Repo Market Guru: "Whatever Changed Last Week Is Clearly Still A Problem"

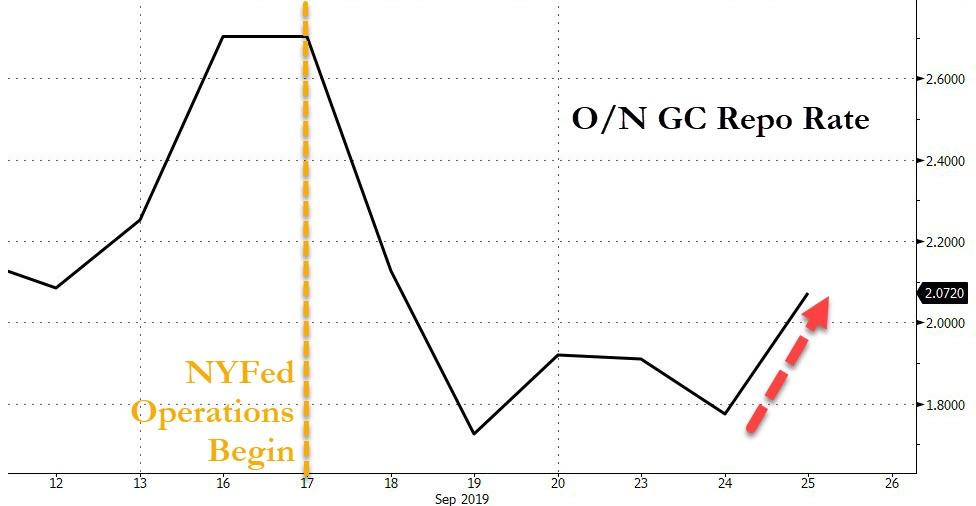

Last week around this time, most of the self-described repo experts on twitter and elsewhere were pounding the table, screaming to anyone who would listen that the unprecedented spike in overnight general collateral repo from 2.25% to 10% was a non-event, and reflects one-time items such as the mid-September tax remittance, the rapid build up of cash in the Treasury's general account and a flurry of Treasury settlements.

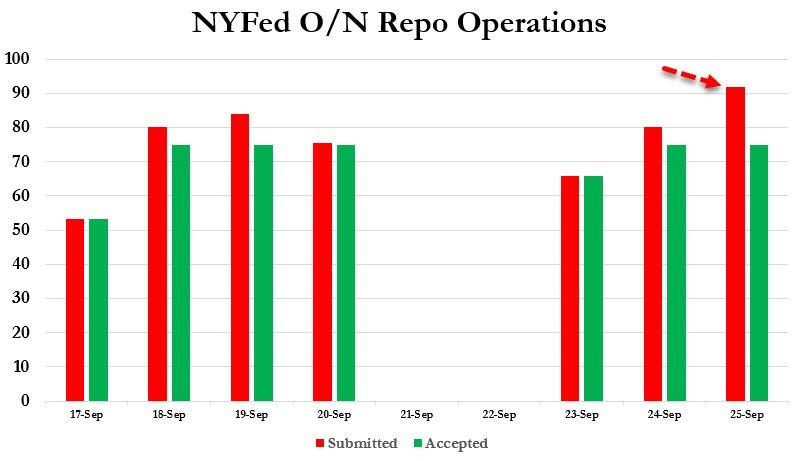

Alas, as we warned, and as the NY Fed today confirmed, the sudden heart attack in the critical, overnight funding market has turned out to be anything but a one-time event. First, as we saw first thing this morning, the latest repo overnight repo operation was the most oversubscribed yet, with $91.95BN in securities tendered for $75BN in reserves, the most yet since the Fed resumed these "unclogging" operations after a decade plus hiatus.

However, the big surprise came later on Wednesday morning, when in an "unexpected" move, the Federal Reserve expanded the size of its two dollar funding operations, the overnight and term repo, from $75BN to $100Bn, and from $30Bn to $60BN heading into quarter-end, effectively injecting up to $250 billion in funding ($30BN in already concluded term repo as well as two $60BN term repos yet to come, together with the $100BN overnight repo, assuming full allottment on all operations, for a grand total of $250BN).

