Tech Tops, Dow Drops, Bonds Flop As Hawkish Inflation Signals Send Rate-Hike Odds Soaring

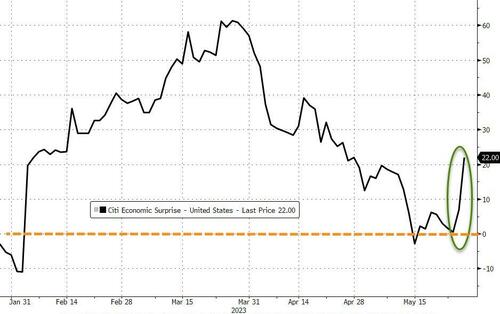

US economic data surprised to the upside this week - but most notably in terms of inflation signals that showed now signs of trending lower...

Source: Bloomberg

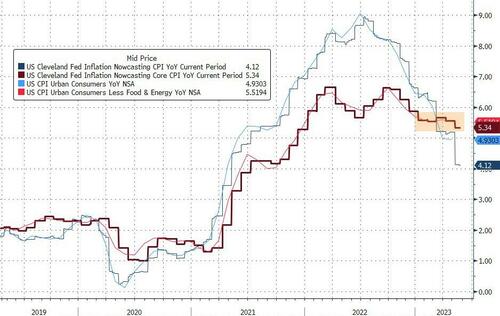

And while core inflation NOWCAST did drop a smidge, it remains a mile away from The Fed's mandated levels - and the drop has stalled...

Source: Bloomberg

That saw the market very hawkishly reprice the entire short-term rate curve with 100% odds of another hike by July and pricing in rates being only 25bps lower by Jan 2024 (from 125bps lower right after the FOMC)...

Source: Bloomberg

But, realistically, the drivers of action this week in markets were debt-ceiling headlines and the AI-bubble's euphoria stage.

The Debt-Ceiling Fear-o-Meter soared to start the week but eased a little today (even though a deal remained absent)...

Source: Bloomberg

And that helped stocks a little into the weekend, but the real driver was NVDA and any mention of AI that sent Nasdaq literally to the moon

0-DTE traders were caught offside in NVDA with massive covering of puts this morning and then buying of calls late on...

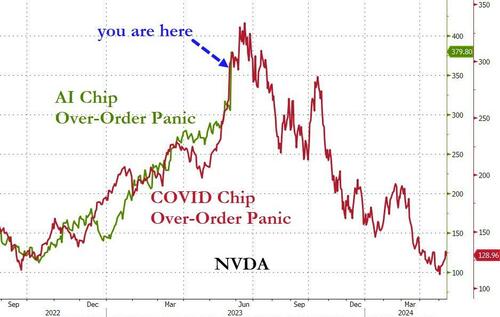

Just one thing to remember, we've seen these massive hoarding orders of chips before (during COVID)...

Source: Bloomberg

And thanks to the knock-on from FOMO-chasing AI, Nasdaq is up over 5.5% from Wednesday's close. The Dow ended the week down 1% with Small Caps and the S&P around unch...

On a side-note, 0-DTE traders were selling the whole day with massive negative-delta flow

Tech - obviously - massively outperformed this week, with only Consumer Discretionary joining them in the green. All other sectors were red on the week with Staples and Financials lagging....

Source: Bloomberg

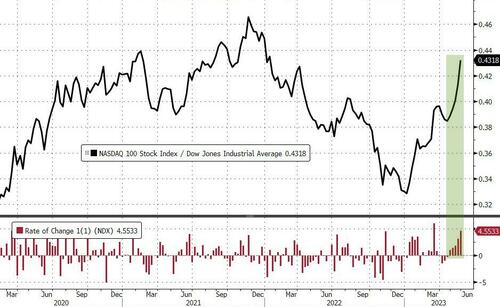

This was the biggest weekly outperformance of Nasdaq over The Dow since early March (and this is the 5th week that Nasdaq has outpaced The Dow)...

Source: Bloomberg

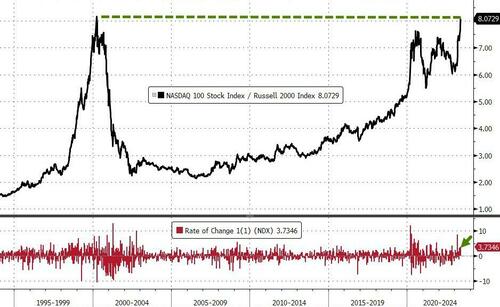

The last time Nasdaq traded at more than 8x Small Caps did not end well...

