Yielding Digital Assets Are The Replacement For A Broken 60/40 Balanced Portfolio

By Marcel Kasumovich, Head of Research at One River Asset Management

The Great Financial Inflation has compelled investors into passive portfolios in our view. Bonds are no longer assets to balance portfolio risk, as seen so far this year. Not surprisingly, investors are searching for replacements to bond holdings.

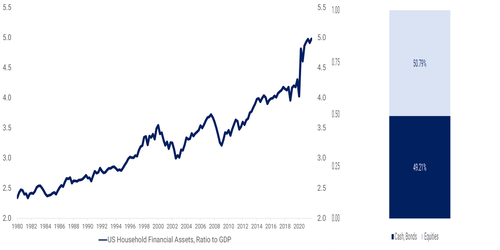

1/ Portfolios, we have a problem. U.S. household financial assets have risen to nearly 5-times nominal GDP in the Great Financial Inflation. So great is the financial inflation, households find themselves (perhaps unintentionally) with a whopping 49.2% allocation to cash, cash-equivalent assets, and bonds (Figure 1). This comes at a time when macro policies are resolutely committed to multi-generational financial repression. For all the hawkish hype, bond markets are convinced that the next easing cycle will come in 2023 and that long-term policy rates will remain well below inflation. This is strongly counter to Fed guidance. We see no historical precedent.

Figure 1: Great Financial Inflation: Large Bond Holdings

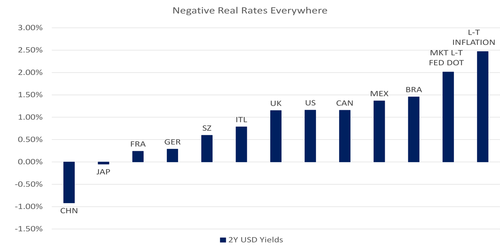

2/ So, financial markets are telling us that nearly 50% of household assets are expected to lose money in real terms in the decades ahead. It is not just a U.S.-asset problem – shorter-term real yields are a global phenomenon (Figure 2). The Great Financial Inflation has masked the misallocation – long gone are the days of diversification. A 60-40% equity-bond portfolio returned 15% last year with a coincident rise in equity and bond valuations. Bonds have taken on equity-like return characteristics – the 60-40% portfolio is unbalanced. No doubt, the drawdown in 60-40% portfolios to start this year was on par with crisis periods – we were only missing the crisis – with equities and bonds both sharply retracing in January.

Figure 2: Problem: Low Short-Term Yields, Inflation Taxing Bond Portfolios

3/ Are digital assets a potential solution to balance portfolio risk? Yes. But the solution has a more subtle first step: yield. Directional exposure to bitcoin and the One River Digital Core Index seeks to offer diversification properties over the course of market cycle. However, shorter-term cyclical correlations are still quite high. Daily bitcoin returns year-to-date have a 53% correlation to US equity returns and a 36% correlation to US fixed income. Not all investors are searching for more risk, slowing the institutional adoption to directional digital asset exposure. Ethereum’s migration to proof of stake will mark a milestone, transforming ether into a bond-like asset. But even then, the yield from staking is low relative to the ether’s volatility.

4/ A more natural first step for some investors is to focus on yield derived from the digital ecosystem. Ideally, a yield investment would avoid any directional exposure and offer an income-like cashflow that is familiar to institutional investors. It would bring digital assets to investment committees in a low-risk manner, a more natural fit for their mandates (What’s Taking So Long? here). It was missing – an uncorrelated, low-risk, liquid yield fund without direct digital asset exposure. So, we built it: the One River Digital Income Fund. The objective was clear – deliver a low-risk yield solution in the digital ecosystem. The lowest end of the risk spectrum is the natural starting point – risk can be added alongside the evolution of investor appetites easily enough.

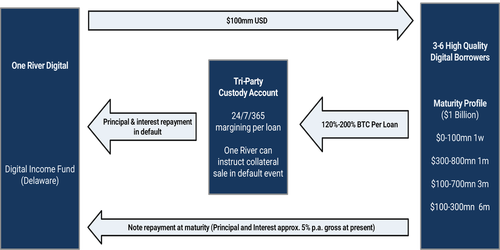

5/ Digital Income is a short-term yield fund. The Fund seeks to generate yield by providing a U.S. dollar loan to high quality borrowers in the digital ecosystem. The loan’s safety is achieved by over-collateralizing the loan through high-quality liquid digital assets, initially only bitcoin. The Fund does not take possession of the bitcoin and thus is not a money transmitter, an important consideration in the context of future regulation. Instead, the liquid collateral is held by a third party with conditions on when collateral can be liquidated (Figure 3). Our process selects known, researched, and regulated counterparties. Investors are granted the added security by over-collateralization of a liquid asset with 24-hour margining, 365 days a year.

