The Return Of The Widowmaker

By Russell Clark of The Capital Flows and Asset Markets Substack,

Yesterday I wondered if the collapse of SVB was the top of the US hiking cycle.

In summary, I thought unless I saw a trend change in GLD/TLT I would not get too worried.

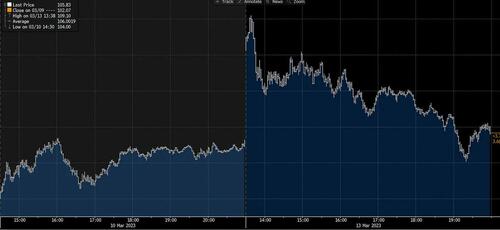

I also like the price action of US treasuries. If 2 year yields fell, my expectation was that the long end would sell off as markets priced in more inflation. Which is what we saw in TLT. It opened much higher yesterday, before closing on it lows.

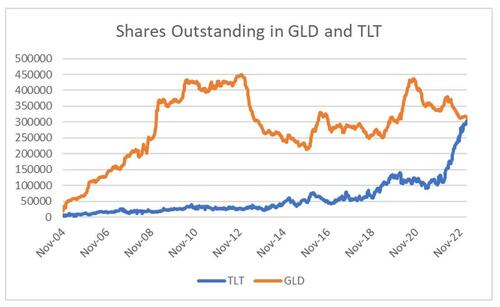

One reason I love long GLD/short TLT trades so much is that fund flow has been the opposite of this. We can get the shares outstanding in GLD and TLT to see how much money is on either side of this trade. People have broadly given up on GLD, while they have been pouring money into TLT.

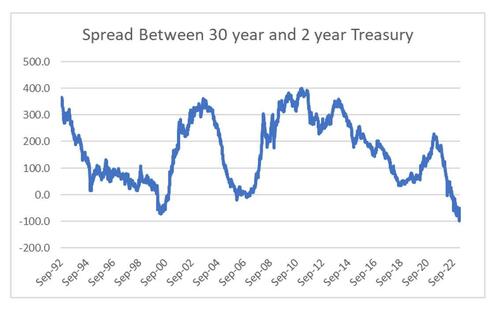

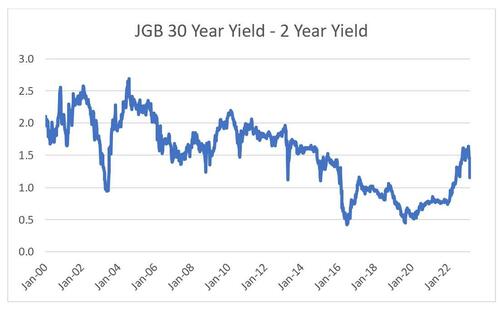

In fact people are so bullish on 30 year treasuries, they are at almost a record discount to the 2 year treasury. Lets say a normal spread is 200bp (2%), and you bought 30 year treasury at 4%, even if the Fed cuts back to 1%, at best you can only make 25% on this trade. But lets say the Fed cuts to 4%, and inflation comes back, then you could see the 30 year go to 6%, and you end up losing 33% of your capital. And price action yesterday seemed to be confirming that much more balance view on treasuries.

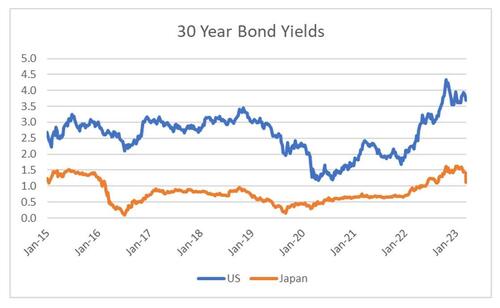

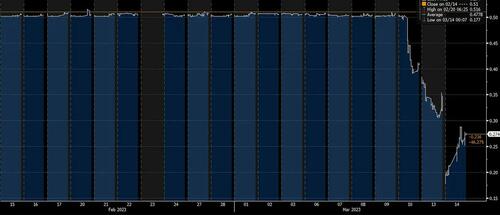

However, to my surprise when I woke up this mornings, 30 year JGB yields have plummeted. I also won’t lie, this put the fear of god into me. JGBs have been a very good lead on treasuries, and for good reason. If Japanese yields fall, Japanese investors will start buying treasuries, forcing yields down. And every major deflationary event I know off begins with JGB yields falling.

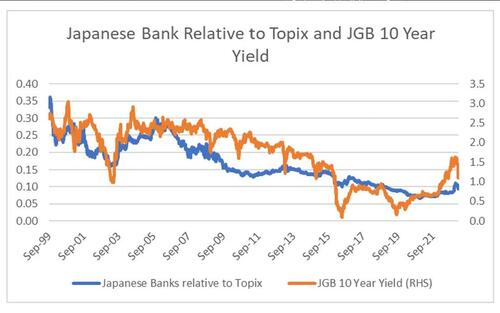

Japanese banks, which are a very leveraged inflation trade have been smoked with the move lower in JGB yields. In perhaps the oldest chart in macro trading is the relative performance of Japanese banks and the movement in JGB yields.

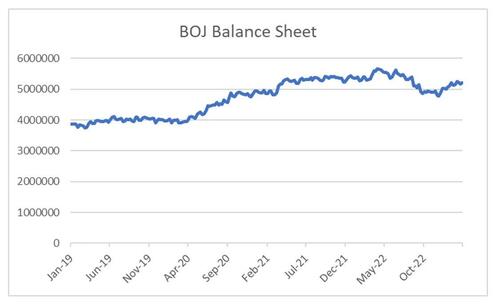

Not many years ago, a move like this in JGBs would have me selling all equities, buying Yen, and buying treasuries, and shorting every inflation trade I could find. That is short gold, and long TLT - the total opposite of the above. What you might call a brown trouser moment. Should we ignore the JGB market? One reason why it has had an outsized move is that the BOJ has been buying more bonds recently.

IT has been doing this to maintain JGBs at level within its yield curve control program. That meant there was very little volatility in JGBs, meaning that leverage short positions could have build up. When these are closed explosive price action is possible, which is what we have seen.

Finally, the 30 year JGB yield was trading much closer to a normal spread against the 2 year JGB yield. That is the curve is much steeper than in the US. That is there was much more room for the 30 year to rally (yields fall).

So where does this leave us all? Well my view is that politics is now pro-labor and pro-inflation. While I can understand that people look at the failure of SVB as a rerun of the GFC, for me its part and parcel with policy to reduce income inequality by making work pay more, and speculation pay less. As a reminder, this is not a lefty political view, this is an observation on where the votes are. And politicians go where the votes are. I think inflation is here to stay, and more than likely this is a chance to put more inflation trades on.

https://ift.tt/szCI5Kb

from ZeroHedge News https://ift.tt/szCI5Kb

via IFTTT

0 comments

Post a Comment