Stocks Panic-Bid Ahead Of CPI; Bitcoin, Bonds, & Bullion Dumped

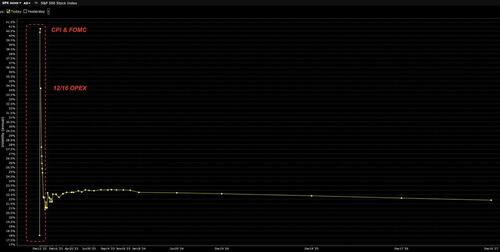

With event risk about as high as it gets this week (just look at the S&P implied vol term structure)...

...today's market action had a feel of anxiety, FOMO, and low liquidity about it.

Equity markets managed solid gains ahead of tomorrow's CPI with Dow and Small Caps leading. A sudden late-day burst of excitement started around 1500ET (was CPI leaked) which sent stocks vertical-er. Notably, The Dow and S&P ran up to erase all the loses from Friday's PPI print and the Nasdaq got within a tick or two...

VIX jumped above 25 intraday...

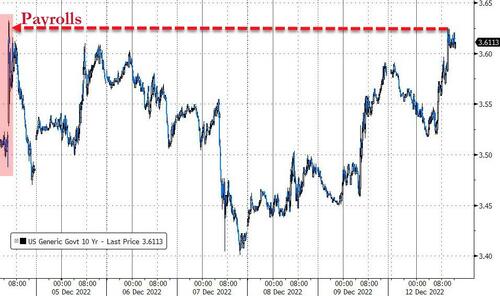

Treasury yields were higher on the day with the short-end underpeforming (2Y +5bps, 30Y +1.5bps) but they all followed the same pattern of buying bonds in Asia and selling in Europe and US...

Source: Bloomberg

A really ugly 10Y auction - with a huge tail - sparked some chaos around 1300ET - pushing the yields up to their post-payrolls peak...

Source: Bloomberg

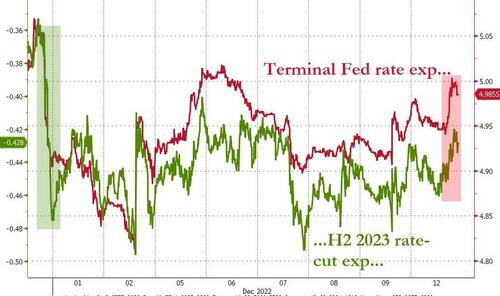

Rate-trajectory expectations rose on the day with the terminal rate back up to 5.00%...

Source: Bloomberg

The dollar rollercoastered lower overnight and then higher to close the day green...

Source: Bloomberg

Bitcoin was dumped overnight but managed to scramble back above $17000...

Source: Bloomberg

NatGas prices soared today as colder than expected weather hit the US (and a big freeze struck Europe for the first time this winter)...

US Crude prices jumped on the day, rebounding from a $70 handle to a $74 handle intraday (best day for WTI since 11/4)...

Gold tumbled back below $1800...

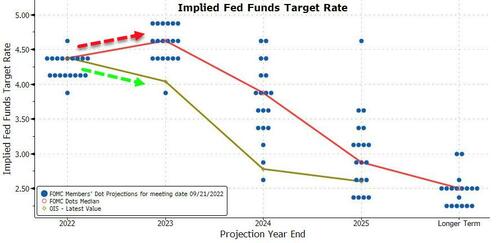

Finally, we note that ahead of this week's CPI and FOMC, the market is pricing in a dramatically different picture than The Fed's 'higher for longer' projections...

Source: Bloomberg

With 185bps of rate-cuts priced in from Jun23 to Dec24...

Source: Bloomberg

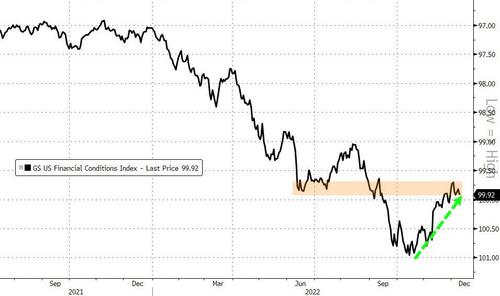

Bear in mind that US Financial Conditions are now the same as they were 6 months ago (and The Fed has raised rates significantly since then so that's not what Powell wants to see)...

Source: Bloomberg

Will Powell push back against this dovishness like last time?

https://ift.tt/1m9f8gH

from ZeroHedge News https://ift.tt/1m9f8gH

via IFTTT

0 comments

Post a Comment