Lyft Slides As Active Riders Shrink After Paying More Than Ever For Driver-Challenged Service

Lyft stock is swinging wildly after hours, first spiking lower, then higher and now drifting lower again. Why? Here's what the company just reported for its Q4 quarter.

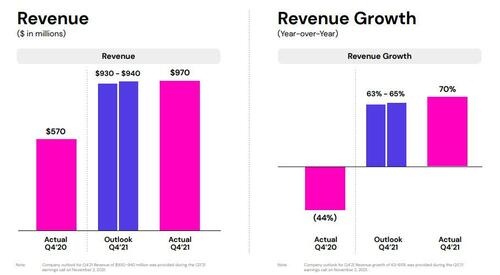

First the good news: the company reported revenues of $969.9 million which beat consensus estimates of $940.4 million as well as its own guidance, rising at a brisk 70% Y/Y benefiting from higher prices due to a continued shortage of drivers...

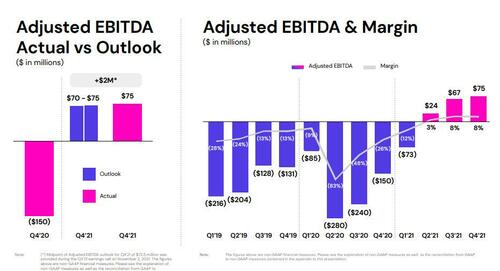

... and achieved a new quarterly record for contribution profit of $578.8 million (exp. $553.7 million) and margin of 59.7% vs exp. 58.9%...

... while adjusted EBITDA of $74.7 million came in at high end of guidance range, if just below consensus of %75.7 million.

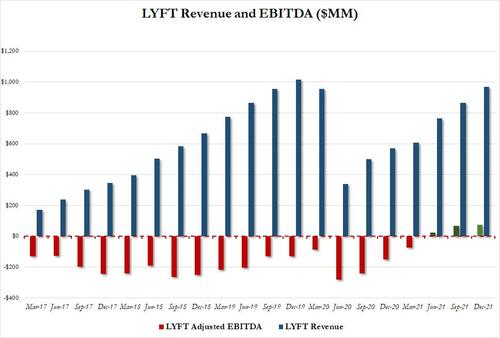

Putting the company's revenue and EBITDA in context:

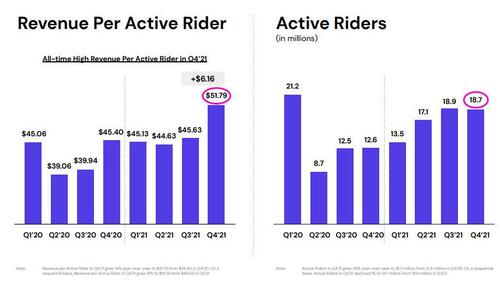

And now the not so good news: the company reported that its Q4 active users were just 18.73 million, up 49% Y/Y, which was not only a big miss to expectations of 20 million and the the first sequential contraction since the covid collapse, but far below the record 22.9 million hit in 2019. Offsetting this, however, revenue per active rider unexpecteldy soared 14% Y/Y to $51.79, "benefiting from improving service levels and a larger mix of longer, higher revenue rides" but mostly due to a continued driver shortage, allowing the company to extract much higher prices. Translation: roaring inflation, only this time wrapped in a mini boost courtesy of the now forgotten Omicron wave.

“We have great momentum but still have lots more to do with one last turn to navigate with omicron,” co-founder and President John Zimmer said in an interview, while CFO Elaine Paul said that “despite short-term headwinds from omicron, we remain optimistic about full-year 2022."

“It’s hard to gauge the impact, large or small, from omicron and the fourth and first quarter are typically seasonally unique because of weather and holidays,” Zimmer said, adding that the majority of omicron’s effect on ridership is “being felt in the first quarter.”

As Bloomberg notes, the results marked a milestone for the ride-hailing giant, which has been buffeted by the effects of Covid and has struggled to match drivers with demand. When the pandemic first seized the U.S. and cities were under lockdowns, demand for rides ground nearly to a halt. Then as restrictions eased, riders were looking for cars, but many drivers stayed on the sidelines, forcing Lyft and Uber Technologies Inc. to offer costly incentives.

And while Uber has been able to pivot into food-delivery during the pandemic with Uber Eats, Lyft’s core business is and remains ride sharing. Even as demand has rebounded, a persistent shortage of drivers has loomed over the companies’ recovery and has left customers waiting longer and paying much more for rides. Zimmer said the number of drivers increased 34% from the previous year with new driver activations jumping 50% in the same period. And while the company has been able to extract much higher costs for now, once drivers are forced to return to work, profits are set to collapse, especially with demand for the company's service already shrinking.

“Investors want to see balance,” said D.A. Davidson analyst Tom White. “You can’t raise prices forever and not start to expect rider demand and volumes impact. More driver onboarding can help stem price increases.”

LYFT stock slumped as low as $37.1 after hours after spiking to $43.24 in kneejerk response to the earnings, while the company's guidance of Q1 revenue in the $800-$850 million range, far below the $985.84 million consensus, is not helping. The share price is down 5% YTD, which however is better than both Uber (-8%) and DoorDash (-33%).

https://ift.tt/ga2tNz4

from ZeroHedge News https://ift.tt/ga2tNz4

via IFTTT

0 comments

Post a Comment