Amazon Explodes 18% Higher On Prime Membership Increase, AWS Beat

With the bulk of the FAAMG stocks - which is now GAMMA following Facebook's rebranding to Meta - having reported Q4 results (some great, like GOOLG and MSFT, some, like Facebook, terrible), investors were keenly looking to Amazon earnings, where the biggest question for Amazon is how sustainable are the growth trends that boosted its performance during the pandemic. The Internet giant was one of the biggest beneficiaries of shifts in consumer and business behavior last year while continuing to grab market share in cloud.

As Bloomberg notes, 2022 is a critical year for new Amazon CEO Andy Jassy, who is facing a declining stock price, slowing e-commerce growth, rising costs, and labor concerns in New York and Alabama. He’s also facing inflation, new consumer technology rivals and third-party product delays in the early days of his first full year as the company’s top executive.

Many analysts are expecting a price hike to Amazon Prime given inflation. Some have speculated that a price increase could hit a $139 price annually, which would come out to about $2 per month extra for consumers. In 2018, the company raised the price of the service from $99 per year to $119 per year. And the prior hike to that one was in 2014, when it increased Prime’s annual cost to $99 from $79.So, if the four year pattern holds, we could see Amazon raise the Prime’s price again either tonight or in the upcoming months.

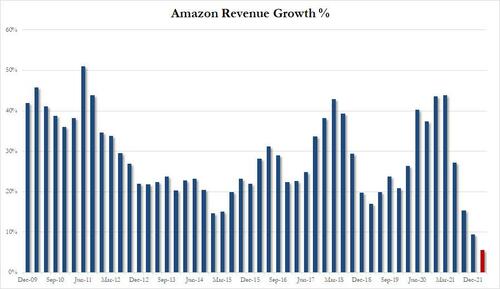

While the Meta fiasco has certainly left a bad taste in investors' mouths, with options implying a 5.5% move after hours, there’s a lot of bad already baked into Wall Street expectations around Amazon, so it might end up skipping over muted expectations. If analysts are right about revenue growth of less than 10% (the company's guidance is for a 7.5% revenue growth quarter), it’ll be Amazon’s slowest growth in two decades years.

For two consecutive quarters Amazon has provided disappointing revenue outlooks primarily due to slowing online sales. Will it be different today? Recent data shows the e-commerce category hasn’t improved. According to the latest Bank of America credit-card data. After rising 6% in November from a year earlier, the e-commerce category’s sales fell 3% in December and have stayed negative in January.

Still, impatient investors will be looking for some turnaround for the stock price, given that Amazon shares are down 11% in the past year while the rest of the SPX index is up about 19%. That said, AMZN shares are up 8% in the last 5 days versus 4.6% for the index.

Alas, much of that gain was wiped out today, with Amazon shares are down 7.47%, the most since July 2021. The NASDAQ is down 3.62%, the most since Jan 24, in response to the Meta results on Thursday.

* * *

So with that in mind, how did Amazon do in what may be Andy Jassy's most important quarter as the company's new CEO? Well, it appears, the answer is pretty good: the company beat operating income and cloud expectations even if it missed on revenues and provided a soggy guidance, and yet the stock is exploding higher, perhaps because as expected, it hiked the price for Amazon Prime. Here is what it just reported:

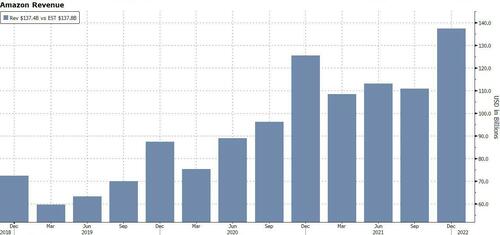

- Net Sales $137.41BN, up +9.4 Y/Y on top of estimates of $137.82B

- EPS $27.75, almost double the $14.09 Y/Y and also smashing estimates of $3.77, but much of this was due to Rivian (see below).

- Net income was a whopping $14.3 billion in the fourth quarter 2021, up from $7.2 billion a year ago, BUT net income included a pre-tax valuation gain of $11.8 billion included in non-operating income from AMZN's common stock investment in Rivian Automotive, which completed an initial public offering in November. In other words, ex Rivian, EPS would have missed.

- Operating Income $3.46BN, down 50%Y/Y but beating est. $2.43B

- AWS net sales $17.78 billion, up 40% beating estimates of $17.23 billion

- Online stores net sales $66.08 billion, down -0.6% and missing estimates of $66.44 billion

Looking ahead, the company's guidance was somewhat weak, with the high end of expectations missing sellside consensus as the company sees several billion dollars in additional costs in Q1.

- Q1 Net Sales $112.0BN to $117BN, missing Wall Street est. $120.5BN

- Q1 Operating income between $0 billion and $3.0 billion, also badly missing estimates of $7.44BN

But perhaps the most important thing the company announced is that as expected above, Amazon did in fact hike the price of Prime: in its first price hike for the service since 2018, Amazon said it will increase the price of a Prime membership in the U.S. from $12.99 to $14.99, with the annual membership rising from $119 to $139. For new Prime members, the price change will go into effect on Feb. 18; for current Prime members, new price will apply after March 25 on the date of their next renewal.

