These Five Niche Commodities Signal China's Recovery Faltering

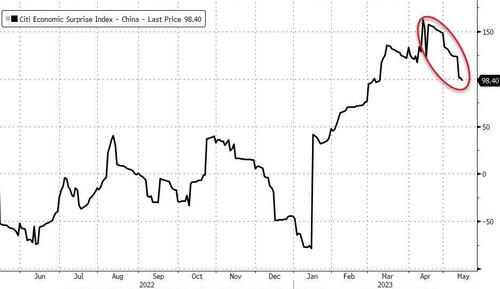

China's economic recovery from draconian zero-Covid controls is faltering. Investors had very high hopes earlier this year that the world's second-largest economy would roar back to life and help offset weakness in the global economy. However, six months later, those same hopes have faded into disappointment.

One of the most immediate warning signs investors are losing faith in the recovery narrative is the Hang Seng China Enterprises Index fell into bear market territory Tuesday, down about 20% from its Jan. 27 peak.

While equities are important to track, we shift attention to sliding commodity prices that might give further input about China's economic growth miracle seen over the last several decades, which has yet to reemerge and ignite a spark. Maybe that's because of an aging population or declining workforce or supply chain reset, or enormous debt loads -- whatever is hobbling China's recovery effort might indicate the days of expanding at 6% to 8% a year are over and only 2% or 3% is the new normal.

On the commodity front, two of the most important commodities to China's economy, copper and iron ore, have been moving lower over the last several months. But five often overlooked commodities essential for economic growth send chilling signs of economic alarm.

"Futures markets for items as diverse as glass, styrene and corn starch are piling on the evidence that China isn't recovering as fast as many people had hoped, after Beijing abandoned the pandemic restrictions late last year that were crushing its economy," Bloomberg said.

Glass

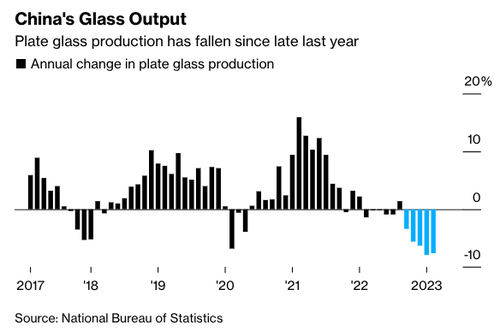

China accounts for more than half of the world's plate glass production thanks to the rapid growth of high-rise buildings and vehicle sales in recent decades. Similar to other industries, low margins and supply gluts have troubled producers for years, forcing them to cut output in recent months.

The situation this year looks even more challenging. Glass futures on the Zhengzhou Commodity Exchange have plunged nearly 20% in the past month, a period when demand usually picks up. The reasons include China's teetering property market and weaker-than-expected vehicle output in April.

Trucked LNG

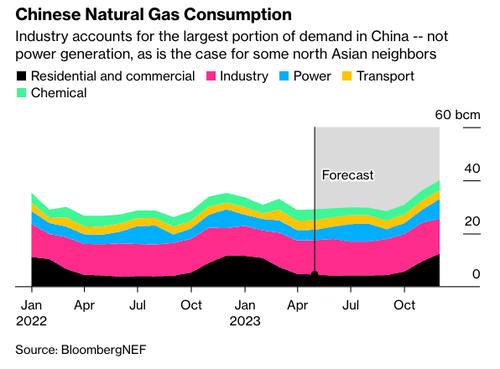

China has a vast requirement for natural gas, carried by sea from mega-projects in far-flung places like Qatar and Australia, or over pipelines that stretch across continental Asia. But the last few miles to consumers is often via trucks that criss-cross China's cities, a barometer of the immediate needs of industries from glass-makers to ceramic factories.

That price has fallen to its lowest level in almost two years. Demand is so weak that the nation's top importers of seaborne liquefied natural gas are even offering to resell their shipments abroad.

Styrene

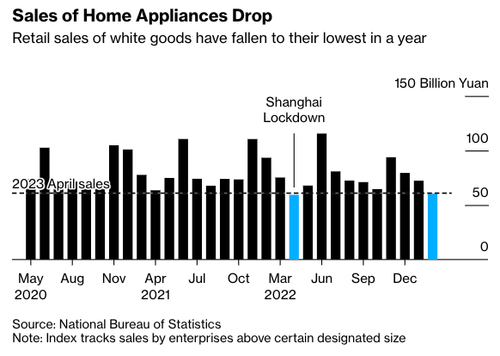

Fewer home buyers also means less demand for the purchases that often accompany a new place to live. The price of styrene monomer, a material used for the plastics and rubber that go into appliances like fridges, has declined. China has been the world's fastest growing market in the past decade with capacity climbing to over 40% of the global total.

Dalian futures fell last week to their lowest since February 2021, after a near-5% drop in home appliance sales in the first quarter, according to the National Appliance Information Center. The problems are slower growth in personal incomes and a "low-frequency sales cycle" for white goods, according to Wu Haitao, a director at the center.

Corn Starch

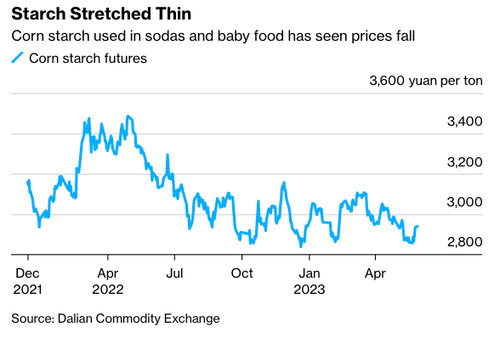

Corn starch has a wide variety of uses, in soft drinks, as a thickening agent for sauces and in the paper and textiles industries. China produces almost 50 million tons a year.

Although retail sales have outperformed other economic measurements in the months since China's Covid Zero restrictions were lifted, they grew at a slower pace than expected in April. China's falling population is another headwind: corn starch is a key ingredient in baby formula.

Paper Pulp

Shanghai pulp futures went into free-fall in February after a sudden recovery in production at paper mills after the Lunar New Year holiday was augmented by resurgent imports. Domestic demand, which was also supposed to rise after China's reopening, couldn't keep up.

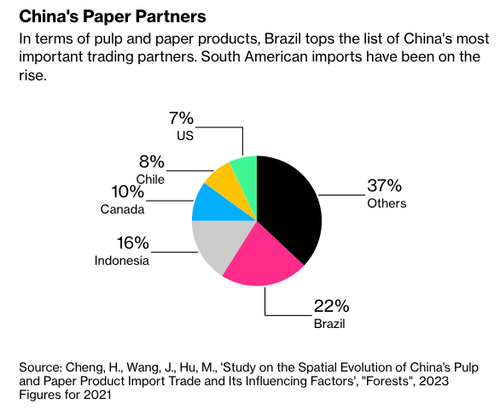

As with many commodities, China is the biggest producer and consumer of pulp, used for packaging, publishing and household goods. But the market is so vast that a lot of pulp and paper also needs to be sourced from abroad.

Meanwhile, China's macro data has failed to show the reopening narrative coming to life.

The faltering recovery led to China's central bank announcing an unexpected cut in mid-May to the amount banks set aside for deposits by 25 basis points, vowing to keep ample liquidity in the interbank system and better fund the real economy.

So the question remains: What's next for the global economy if China's highly anticipated economic rebound doesn't materialize?

https://ift.tt/UPvNeF5

from ZeroHedge News https://ift.tt/UPvNeF5

via IFTTT

0 comments

Post a Comment