Silvergate Capital To Wind Down Ops, Liquidate Bank

In the end, those shorting Silvergate - which recall emerged as the most shorted stock in early February - ended up being right, and the bank's last ditch discussions with the FDIC for a hail mary rescue didn't go quite as expected.

Silvergate Capital said it intends to wind down operations and voluntarily liquidate the bank in an orderly manner and in accordance with applicable regulatory processes.

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of bank operations and a voluntary liquidation of the bank is the best path forward,” it said in a statement

The firm opened for business in 1988 to make loans to industrial clients, and filings show that it dealt in conventional services such as commercial and residential real estate lending. But in 2013, the La Jolla, California-based company started to pursue crypto clients.

With its crypto business growing, Silvergate went public in 2019, telling investors in its prospectus to expect an even bigger shift toward crypto. Eventually the company’s Silvergate Exchange Network helped attract $11.9 billion in digital assets held as deposits as of Sept. 30.

As Bloomberg reports, Silvergate collapsed amid scrutiny from regulators and a criminal investigation by the Justice Department’s fraud unit into dealings with fallen crypto giants FTX and Alameda Research. Though no wrongdoing was asserted, Silvergate’s woes deepened as the bank sold off assets at a loss and shut its flagship payments network, which it called “the heart” of its group of services for crypto clients.

SI shares are down 50% after hours...

At its peak in Nov 2021, SI traded at $239...

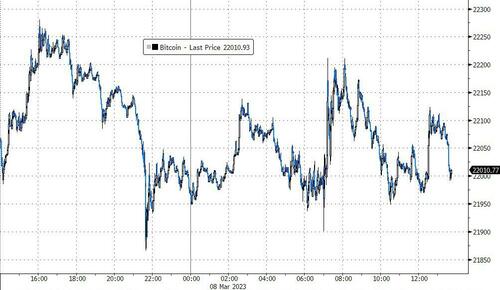

No reaction in bitcoin.

Read the full press release below:

Silvergate Capital Corporation (“Silvergate” or “Company”) (NYSE:SI), the holding company for Silvergate Bank (“Bank”), today announced its intent to wind down operations and voluntarily liquidate the Bank in an orderly manner and in accordance with applicable regulatory processes.

In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward.

The Bank’s wind down and liquidation plan includes full repayment of all deposits.

The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets.

In connection with the above: Centerview Partners LLC is acting as financial advisor, Cravath, Swaine & Moore LLP is acting as legal advisor and Strategic Risk Associates is providing transition project management assistance.

In addition, Silvergate Bank made a decision to discontinue the Silvergate Exchange Network (SEN), which it announced on March 3, 2023 on its public website. All other deposit-related services remain operational as the Company works through the wind down process. Customers will be notified should there be any further changes.

It’s the first bank failure in the US since 2020, according to the FDIC’s website, which listed four during the first year of the pandemic. We also note that the last time the FDIC had to cover deposits for a failure was in 2013 when Connecticut-based Community’s Bank closed

https://ift.tt/BjX0pOl

from ZeroHedge News https://ift.tt/BjX0pOl

via IFTTT

0 comments

Post a Comment