Nomura Calls For Rate Cut At Next FOMC Meeting, End Of QT

These banks are the first casualties of the Fed's tightening cycle. Historically, you can't raise interest rates by over 400 basis points in one year without breaking something (think 1994). - Curvature Securities

In the past year, Japanese bank Nomura has had a penchant for making several headline-grabbing outlier predictions about the Fed: last June, Nomura was the first bank to call for a 75bps rate hike (a view that quickly became consensus after the infamous Hilsenrath weekend report that blew up the Fed's forward guidance), followed one month later by an even more show-stopping forecast for a 100bps rate hike in July. Verdict: it got one out of two right (the former yes, the latter no), yet still not a bad track record when the bank takes the bold step to break away from the echo chamber herd.

Then two weeks ago, the bank did it again, because with the Fed seemingly torn between keeping its 25bps rate hike cadence or expanding it to 50bps to give the tightening campaign a little extra "oomph" after the latest FOMC minutes found that a higher than expected "few" favored a 0.5% rate hike, Nomura's strategist Aichi Amemiya wrote that he expects a 50bp hike in March followed by 25bp hikes in May and June "as persistent inflation drives the Fed to a more hawkish stance."

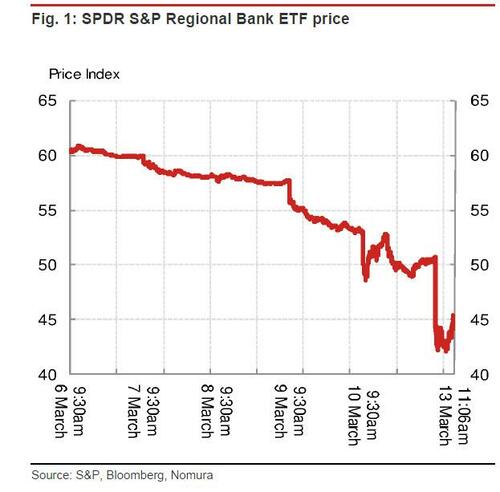

Alas, that particular outlier call didn't last long, because with everyone expecting tomorrow's CPI to be the "most important CPI in history" and one which would cement if we get 25 or 50, something unexpected happened: the shocking collapse of all crypto-friendly banks and the one bank catering to Web3 - courtesy of Liz Warren who told regulators to ignore potential bank bids - has flipped markets on their head in line with our forecast from 2022 that this hiking cycle would end in tears when the Fed breaks something... in this case the regional bank system.

The thing about trying to break the economy is that you always break the market first pic.twitter.com/CQ3e288n7Q

— zerohedge (@zerohedge) November 3, 2022

Quickly realizing that he needed to make an stark impression with yet another super outlier call - after Goldman broke the seal last night when it said it expects an FOMC pause in March - Nomura's Amemiya decided he has to do what he has done so many times before and quickly published the most controversial Fed forecast yet, going from +50bps to -25bps at the next FOMC meeting, thus becoming the first on Wall Street to call for a cut to Fed rates at the next FOMC meeting.

So why a rate cut when merely calling for a pause seems controversial enough (JPM's Michael Feroli is still calling for 25bps hike)? Well, as Amemiya explains in his note (available to pro subscribers), while the Fed launched several bailout policy actions (all discussed here) which were "significantly more aggressive than Nomura had expected. Regulators expanded the scope of the emergency measures to protect the depositors of Signature Bank, which had amounted to much less than SVB."

We think this suggested the strong intention of the Regulators to prevent a similar episode with other banks and contain contagion. In addition, the Fed’s new lending facility will likely mitigate the risk of small banks selling holding assets and incurring capital losses.

However, as we also first noted, Nomura admits judging by the market’s reaction, "financial markets seem to view these policy actions as insufficient, as stock prices for the US financial sector continue to decline as of this writing."

One market concern, according to Nomura (and ZH), is that "a deposit flight might not slow anytime soon for a number of reasons."

Despite the FDIC’s protection of all depositors of SVB and Signature Bank, corporate depositors are still concerned about a loss, even temporarily, of access to their deposits from the bank(s) going under conservatorship, even if they are made whole later.

Second, ironically, the sensitivity of individual depositors to deposit rates might have increased due to the FDIC’s announcement of making all Silicon Valley Banks’ depositors whole. We could see a significant outflow from commercial banks, which may compel banks to liquidate their loan portfolios unless banks raise their deposit rates substantially.

Third, on banks’ securities investment, unrealized capital losses in the banks’ held-to-maturity portfolio might not become an imminent issue because of the Fed’s new BTFP. However, if the Fed keeps the policy rate “higher for longer”, banks would be averse to liquidating securities holdings for which selling would realize losses in securities any time soon.

Putting it all together, Nomura now expects the Fed "to cut rates in 25bp increments in the March FOMC meeting in comparison to where we had previously expected a 50bp rate hike since 24 February, well before Chair Powell’s testimony last week."

The bank adds that "although a 25bp rate cut seems unlikely to be a panacea for financial institutions, if the Fed shows expected continued rate cuts in the Summary of Economic Projections (“dots”), markets could quickly price in further rate cuts. This could somewhat reduce the risk of further bank runs, as well as reduce unrealized capital losses."

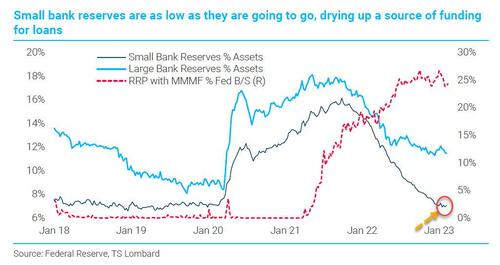

There's more: the Nomura strategist also expects the Fed to stop quantitative tightening. Also echoing out observation that small banks are now reserve constrained...

... Amemiya says that "although the choice of deposits vs. non-deposit investment vehicles such as Money Market Funds (MMF) matters for banks, ending QT should help keep the amount of reserves more ample than they would be otherwise."

... the fact that other banks are facing a serious bank run risk suggests an increasing risk of over-tightening by the Fed, which also supports a rate cut in the near term. As we argued, the cumulative rate hikes are disproportionately reducing the supply of credit through bank loans relative to financial market conditions .

The lagged impact of past rate hikes could now materialize in a draconian way. We believe a tightening of financial conditions through bank loans could potentially steer the economy into a recession starting in H2 2023. However, the process might be accelerating, potentially moving forward a recession and exerting disinflationary pressures with some lag.

At this point, the Fed could become more forward-looking in a sense that it might put more weight on the inflation outlook as opposed to waiting for realized inflation to come down materially. In this regard, although we expect a solid 0.4% m-o-m core CPI inflation in the February CPI report on Tuesday 14 March we think financial stability risks are quickly becoming a dominating factor for monetary policy.

And while Nomura is still in the camp that a recession can still be avoided if only the Fed cuts enough, we will show momentarily that according to Deutsche Bank, today's market actions confirms that a recession has already started.

More in the full Nomura note available to professional subs.

https://ift.tt/fG3A8gD

from ZeroHedge News https://ift.tt/fG3A8gD

via IFTTT

0 comments

Post a Comment