Commenting on this dramatic expansion in Fed liquidity injections, BMO's rates expert ian Lyngen, had a simple, if very powerful observation: "the fact that we’re discussing a quarter trillion dollars is telling as to the depth of the constraint in repo." Indeed a far cry from the "all clear" the twitter repo "experts" were screaming from the top of their lungs last week.

As we approach quarter-end, it’s intuitive that funding markets are attracting heightened attention after last week’s repo fiasco. One thing has become clear, however, and that is that the Fed is willing to provide significant amounts of liquidity to primary dealers to alleviate as much stress as possible. By upsizing injections to $250 bn or more (assuming overnight remains at $100 bn through October 1 and the terms are $30 bn/$60 bn/$60 bn, respectively) the fact that we’re discussing a quarter trillion dollars is telling as to the depth of the constraint in repo as well as the New York Fed’s desire to make September 30 boring. At the end of the day, only primary dealers are counterparties of this facility. This presents a possibility of some upward pressure on rates were cash not to have permeated throughout the system by the reporting date.

Confirming Lyngen's fears, and in a troubling indication that despite the Fed is now clearly throwing the kitchen sink at the repo problem and failing, was today's increase in the overnight G/C repo rate which has once again started to rise ominously.

Unfortunately, in its attempt to window-dress the issue, and pretend there is no problem at all, the Fed continues to pretend as if the problem isn't there, and following on this morning's comments from Lael Brainard that the repocalpyse was the result of a "simple imbalance" of supply and demand - and not a sign of deeper distress in credit markets - Dallas Fed president Kaplan said late on Wednesday that whereas the repo strain is important, it does not signal broader stress, and merely shows that the system needs more liquidity.

To be sure, as we explained over the weekend, he is right about the latter, but wrong about the former, and to make it crystal clear to everyone that something is clearly broken with the systemic plumbing, here is repo market guru, Scott Skyrm, who works for Curvature Securities, and whose sole business is Repo financing in U.S. government securities, so yes, he knows better what he is talking about than any so-called fintwit expert.

Let's just say that the Repo market is not so simple. Just a week ago I was singing praises to the Fed's overnight and term RP operations. Then, when rates backed-up the past two days, I was worried there was not enough cash in the system and the existing operations had failed. Now, it looks like smooth funding again! The Fed announced they are doubling the term and overnight RP operations tomorrow to $60 billion and $100 billion, respectively. When in doubt, throw more money at the problem!

To be sure, if there is anything the Fed has demonstrated amply over the past decade, is that when in doubt, it will throw "enough money at the problem" that it will inflate the biggest asset bubble in history in the process.

But it was Skyrm's punchline that was especially troubling as it confirms our worst fears:

Now, here's the rub. It's great that the Fed is pumping liquidity into the system, however, why were the existing operations insufficient?

As of today, the Fed had injected $105 billion in liquidity into the Repo market, but rates were still stubbornly high. Whatever changed last week to cause the funding spikes is clearly still an problem.

Indeed it is, and unfortunately neither the Fed nor apparently anyone else, still has a clue what is going on.

