Morgan Stanley: "It Begins"

By Andrew Sheets of Morgan Stanley, Chief Cross-Asset Strategist for Morgan Stanley

If you’re a fan of American football, this year’s playoffs were some of the best in the sport’s history. The last six contests were all decided by the narrowest of margins, often at the last second. It was a good reminder that you need to stay until the end.

I mention this because between lunchtime on Wednesday January 24 and this past Wednesday, there was a distinct feeling of 'we made it'. Yes, inflation has surprised to the upside. Yes, key data were weak. Yes, central banks are pivoting more hawkishly. Yes, yields are rising. Yet, thanks to good earnings and fund inflows, global equities are only down 3%. Well done.

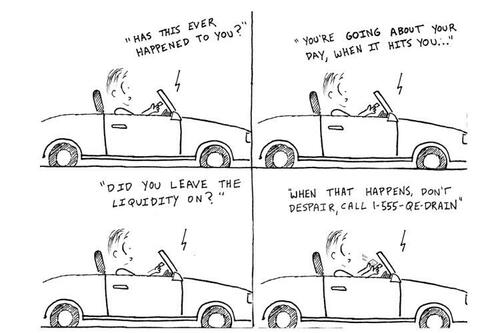

It’s tempting to think that this is the end of the story: the test arrived early this year,and the markets passed. But the reality is likely to be more complicated. This is just the start of the game. A record amount of stimulus is about to be withdrawn from the global economy. It begins.

Part of the withdrawal will come through monetary policy. That shift has two parts: reversing the lowest policy rates in history, and reversing the largest central bank bond purchases in history. You know, simple stuff. From May 2022 to May 2023, Morgan Stanley economists expect G4 central bank balance sheets to shrink by US$2 trillion, four times the largest 12-month decline ever, from 2018-19.

If that isn’t enough, central banks need to engineer this policy withdrawal while unemployment is historically low and inflation is historically high. One often hears that central banks provide markets with a backstop, or ‘put’,given their desire to avoid tighter financial conditions. But central banks now have to balance this concern against their core mandates. And regarding financial conditions, isn’t tightening them kind of the point?

Still, maybe January gave markets a look at these challenges – the weak growth, the high inflation, the hawkish pivots. And after some (very)volatile contemplation, didn’t they pass?

We think it's simply too early to tell. While rates have risen, our strategists think they rise further. While markets have priced in 'more hawkish' central banks, they still expect these hiking cycles to end at historically low levels. For example, the Fed is priced to stop raising rates in 2023,at 1.8%. It’s a similar level for the BoE.

Other factors suggest plenty of twists and turns,and soon. 1Q22sees the greatest risk to our growth estimates, the highest readings for inflation,and the greatest concentration of geopolitical risk.2Q22 could feel very different, with our economists forecasting a growth rebound in the US and China, alongside an inflation decline. And then 2H22 sees a record central bank balance sheet decline begin in earnest. There is a lot of time on the game clock.

For investors, the scale of what lies ahead means we think they should keep overall exposure light. We remain cautious towards duration and IG-rated spread product, believing that both have outsized sensitivity to these policy shifts, with more uncertainty around where 'fair value' is without central bank largesse.

Other areas of the market look more promising. While the ECB was surprisingly hawkish this week, that’s probably a good thing for the euro, European banks, and even European equities overall. European stocks have tended to do better when the euro has been rising, perhaps because such environments tend to reflect more relative economic strength and 'normalcy'. Valuations also matter; despite low rates and QE, stocks in Europe and the UK trade at lower valuations than they did five years ago.

That valuation argument applies elsewhere. Stocks in Japan, Brazil and Korea also trade at similar or lower valuations versus five years ago, suggesting less risk as QE reverses. Most currencies have depreciated against the dollar,a reason why our FX strategists recently upgraded EM FX to neutral. And in commodities, we think that strong fundamentals in energy can help to outweigh this liquidity reversal. We continue to like oil over gold (via 1-year forwards).

January was eventful.February has been, too. While the issues facing the market this year are clear, their impact and timing are uncertain and will continue to play out as the year unfolds. This is the start of a historic policy reversal,not the end. There is a lot of game left to play. Good luck. Enjoy your Sunday.

https://ift.tt/mWgPAGf

from ZeroHedge News https://ift.tt/mWgPAGf

via IFTTT

0 comments

Post a Comment