"We Don't See That Very Often" - Credit Market Cracks Could Spark Doom-Loop With Stocks

As the old adage goes (for those who have been trading for more than the last 12 years of central bank fantasy-land enablement, "Credit anticipates, equities confirm."

Credit and equities decoupled in Q3 2014 when The Fed (under Yellen) issued policy normalization plans...

Credit and equities decoupled in Q4 2017 when The Fed (under Yellen) embarked on balance sheet normalization...

And now, since The Fed began to talk about normalization and accelerated that with the Powell Pivot, credit and equity markets have decoupled dramatically once again...

The issue at hand, however, is that this time is 'different'...

Which means it will not be as easy to slow-down the taper, fold on normalization, temper the tantrum as it was in 2015 and 2018.

Perhaps it is that realization that credit is "anticipating" (and equity is yet to "confirm")

As The FT reports, Viktor Hjort, global head of credit strategy at BNP Paribas. said he believes the credit cycle has turned, meaning that the positive economic backdrop will no longer benefit corporate bond investors.

“The market is a lot more nervous than it was at the start of the year,” warned Hjort, as investors rush into derivative markets to hedge their credit portfolios...

“It signals that more people are cutting risk and adding hedges,” said Calvin Vinitwatanakhun, a strategist at Citi.

In another sign of bearishness, funds that buy US high-yield bonds have suffered outflows for four straight weeks, taking year-to-date withdrawals close to $11bn.

And finally, perhaps the most notable litmus test of the market, The FT reports that Ion Analytic pulled a bond deal from the market in January citing volatile market conditions, according to people familiar with the deal, highlighting the sense of nervousness in the market.

“We don’t see that very often,” said one credit investor who had been briefed on the deal.

“It’s a sign the money sloshing around looking for things to buy is low.”

All of which sets up the rather ominous potential for a doom-loop of cross-asset-class-driven vicious selling as credit's current signal impels the marginal stock holder to sell (in an increasingly illiquid stock market), which, given the record amounts of corporate debt, will lead to an accelerating sell-off in credit as spreads adjust for equity (asset) values that are considerably lower than the Fed-Balance-Sheet-inflated state of nirvana for which they are still currently priced.

And once credit starts to accelerate lower in price (higher in spread), it can get ugly fast on the other end of the balance sheet...

Which would only stop - as it did on a dime in 2020 - if The Fed stepped back in and put the world's risk-takers back on its shoulders (but remember the inflation mandate?).

And bear in mind that if credit is correctly anticipating an increase in equity volatility (to a VIX of around 40 currently), we are talking about the S&P dropping to around 4,100.

There is, however, a potential silver lining.. or throttle on this potential waterfall.

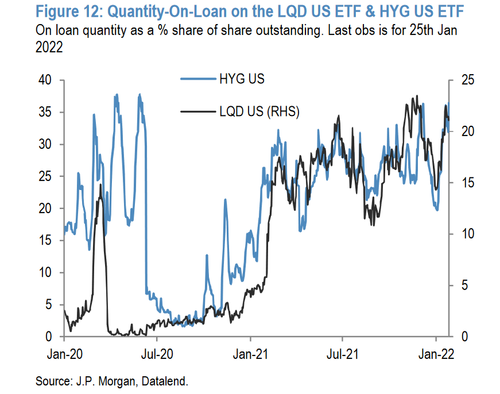

As JPMorgan's Marko Kolanovic recently noted, the short interest on the two biggest credit ETFs, HYG and LQD, has been elevated since last March...

Which, while providing some cushion for the current collapse, may be just enough ammunition for a short-squeeze (dead-cat bounce) to save the day.

However, before traders get their hopes up, remember the wise words of Nomura's Charlie McElligott who warns that there is an overhead "lid" on Equities, where the Fed is effectively shorting Calls / upside because anytime US Equities rally higher substantially higher, US FCI eases... and that’s exactly when we have to anticipate them to “up” their “hawkish” messaging.

The Powell Put is dead... and credit knows it.

https://ift.tt/9JqyUHz

from ZeroHedge News https://ift.tt/9JqyUHz

via IFTTT

0 comments

Post a Comment