Fed Emergency Bank Bailout Facility Hits Record High; Money Market Inflows Suggest Deposit Run Not Over Yet

With regional bank stocks squeezing higher, one could be forgiven for thinking everything's awesome again (if you memory or charts only go back a week or so) except last week's deposit flows did not support that narrative and tonight's ongoing inflows into money market funds suggest banks are still struggling to keep hold of their deposits.

Money Market Funds saw $13.6 billion of INFLOWS, pushing the aggregate to a record high of $5.341 trillion. That is over $520 billion of inflows in the last three months...

Source: Bloomberg

Retail funds saw over $14 billion of inflows while institutional funds actually saw a small outflow...

Source: Bloomberg

This surge in money market fund inflows strongly suggests tomorrow's H8 deposit report will show the bank walk/run is continuing...

Source: Bloomberg

After last week saw a tiny drop in the Fed's balance sheet, The Fed's infamous H.4.1 report shows that it dropped $46.3 billion last week - the 8th straight week of declines...

Source: Bloomberg

As far as QT is concerned, after last week saw an increase of $461 million, the Total Securities Held Outright dropped $29.89 billion last week as QT started up again...

Source: Bloomberg

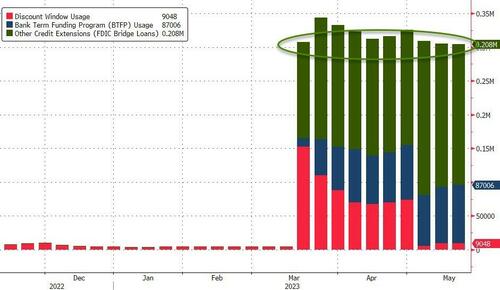

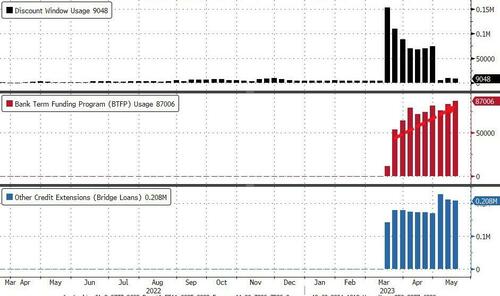

The total size of the Fed's backstopping facilities remained extremely high at around $305 billion...

Source: Bloomberg

...with the Fed's Bank Term Funding Program rising yet again to a new record high (up from $83.1 to $87.0 billion)

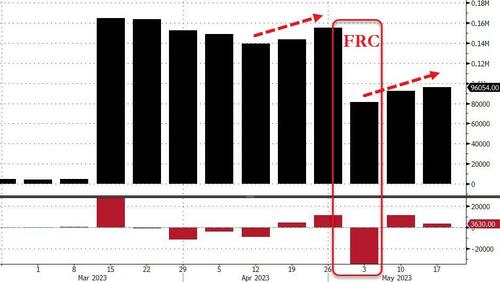

The US central bank had $96.1 billion of loans outstanding to financial institutions through two backstop lending facilities in the week through May 17, compared with $92.4 billion the previous week.

US Bank reserves at The Fed rose for the second week in a row...

Tomorrow we get the big one - more answers after the bell when The Fed releases its H8 report on bank deposit flows and whether the seasonal-adjustments are total bullshit or not.

https://ift.tt/KjO8NIw

from ZeroHedge News https://ift.tt/KjO8NIw

via IFTTT

0 comments

Post a Comment