Stocks Have "Considerably More Downside" & Commodities Have A "Brand New Tailwind" In 2023

Submitted by QTR's Fringe Finance

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter last week, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast (and will be coming back on again soon hopefully) and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Photo: Real Vision

Mark was kind enough to allow me to share his thoughts from his November 2022 investor letter.

Mark’s Thoughts On Macro

Despite the stock market’s recent rally (we were up a hell of a lot more this month before today!) we continue to carry a large SPY short position, as I believe the major indexes—although not all individual stocks—have considerably more downside to go, the inevitable hangover from the biggest asset bubble in U.S. history.

For far too long, the Fed printed $120 billion a month and held short-term rates at zero while the government concurrently ran a record fiscal deficit. Now, thanks to the massive inflationary hangover from those idiotic policies (November’s “not as bad as feared” data not withstanding), the Fed is reducing its balance sheet and raising interest rates, and although the current rate of high-7% year over-year inflation is unsustainable, the eventual end of China’s “zero-Covid policy” and its November reversal on bailing out its real estate industry combined with the end of Biden’s SPR drawdowns will give commodity prices a brand new tailwind in 2023.

Longer term, the war on fossil fuel, expensive “onshoring,” fewer available workers and perpetual government budget deficits make a new baseline of around 4% inflation (double the Fed’s 2% target) likely.

Even a 2023 Fed interest rate “pause” at 4.75% (and remember, a “pause” is not a “pivot”!) would, combined with $90 billion a month in ongoing QT, make current stock market valuations unsustainable, as stocks are still expensive.

[QTR’s note: This echos Kenny Polcari’s sentiments & my sentiments of recent.]

According to Standard & Poor’s, with 97% of companies having reported, Q3 S&P 500 GAAP earnings came in at around $44.79, which annualizes to $179.16. (And these were the sixth highest quarterly earnings in history; i.e., they were not “trough.”)

A 16x multiple on that—generous for a rising rate, recessionary (or even just slow-growth) environment—would bring the S&P 500 down to 2867 vs. November’s close of 4080.11. And remember, just as in bull markets, PE multiples usually overshoot to the upside, in bear markets they often overshoot to the downside. A bottom formed at a considerably lower multiple is not unfathomable.

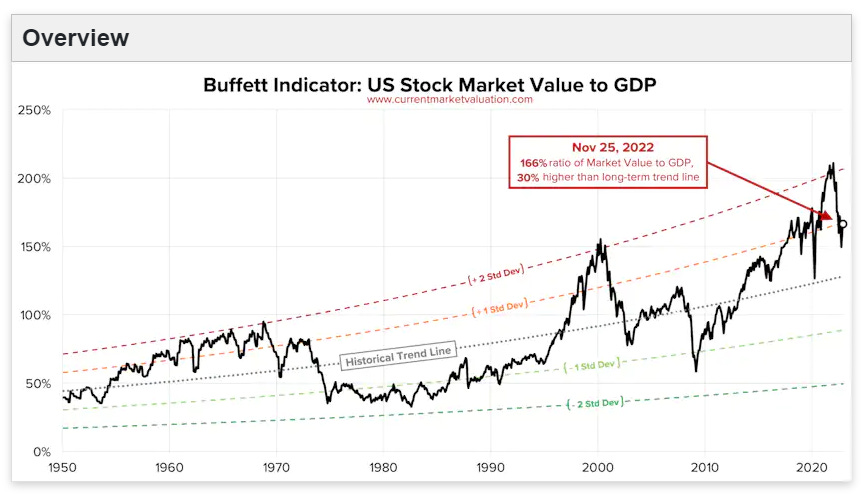

Additionally, we can see from CurrentMarketValuation.com that the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is still very high, and thus valuations have a long way to go before reaching “normalcy”:

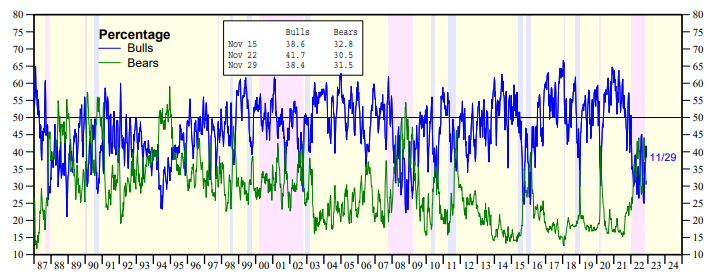

Regarding sentiment, we can see from Ed Yardeni that in the Investors Intelligence poll the highest the “bear percentage” got so far in the current market was only around 45% (in the most recent poll it was just 31.5%), yet there were multiple times during the 1980s, 1990s and 2008 that it climbed much higher:

Also, we can see from this old academic paper that during the grinding bear market of 1973 to 1975, when the S&P 500’s GAAP PE multiple dropped from 18x to 8x, the bears in the Investors Intelligence poll climbed to around 75% and went over 80% during the bear markets of the 1960s.