Bloomberg Intelligence Analyst Poonam Goyal notes that with the Prime Membership increase "a lot of that helps them offset rising costs" adding that "the Prime fee increase will address the largest pain point across Amazon’s retail business, which is margin.”

Commenting on the quarter, CEO Andy Jassy said that “as expected over the holidays, we saw higher costs driven by labor supply shortages and inflationary pressures, and these issues persisted into the first quarter due to Omicron. Despite these short-term challenges, we continue to feel optimistic and excited about the business as we emerge from the pandemic. When you combine how we’re staffing and scaling our fulfillment network to bring even faster delivery to more customers, the extraordinary growth of AWS with 40% year-over-year growth (and now a $71 billion revenue run rate), the addition of marquee new entertainment like The Lord of the Rings: The Rings of Power and Thursday Night Football, and a plethora of new capabilities that we’re building in areas like Alexa, Ring, Grocery, Pharmacy, Amazon Care, Kuiper, and Zoox, there’s a lot to look forward to in the months and years ahead.”

Digging into the numbers we find that the company's revenue grew by 9.4% in Q4, far below the 43.6% a year ago, but above its own guidance. It gets worse because the Q1 midline revenue guidance of $114.5BN is projected to grow just 5.5% Y/Y, the slowest growth in the past decade.

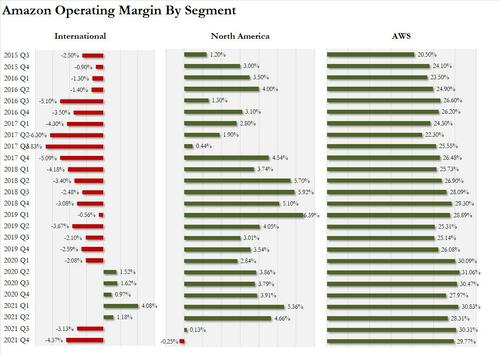

A breakdown of sales in Q4 between domestic and international shows misses in both:

- North America Net Sales $82.36B, beating est. of $81.06B

- Intl Net Sales $37.27B, missing est $38.97B

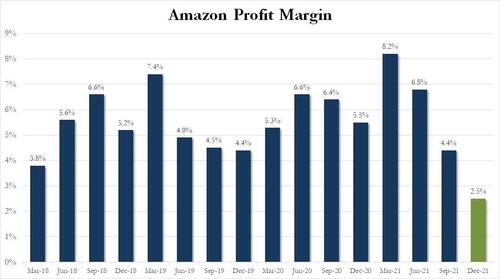

While operating margins dropped, sliding from 4.4% in Q3, to just 2.5%, tied for the lowest since March 2018, it was better than the 1.82% expected.

A look at margins showed more ugliness with a big drop in both North American and Intl retail margins, both of which actually turned negative, and it was the AWS margin of just under 30% - the lowest since Q2 - that saved the company's overall profit margin. And perhaps most remarkably, if it weren't for AWS's $5.293BN in profit, AMZN would have a negative profit margin across its legacy operations.

One would know it looking at margins, but Amazon said this past Black Friday to Cyber Monday shopping period was its biggest ever and that apparel, beauty, home and toys items were among the top categories.

The good news is that while AWS margins are not growing any more, total revenue is, and in Q4 AWS net sales rose 40% to $17.78 billion, beating estimates of $17.23 billion.

It was also notable that for the first time, Amazon disclosed advertising revenue as its own line item, after traditionally lumping it as part of Amazon’s “other” category, just like Amazon Web Services was years ago. In Q4, Advertising service revenue grew to $9.7 billion, up 33% from $7.350 billion a year ago. That Amazon is breaking out advertising revenue is a signal Amazon sees continued growth from that profitable business line.

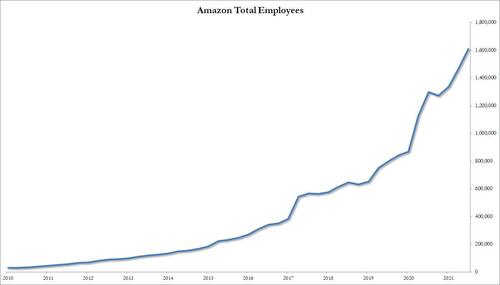

The company continued its hiring ways and after a small dip in Q1, the company employees hit a new record high of 1.608 million.

Yet while the company's growth rate is clearly slowing and its earnings were a mixed bag, they were clearly above downbeat whisper expectations, and between solid AWS numbers and the Prime price hike, the stock is soaring after hours, up nearly $500 or more than 18% - its biggest jump post-earnings release since October 2017, when the stock jumped 13.22% after market open - and helping the Nasdaq recover some 2% from its worst drubbing since September 2020.

And another factoid: this was the first positive move for the stock after an earnings release in the last five quarters. The last time shares were in the green post earnings was July 2020, after the open. And boy, what a time to make up for the collapse.

To those who took a flyer on our trade reco to buy a straddle ahead of earnings, where options were pricing "only" a 5.1% 1-day swing, congratulations.

AMZN implied 1-day move following earnings: 5.1%

— zerohedge (@zerohedge) February 3, 2022

good straddle

https://ift.tt/COcrpXW

from ZeroHedge News https://ift.tt/COcrpXW

via IFTTT

0 comments

Post a Comment