What Rent Drop? New York Median Rent Rises For 18th Consecutive Month To $4,095

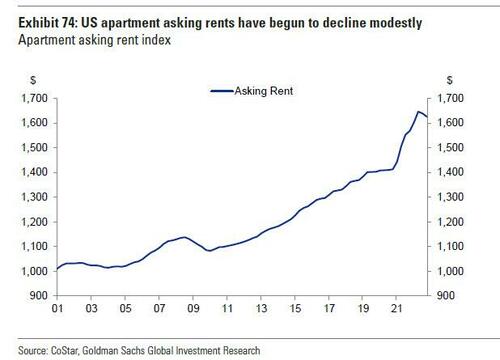

Rents across the country may be finally sliding amid a "crush" of new supply as reported last week...

... but no such luck for New York City residents and apartment hunters who have yet to see any relief from near-record rents.

According to appraiser Miller Samuel and brokerage Douglas Elliman Real Estate, effective median rents rose from a year earlier for the 18th straight month in Manhattan as landlords grew less willing to grant concessions and renters desperate to find a home amid dwindling inventory engaged in bidding wars. The median rent rose 10.7% year-over-year to $4,095 in February from $3,700 the same month a year earlier, and down just $2 - yes, two dollars - from January, Bloomberg reported. The median rent peaked at $4,150 in July and has held close to that level ever since, breaking with the market’s traditional pattern for the cooler months, when costs typically drop as competition for apartments eases.

“Every couple of months the market sees some sort of record,” Miller Samuel President Jonathan Miller said. “What's different is, instead of rising sharply upward, it's just pressing against the record levels every month. Sometimes it exceeds it and sometimes it doesn't. "

"The takeaway from that is that rents, since the summer, don't appear to show any signs of declining,” he added.

While NY landlords clearly still have the upper hand in rental negotiations, there are finally signs that renters are pushing back on renewal increases. Roughly 1,200 more new leases were signed in February than a year earlier, while the number of units left on the market at the end of the month was up by 1,400. Those numbers suggest that a larger-then-usual share of people are rejecting their landlords’ rent hikes and searching for new apartments, according to Miller.

“Landlords are still trying to catch up” and align renewal rates with the prices they’re getting for new leases, Miller said. “So that’s pushing people to churn, to look for new space.”

“Essentially, all three markets are doing the same thing this particular month, where they're seeing at or near-record prices, but effectively moving sideways to a record set in the summer,” Miller said. “Leasing activity is relatively high and we're seeing inventory relatively low. So that combination is creating a fairly robust New York City rental market.”

In Manhattan, listing inventory fell month-over-month at a higher rate than the February average over the last 10 years. The number of new leases rose year-over-year by 43.5%, the biggest annual increase in new leases in the last 19 months.1 Higher mortgage rates drove up the cost of buying and pushed many prospective homeowners into rentals.

“We're seeing activity expand a lot faster than we would normally expect seasonally. That's an indicator of the impact that rising mortgage rates are having on would-be homebuyers into the rental market,” Miller said.

In some cases, renters seeking to renew are being quoted prices that no longer include the discounts and free months they were able to score early in the pandemic.

“There is a definite sticker shock,” said Gary Malin, chief operating officer of Corcoran Group. “People are saying, ‘I was paying this and I’m supposed to be paying that if I want to stay.’”

While vacancies are ticking up, landlords haven’t felt particularly compelled to fill empty apartments by cutting prices unlike their office lending peers (where the market is in freefall). Instead, according to Malin, they’re holding out to see how demand looks during the traditionally high-volume spring and summer months.

“They want to see how deep the market is — why not be a little bit more aggressive and hold onto my current rent,” he said. Once the market gets busier, “they’ll be able to fill them all if they really want to.”

Making their lives even easier, renters are hedging against even more increases in the future by signing longer leases thus taking out future capacity out of the market. Over 50% of the new deals signed last month were for two-year terms, up from 36% in October, when it appeared that a recession — and lower rents — might be on the horizon data from Miller Samuel and Douglas Elliman show.

Renters are also working against the calendar. Heading into the busy spring and summer months, Miller doesn’t expect Manhattan renters to catch a break. With the increased pressure on the market, rates will likely “edge higher, just enough to break the last record,” he said.

While Manhattan remains unattainable for most, there are some signs of topping in the outer boroughs. In Brooklyn, the median rent was $3,400, down 2.8% from January, according to Bloomberg. The number of leases signed rose 19% from a year earlier, while available listings increased 20%. In Northwest Queens, the neighborhoods closest to Manhattan, the median was $3,238, a 3.9% drop from January.

https://ift.tt/0ZAYyER

from ZeroHedge News https://ift.tt/0ZAYyER

via IFTTT

0 comments

Post a Comment