21% yesterday, as concerns about global energy demand following the US data releases coupled with hopes that Saudi output would be restored sent prices lower. Gold advanced +0.65% however as investors sought out safe havens, up for a 4th successive positive session.

As for the US data, the Conference Board’s consumer confidence indicator fell to 125.1 (vs. 133.0 expected), while the present situation (169.0) and the expectations readings (95.8) also lost ground on last month. Adding to the negative sentiment, the Richmond Fed’s manufacturing index underwhelmed as well, falling to -9 (vs. 1 expected). Following the releases, the dollar slipped back while Treasuries rallied, with 10yr yields down -8.6bps, though the rally gained momentum amid the equity selloff during the NY afternoon session. The 2s10s curve flattened by -1.8bps to close at 2.3bps the lowest since September 6.

Turning to the day ahead, data highlights include French consumer confidence for September and the CBI’s September distributive trades survey from the UK, while from the US we have August new home sales figures and weekly MBA mortgage applications. In terms of central bank speakers, we’ll be hearing from the ECB’s Coeure and Lautenschlaeger, the Fed’s Evans, George and Brainard , and the BoE’s Governor Carney. And of course keep an eye out for further developments on Brexit as both houses of the UK Parliament will be sitting again.

https://ift.tt/2l7xW2s

from ZeroHedge News https://ift.tt/2l7xW2s

via IFTTT

0 comments

Post a Comment