Figure 3: Solution: Digital Income, Low Risk Strategy in the Digital Ecosystem

Here are the four most common questions on Digital Income:

6/ First, what are the risks to the structure? The short answer – negligible. Digital Income builds layers of protection. The over-collateralization means that a default scenario is recognized well before collateral values breach the par value of a loan. This negates counterparty risk. Digital Income also allows for U.S. dollar collateral, which can be used to buffer a cascading decline in the price of bitcoin. Further, the loan has recourse beyond the collateral. These measures are designed to add safety. Not surprisingly, our estimates of the “risk premium” needed to compensate for collateral risk is comfortably less than ten basis points. The yield is not compensating lenders for a known risk premium. Instead, Digital Income will seek to provide income to lenders for intermediating activity in the digital ecosystem. And we believe there is a shortage of high-quality lenders doing so.

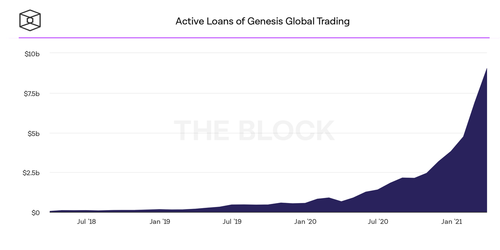

7/ Second, where does the yield come from? Demand for capital in the digital ecosystem is robust, alongside high expected asset returns. This is the natural flipside of high asset volatility. In the early phase of lending growth, retail capital, such as yield-bearing digital deposits, were sufficient. However, as the system has matured, growth in loan demand has increased through digital banking partners, high net worth individuals, corporations, hedge funds and family offices. Active loans for Genesis Global Trading, for instance, are approaching $10 billion, an increase from less than $1 billion at the start of last year (Figure 4). Rapid and broadening growth in digital assets will require substantial debt capital, including attractive, low-risk rates for institutional investors.

Figure 4: Market Demand, Shortage of High-Quality Lenders

8/ What is the right benchmark to compare Digital Income? Digital Income is a quarterly fund and will be compared to cash-equivalents such as the Bloomberg 1-to-3-month U.S. Treasury bill total return index. We anticipate Digital Income yields to be in the 4-12% range, varying pro-cyclically with the demand for capital. A rise in digital asset prices raises expected returns and the interest rates paid by the borrower, even with collateralization. Rates are driven by demand. However, it is important to value Digital Income relative to other benchmarks. One way is to infer unsecured funding rates from publicly traded digital asset companies. Five-year unsecured financing, inferred from one convertible bond, is running at ~4%, the low end of our expected range. Digital Income is secured and can still offer an attractive premium.

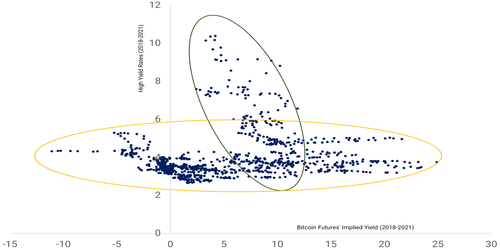

9/ How does Digital Income fit into a portfolio? This is a subtle benefit. Typically, credit and risk assets co-move. As equity asset prices decline, credit spreads widen. This is a mathematical truism of credit spreads– it is equivalent to being long a risk-free asset and short an equity put. But this is not how yields in digital assets behave. Figure 5 illustrates the implied yield in bitcoin futures against high-yield corporate borrowing costs. Most of the time, there is no correlation. However, digital asset yields decline alongside the fall in the demand for borrowing in sell-off periods for risk assets and widening in credit spreads. Digital Income spreads are counter-cyclical, narrowing as asset prices decline. This behavior is more like a Treasury bill than credit.

Figure 5: How Do Spreads Behave? Opposite of Credit!

10/ The beginning is a good place to start. That is precisely what we are doing with Digital Income – we are defining the lowest risk point of the digital asset yield curve. Doug Wilson, the portfolio manager, executed our first loans this week with research and operational tools in place. We believe that this will be a comfortable step into the digital ecosystem for institutional investors. And it will also be a natural point from which to migrate out the risk spectrum, lowering collateralization rates to enhance yields and moving into credit provision through bitcoin bond-like structures. Bonds are a problem, and we believe Digital Income is a solution.

https://ift.tt/LU5GYX3

from ZeroHedge News https://ift.tt/LU5GYX3

via IFTTT

0 comments

Post a Comment