Credit Card Debt Hits All-Time High Just As US Savings Rate Plummets To 17-Year Low

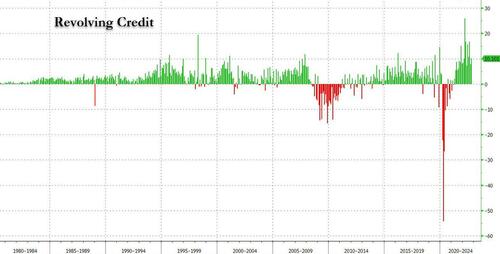

While it is traditionally viewed as a B-grade economic indicator, the monthly consumer credit report from the Federal Reserve has become a closely-watched signal of consumer health because as we first noted half a year ago - and subsequently most economists and strategists have also noticed - there has been a surge in credit card usage by US households, a troubling sign suggesting that in lieu of disposable income more Americans are forced to max out their credit card to stay on top of soaring prices.

And as the latest Consumer Credit report by the Fed released moments ago showed, in October the trend continued: Total consumer credit rose $27.1 billion, above last month's $25.8 billion if below the $28 billion consensus estimate.

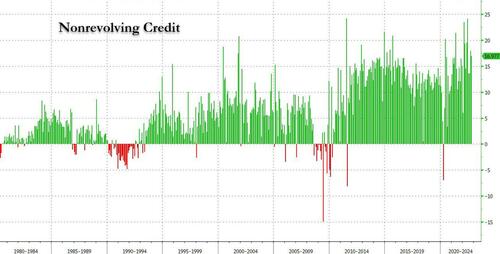

And while non-revolving credit (student and car loans) rose by a relatively pedestrian $17BN (down from $17.9BN last month, if above the 12 month average of $16.3BN)...

... it was revolving, or credit card, debt which once again surprise to the upside, rising by $10.1 billion, up sharply from $7.9 billion last month, if somewhat below the post-June average where double digit monthly increases have been the norm.

Looking at the composition of non-revolving credit, Q3 saw a surge in both student and auto loans, the former rising by $23.9BN in Q3 - the most since Q1 2021 - while the latter soared by $30.9BN (which however was just below last quarter's $34.6 billion surge).

Bottom line: the state of the US consumer is dire and getting worse, and as shown in the next chart, credit card debt hits a record high just as the personal savings rate hit a 17 year low. The catastrophic implications for the US economy is clear.

https://ift.tt/3rIckvp

from ZeroHedge News https://ift.tt/3rIckvp

via IFTTT

0 comments

Post a Comment