Source: Bloomberg

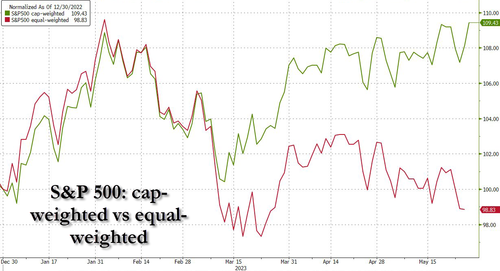

The equal-weighted S&P 500 is now underwater for the year while the cap-weighted S&P is up around 10%...

Source: Bloomberg

This is the biggest divergence in at least 30 years for this time of year...

Source: Bloomberg

The 3-month performance spread between the S&P 500 and the S&P 500 Equalweight is the widest it has been since December 1999. pic.twitter.com/EJq1vVIBGA

— Bespoke (@bespokeinvest) May 25, 2023

Regional Banks squeezed up to resistance but faded back later in the week ahead of tonight's deposit data...

1D-VIX surged higher today, once again recoupling with VIX as the debt ceiling doubts remain...

Source: Bloomberg

Treasury yields were dumped all week, but today saw some buying come back into the long-end, leaving the short-end (2Y) up 30bps on the week while 30Y yields were up only 3bps...

Source: Bloomberg

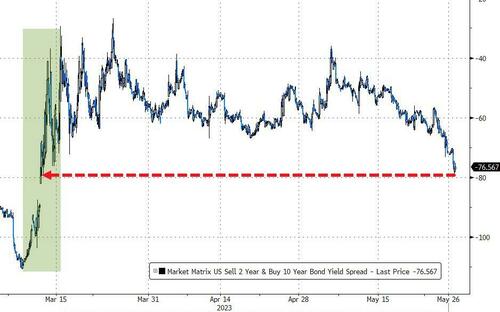

And that shift led to the biggest weekly curve (2s10s) flattening since April 2022 to its most inverted since the peak of the SVB crisis...

Source: Bloomberg

Before we leave bond land, there's this - the traditional relationship between higher yields and tech performance (long-duration equities) has completely blown up...

Source: Bloomberg

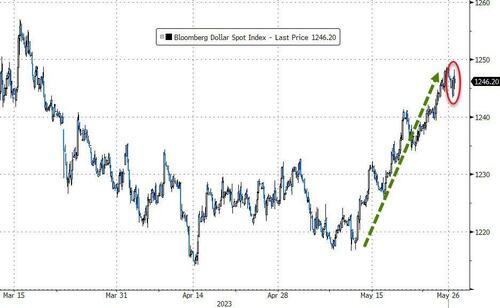

The dollar rallied for the 3rd straight week (5 of last 6), but ended the week with selling pressure...

Source: Bloomberg

Bitcoin ended the week unchanged, hovering around $26-27,000...

Source: Bloomberg

Oil managed modest gains on the week but NatGas was clubbed like a baby seal as copper and PMs

Source: Bloomberg

Overall, commodities are screaming recession... stocks not so much (or are stocks screaming recession-implied QE?... in which case why aren't commodities doing the same?)...

Source: Bloomberg

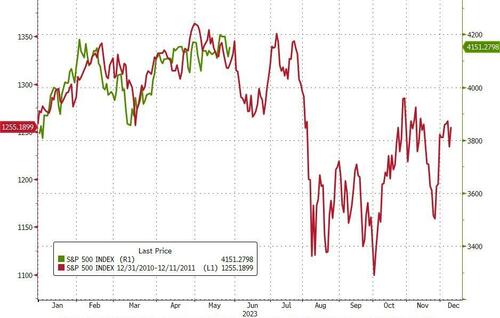

Finally, as optimism builds of a debt-ceiling deal, remember, remember, the summer of 2011...

Source: Bloomberg

Will we get 'sell the news' next week on a short-term deal?... then a bounce, then a reality check that the short-term extension won't last?

https://ift.tt/9LZkBjf

from ZeroHedge News https://ift.tt/9LZkBjf

via IFTTT

0 comments

Post a Comment