Banks, Bitcoin, & Bond Yields Battered Ahead Of Payrolls Print; Bullion Bid

Jobless claims and layoffs rose more than expected this morning, throwing some shade at the 'strong' labor market narrative but it was bank headlines that seemed to really spook markets with stocks hammered lower, bitcoin battered, and bond yields puking hard.

There's nothing like a forced capital raise to wake markets up (from their labor market-driven stupor) and the KBW Regional Fed plunged over 7% back to pre-COVID collapse levels...

Source: Bloomberg

With SIVB collapsing...

Source: Bloomberg

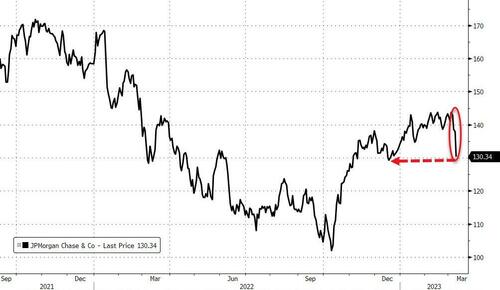

And Signature Bank and JPMorgan also punished (crypto anxiety and Staley/Epstein/Dimon headlines respectively).

Source: Bloomberg

Source: Bloomberg

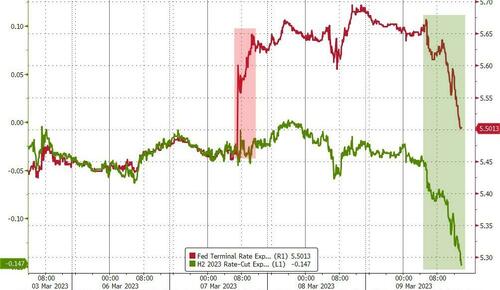

Interestingly, short-term interest-rates adjusted dovishly with the terminal rate falling (erasing 25bps off the peak) and expectations of a H2 2023 rate-cut starting to pick up again (now 509% odds of a 25bps cut)....

Source: Bloomberg

All the US majors though were hit hard with Small Caps worst and The Dow, S&P, and Nasdaq all down almost 2%...

Financials were clubbed like a baby seal, but all the S&P sectors are red on the week...

Source: Bloomberg

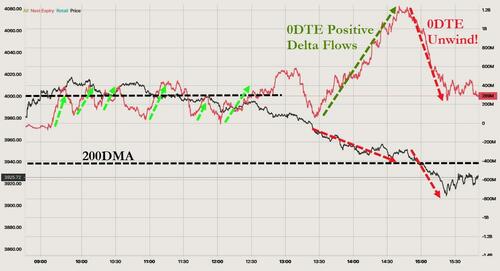

When the S&P dropped back to 4,000 (and around the 50DMA), we saw a very active 0DTE positive delta flow (but it failed to ignite any momentum). As the afternoon began, stocks started to slide hard - amid rising banking sector anxiety - and positive 0DTE delta flows surged into the drop as the S&P neared its 200DMA. But when the selling sliced straight through its 200DMA, the 0DTEs ran for cover and flattened out their positioning...

The S&P 500 broke below its 50DMA and accelerated down through its 100- and 200-DMA to its lowest since 1/20...

The Dow fell back close to its 200DMA, down to its lowest level in 4 months...

After being decoupled for two weeks, VIX exploded back higher today, from an 18 handle at its intraday lows to over 23...

Source: Bloomberg

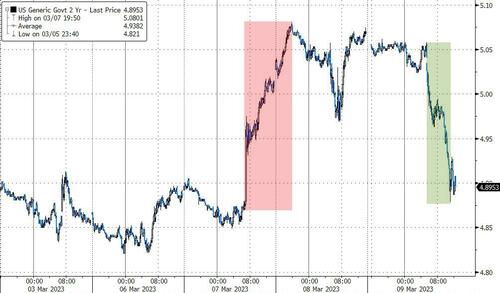

Treasury yields plunged on the day, led by the short-end (2Y -18bps, 30Y -2bps). Today's move dragged everything but the 2Y yield lower on the week...

Source: Bloomberg

The 10Y tagged 4.00% overnight and then puked back to recent channel lows...

Source: Bloomberg

The 2Y Yield puked back all its post-Powel spike from Tuesday...

Source: Bloomberg

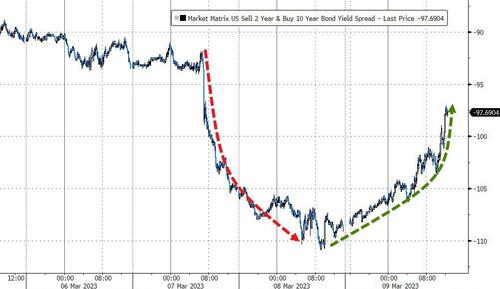

The yield curve steepened (and remember it's the re-steepening from inversion that is the big recession signal)...

Source: Bloomberg

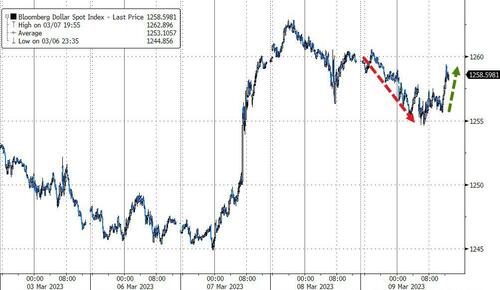

Amid all this chaos, the dollar was actually well behaved and ended practically unchanged, rallying back as everything fell apart this afternoon...

Source: Bloomberg

Bitcoin puked back near $20,000 - its lowest since Jan 13th...

Source: Bloomberg

Gold managed decent gains on the day (despite only a modest move in the dollar) as perhaps QE fears are reignited by the bank stresses...

Oil tumbled, with WTI back to a $75 handle...

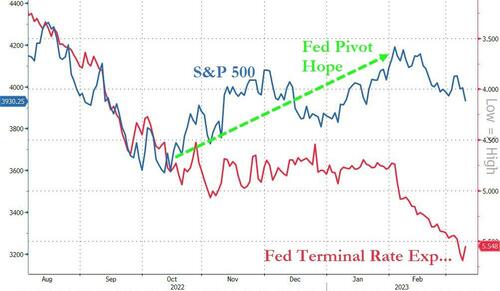

Finally, if the short-term bond market is right, then stocks have a long way to fall back to reality as any hopes for a Fed Pivot are erased...

Source: Bloomberg

Or will all this be reversed into an explosive surge higher tomorrow if/when payrolls misses big and QE is back on the table? Or even more nonsensical, if SVB is any signal of systemic risk in mid-sized banks, then will The Fed pause and pivot even faster?

https://ift.tt/1mTJYDG

from ZeroHedge News https://ift.tt/1mTJYDG

via IFTTT

0 comments

Post a Comment