US X-Date Is Now June 5 As Treasury Burns $52BN Cash In One Day, Only $87BN Left

Yesterday, in her crusade to scaremonger Republicans into submission and yielding to Biden on the debt ceiling negotiations, Janet Yellen repeated that the Treasury X-Date will be in early June, potentially as soon as the first of the month. The former Fed chair then cranked up the doom to 11, and six years after predicting "no new financial crisis in our lifetimes", Yellen said that a US default could see "a number of financial markets break - with worldwide panic triggering margin calls, runs and fire sales." Basically all the worst parts of the bible. And incidentally, Yellen isn't wrong: a US default would indeed be the end, but of course that will never happen as US tax receipts are more than enough to pay debt interest and maturities; the worst that will happen is that the bloated US deep state and some 25 million government workers will be out of a job, which is long overdue anyway.

Yellen is probably also correct about the timing of the X-Date. As Bloomberg rates strategist Ira Jersey writes, he concurs with Yellen's assessment "that the debt ceiling X-date could be as early as June 1" although his calculations suggest the date is a few days later (June 5-8), as shown in the chart below.

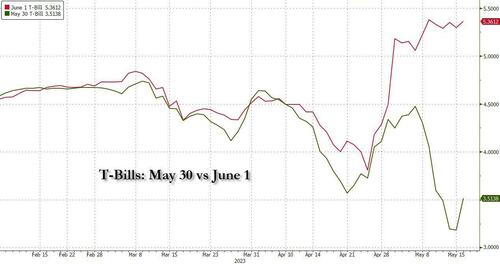

And while this leaves Treasury bill maturing June 6 and 8 in the cross hairs of the debt-ceiling angst, the market is not taking any chances, and as the next chart shows, there is now a massive divergence between the yield on bills maturing May 30 and those maturing June 1, indicating that the market is now confidence that June 1 is indeed the X-date.

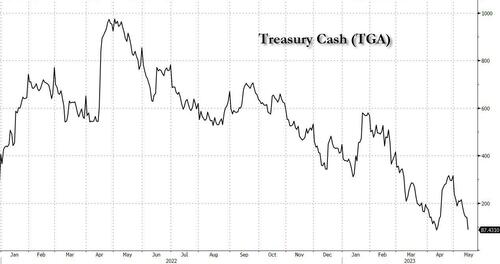

Unfortunately, the bill market may end up being optimistic: today's update showed that Treasury cash collapsed by a whopping $52 billion, from $140BN to just $87BN, bringing the TGA it back to where it was before tax receipt season.

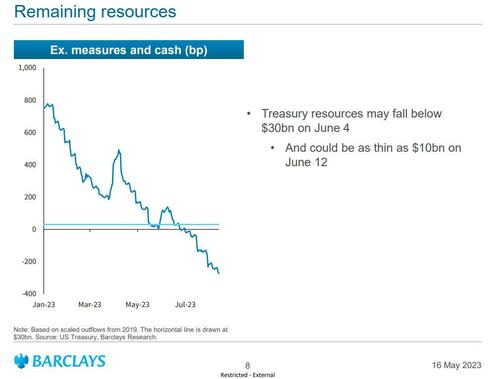

A monthly money market update from Barclays' rates strategist Joseph Abate is in line with BBG's conclusion. According to Abate, the Treasury may run out of cash and extraordinary measure capacity under the statutory borrowing limit between June 4 and 12. As the Barclays strategist shows below, Treasury resources including remaining borrowing capacity (which as of May 12 was about $230 billion), may fall below $30BN as soon as June 4, and could drop as low as $10BN on June 12.

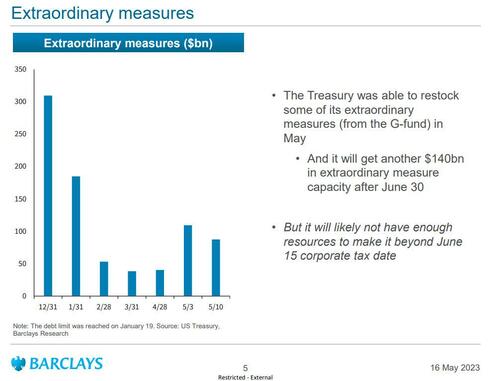

“The Treasury was able to restock some of its extraordinary measures (from the G-fund) in May, and it will get another $140bn in extraordinary measure capacity after June 30,” Abate wrote in the monthly report. But, he added "it will likely not have enough resources to make it beyond June 15 corporate tax date”

Two other banks also agree: according to Deutsche Bank strategists the base case for the X-date is early June with late July becoming the hopeful scenario, while an analysis by JPMorgan's Jay Barry concludes that the Treasury will exhaust all available resources by June 7, slightly earlier than their previous estimate of June 9. However, they see a “significant” amount of risk of an early-June X-date given large Social Security and Medicare payments that are due the first two days of the month.

In short, the market is now acting as if June 1 is the X-date, with some uncertainty over the day to day cash needs which could push out the X-date a few days, or even a week, but not beyond that.

And while the math is rather straightforward, the chance of a political mistake is far higher than during previous standoffs due to the game of chicken being waged by both sides, a game that has been largely ignored by the market, which in turn is , the government failing to make a payment to someone.

Finally, while the Treasury Department makes no secret it will be loath to prioritize any payments, and it claims there are no plans to do so, Bloomberg calculates that if push came to shove, if the government were to immediately cut total spending by 25% starting June 1, it would have a surplus until the March 2024 tax refunds. Which, as we said before...

As a reminder, the US can not default: tax receipts are more than enough to cover debt maturities and interest. Those 25 million govt/deep state workers and Ukraine wire transfers may not be so lucky though.

— zerohedge (@zerohedge) May 16, 2023

.... means there is no crisis: there is just a question of whether or not 25 million bureaucrats and deep state operatives need to be paid billions every day.

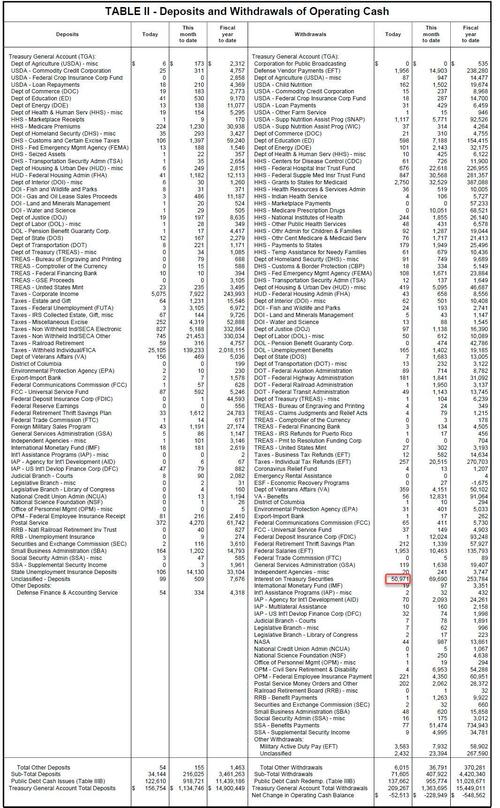

Appendix: for those asking how it is possible that the US Treasury burned through $52.5 billion in cash in one day, here is the answer.

There is much more in the Barclays presentation which is a must read for those closely following the nuances in the debt ceiling drama, and which is available to pro subs.

https://ift.tt/dtBKsqG

from ZeroHedge News https://ift.tt/dtBKsqG

via IFTTT

0 comments

Post a Comment