So if you think that based on this bear market’s sentiment we’ve “seen the bottom,” I wish you luck!

Meanwhile, interest costs on the Federal debt are already set to grow massively. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with crushing even just 4% inflation?

Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

Mark On His Fund’s Positions (Positions May Change At Any Time)

We continue to own automaker Stellantis (STLA), which has a great balance sheet with plenty of net cash (and a 7% dividend yield!) and which—at a current price of $15.62/share—sells for only around 3x 2022 earnings estimates of $5.26/share.

I believe Jeep alone (which in September announced a full electrification strategy) could be worth more than what we paid for the entire company, which also includes Dodge, Chrysler, Ram, Fiat, Citroen, Peugeot, Opel, Alfa Romeo, Vauxhall, Lancia and Maserati. And if current EV sales are your interest, Stellantis already has Europe’s best-selling mass-market model.

We continue to own Volkswagen AG (via its VWAPY ADR, which represent “preference shares” that are identical to “ordinary” shares except they lack voting rights and thus sell at a discount). VW currently sells for around 4.2x estimated 2022 earnings due to a combination of “recession fears” and short-term issues obtaining energy (until either the Ukraine war is over or alternative supplies are in place), but it controls a massive number of terrific brands including Porsche, of which it recently IPO’d a small percentage at a $73 billion valuation, thus valuing the rest of the company at only around $10 billion; I believe Audi alone is worth 4x that! And a Lamborghini IPO may be next. Additionally, VW will pay a January special dividend of around $1.90 per VWAPY share in proceeds from Porsche’s IPO, and the regular yield is currently over 5%!

Meanwhile VW Group’s EVs (several of which are more technologically advanced than any Tesla) combine to heavily outsell Tesla in Europe and by 2025 may outsell Tesla worldwide.

We continue to own General Motors (GM), which currently sells for only around 6.5x the $6.26/share midpoint of its 2022 GAAP EPS guidance (which was reiterated in November). GM is doing all the right things in electric cars, autonomous driving (via its Cruise ownership) and software, yet it’s cheap because, as with other established automakers, many investors have (for now) forsaken it in favor of “electric car pure-plays,” a sector which has thus become the largest valuation bubble in history.

Get 50% off: If you enjoy this article, would like to support my work, I would love to have you as a subscriber and can offer you 50% off for life: Get 50% off forever

And regarding “autonomy,” keep in mind that unlike Tesla, which sells a LiDAR-less fraud to rubes, Cruise is already running a fleet of fully autonomous cars in San Francisco (and soon Phoenix and Austin); you can see many videos of this on its YouTube channel. GM will also benefit more than any other manufacturer from the proposed new EV tax credit, as it will soon have the largest variety of North American-made (a requirement of the credit) EV models fitting within the new price restrictions. Additionally, in August the company reinstituted a modest dividend.

I thus consider these positions (Stellantis, GM and VW) to be both “freestanding value stock buys” and “relative-value paired trades” against our Tesla short.One oft heard knock against “the autos” is a belief that their recent earnings have been “peak,” but keep in mind that due to supply chain issues they all sold around 20% fewer cars than they otherwise could have. Thus, I believe those recent earnings are more like “strong midcycle” and should likely have around a 10x run-rate PE, not the current 3x to 6x. Also, thanks to those same supply chain issues they’re much lighter on inventory than they’d normally be heading into a recession. Therefore, I believe these stocks have considerable upside from here.

We continue to own Fuel Tech Inc. (FTEK), a seller of air and water pollution control technologies, which in November reported a solid Q2, with revenue up 6.1% year-over-year (although at a lower gross margin), .01/share in GAAP earnings and around $600,000 in free cash flow. At a current price of $1.24/share with 30.3 million shares outstanding and $33.9 million in cash and Treasuries (and no debt), this is a 43% gross margin business selling for an enterprise value of only around 0.14x 26.4 million in TTM revenue. This is the kind of company that will either ignite growth and its stock will take off (its new “Dissolved Gas Infusion” water treatment technology is a potential medium-term catalyst for that), or it’s so cheap that it will make for a good strategic acquisition target, as removing the costs of being an independent public company could make it instantly earnings-accretive while allowing the buyer to acquire a nice chunk of revenue very cheaply. In short, I think it’s a good “value stock” in which to park some money and see what happens.