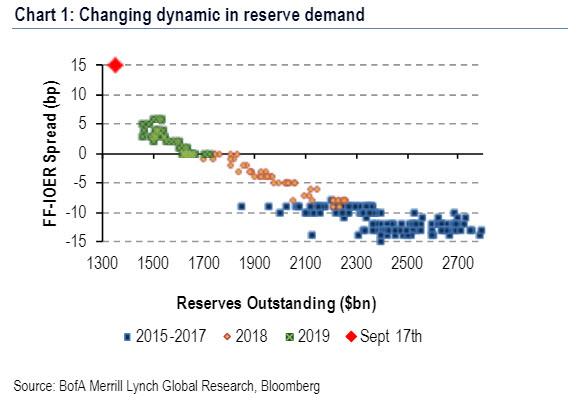

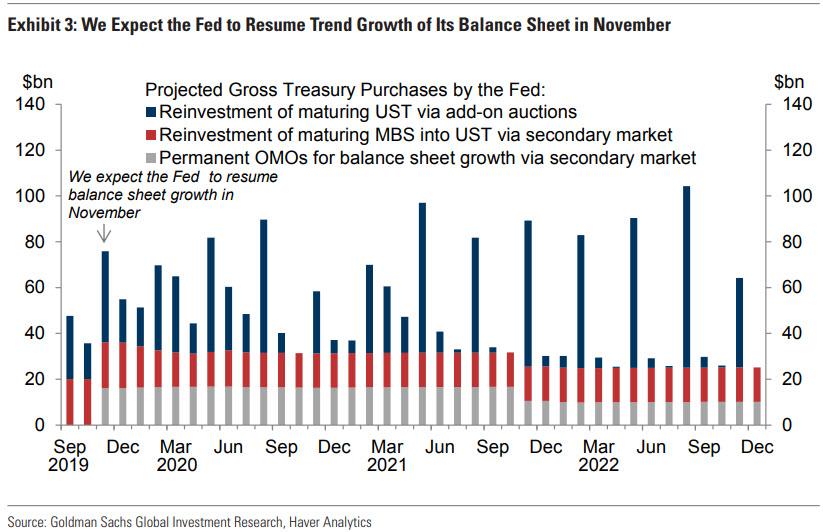

Which brings us to something else that Kaplan said late on Wednesday, namely that the Fed will now study what size the balance sheet should be in the future. Sound familiar? It should: that's precisely the exercise we conducted over the weekend, when we analyzed how much bigger the Fed's balance sheet will be in the coming year, and how the Fed will get there. For those who missed it: the Fed needs to boost its reserves by roughly $400 billion to get the total to $1.8 trillion.

The only question is what how it will do it. And here we get to the bottom line, because whereas the Fed and its sycophantic media enablers are desperate to avoid calling the upcoming bond purchases by their real name, instead settling for the far more technical POMO, or permanent open markets operations, which as Goldman estimates will have to by roughly $15BN per month for a total of about $150BN per year...

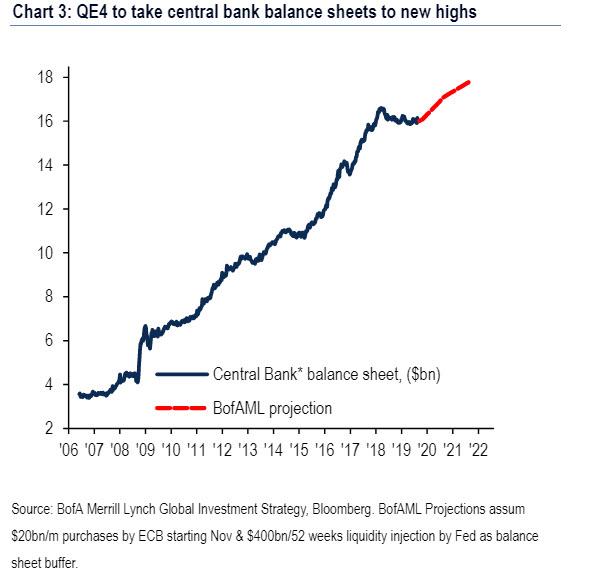

... it was Bank of America that let it slip, and in a chart from BofAs' Michael Hartnett, the Chief Investment Strategist called what is coming by its real name: QE4.

The problem, as Hartnett also identified, is that this will take the central banks' balance sheet to new all time highs, resulting in the biggest asset bubble in history getting even bigger... and setting up the world for an even greater crash when the fed's pushing on a string fails. And while nobody knows when that will happen, the fact that the financial system nearly collapsed last week even with $1.4 trillion in "excess" liquidity for reasons still unknown, means that like a great white shark, the market now needs constant liquidity injections, or else it will collapse.

Finally, considering that it has now filtered down to even the average American that - courtesy of Bernie Sanders and Elizabeth Warren - that it is the Fed's market distorting operations that have resulted in a record wealth and income gap, we wonder: is it Trump's impeachment, or is it the Fed's upcoming QE4, that sets the stage for the now upcoming US civil war?

https://ift.tt/2lOxWEM

from ZeroHedge News https://ift.tt/2lOxWEM

via IFTTT

0 comments

Post a Comment