And now, Tesla…

Despite big, margin-slashing price cuts in both China and Europe, Tesla delivery wait times worldwide have declined substantially, down to just one week in China while in the U.S. (where Musk’s Twitter boondoggle is rapidly destroying the brand) Tesla is choking on Model 3 inventory and offers December Model Y delivery, while Europe’s backlog is expected to be completely gone by year-end. This means Tesla’s production capacity now outstrips its rate of incoming orders despite the new German and Texas factories producing at only around 10% of capacity!

Meanwhile, combined deliveries for the last two quarters (Q2 & Q3 2022) were lower than those for the previous two quarters (Q4 2021 & Q1 2022). As Tesla slashes prices it will undoubtedly sell more cars (I expect Q4 deliveries to be in the range of around 400,000 vs. previous quarters in the 300,000s, thanks to the cuts plus a rush to beat year-end expiring EV incentives in China, Germany and France), but any other car company can slash prices and do the same thing. (Welcome to the auto business, which currently sells for around 5x earnings!) Tesla’s apparent market saturation rate of around 1.6 million cars/year worldwide (at least until it slashes prices yet again!) is massively below its current factories’ production capacity, much less the bulls’ absurd expectations of adding a new factory every six months for the next ten years!

For some valuation perspective, BMW sells around 2 million cars a year with very high margins (including the best electric SUV now on the market (the new iX), the best luxury EV( the new i7), and among the best small luxury EVs (the new i4), and has a market cap of around $59 billion. If Tesla grew annual deliveries to the size of BMW’s and had BMW-level margins, at BMW's current market cap it would sell for less than $19/share vs. this month's closing price in the $194s! (Remember: Tesla now has 3.16 billion shares outstanding!)

Meanwhile, Elon Musk remains the most vile person ever to head a large-cap U.S. public company, and we remain short Tesla, the biggest bubble-stock in modern market history, because:

1) It has a sliding share of the world’s EV market and a share of the overall auto market that’s less than 2%, yet a market cap almost as big the next 6 largest automakers (by market cap) combined.

2) It has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of its electric car technology (which has now been equaled or surpassed by numerous competitors) and its previously proprietary Superchargers are being opened to everyone), while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

3) Excluding working capital benefits and sunsetting emission credit sales Tesla generates only minimal free cash flow.

4) Growth in sequential demand for Tesla’s cars is at a crawl relative to expectations.

5) Elon Musk is a pathological liar.

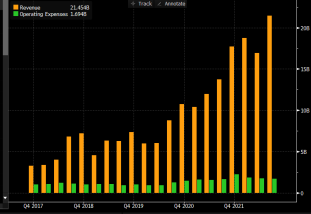

In October Tesla claimed that it had Q3 GAAP earnings of around .87/share excluding sunsetting emission credit sales. If you believe that after viewing this chart (courtesy of Twitter user @Keubiko), I have a bridge to sell you in Brooklyn:

Orange is revenue, green is operating expenses

Furthermore, Tesla’s minimal depreciation of its new factories appears fraudulently low, as does its warranty reserve.

Even if you believe Tesla’s clearly nonsensical earnings number, it annualizes to only $3.48/share, which based on November’s closing price of $194.70 = a run-rate PE ratio of around 56 for a now slow-growing (or growing-but-margin-slashing) car company in an industry with a current average PE of around 5.

Meanwhile, Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. (Tesla ranks near the bottom of Consumer Reports’ reliability survey while British consumer organization Which? found it to be one of the least reliable cars in existence.) Thus, due to competitors’ temporary production constraints, waiting times are now longer for many of Tesla’s direct EV competitors than they are for a Tesla.

In fact, Tesla is likely now the second, third or fourth choice for many EV buyers, and only maintains its volume lead though a short-lived edge in production capacity that will disappear over the next 12 to 36 months as competitors rapidly increase the ability to produce their superior EVs. Tesla’s poorly-built Model Y faces current (or imminent) competition from the much better made (and often just better)

electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Chevrolet Blazer EV & $30,000 Equinox EV and Polestar 3. And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4, the upcoming Hyundai Ioniq 6 and Volkswagen Aero, and multiple local competitors in China.

And in the high-end electric car segment worldwide the Porsche Taycan (the base model of which is now considerably less expensive than Tesla’s Model S) outsells the Model S, while the spectacular new BMW i7, Mercedes EQS, Audi e-Tron GT and Lucid Air make it look like a fast Yugo, and the extremely well reviewed new BMW iX, Mercedes EQS SUV and Audi Q8 eTron (as well as multiple new Chinese models) do the same to the Model X.

Indeed, for years I’ve said “Tesla is Blackberry”—the maker of a first-generation version of a product that—once the market was proven—would be supplanted into niche obscurity by newer, better versions; now I can provide a much more recent analogy: Tesla is Netflix.

For years Netflix had an absurd valuation based on its pioneering position in streaming media, but once it proved that such a market existed myriad competitors swarmed all over it, and this year the stock collapsed when we learned that not only is Netflix no longer in “hypergrowth” mode but for the first time since 2011 (when it transitioned from physical DVDs) it actually lost subscribers. I believe Musk knows that Tesla is “the next Netflix” (hence his recent “Twitter buying distraction”), with VW, Hyundai/Kia, Ford, GM, Stellantis, BMW, Mercedes, BYD & other Chinese competitors and, in a few years, Toyota & Honda, being the Disney, HBO Max, Amazon Prime, Peacock, Hulu, Paramount +, etc., of the electric car market, stealing Tesla’s share and eventually pounding its stock price down 90% or so from today’s, into the valuation of “just another car company.”

Despite this obvious “writing on the wall,” many Tesla bulls sincerely believe that ten years from now the company will be twice the size of Volkswagen or Toyota, thereby selling around 20 million cars a year (up from the anticipated Q4 annualized run-rate of around 1.6 million); in fact in May Musk himself even raised this as a possibility. Setting aside the absurdity of selling that many cars into the limited market of Tesla’s high price points, the “logistical absurdity” of selling 20 million cars/year in ten years means that

in addition to 2.4 million cars a year of sold-out existing claimed production capacity (once the German and Texas factories are fully operational), Tesla would have to add 35 more brand new 500,000 car/year factories with sold out production; i.e., a new factory approximately every single quarter for the next ten years! Only a Teslemming could be dumb enough to believe this!

Meanwhile, in June the NHTSA announced that its investigation of Tesla’s deadly Autopilot has expanded into “an engineering analysis,” the last required step before (finally!) demanding a full recall, and in October it was reported that this deadly scam is being investigated by both the SEC and the DOJ. The refund liability potential for Tesla for this is in the billions of dollars, and possibly even the tens of billions if a class action lawsuit proves that the cars involved were purchased solely due to the (fallacious) promise of “full self-driving.”

And, of course, there will be a massive “valuation reappraisal” for Tesla’s stock as the world wakes up to the fact that Tesla’s so-called “autonomy technology” is deadly, trailing-edge garbage. In fact, the NHTSA has reported a slew of Autopilot-related deaths just since last year. For all Tesla deaths cited in the media—which is likely only a small fraction of those that have occurred—see TeslaDeaths.com. And Tesla has sold this trashy software for over six years now:

…and still promotes it on its website via a completely fraudulent video!

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars. And if new-format 4680 cells enter the market some time in 2024 (as is now expected), even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone, and BMW has already announced it will buy them from CATL and EVE.

And oh, the joke of a “pickup truck” Tesla previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as by the time it’s in mass-production in 2024 it will enter a dogfight of a market; in fact, Ford’s terrific 2022 all-electric F-150 Lightning now has over 200,000 retail reservations (plus many more fleet reservations), GM has introduced its fantastic 2023 electric Silverado which already has nearly 200,000 reservations, Rivian’s pick-up has gotten excellent early reviews, and Ram will also be out with a great truck in 2024.

About Mark Spiegel

Mark manages Stanphyl Capital, established in 2011, a deep-value equity & macro long-short investing fund based in New York City. Mark can be reached at mark@stanphylcap.com or at @StanphylCap on Twitter.

Disclaimer: This letter was not reproduced in full. I may own Tesla call and put options and may be long/short TSLA and or any names mentioned. You should assume I have positions in any names I publish about. I have no position in Mark’s funds. Mark is a subscriber to Fringe Finance via a comped subscription I gave him and has been on my podcast. The excerpts from Mark’s letter, above, shall not be construed as an offer to sell, or the solicitation of an offer to sell, any securities or services. Any such offering may only be made at the time a qualified investor receives formal materials describing an offering plus related subscription documentation. There is no guarantee the Fund’s investment strategy will be successful. Investing involves risk, and an investment in the Fund could lose money.

https://ift.tt/KnJcWgs

from ZeroHedge News https://ift.tt/KnJcWgs

via IFTTT

0 comments

Post a Comment