Amazon Soars After Smashing Expectations On AWS Strength, Guides Higher

With three out of five FAAMG stocks - which of course is now known as GAMMA ever since Facebook's ignominious rebranding to Meta (at least until the company changes its name to MetAI... or Twitter) - having already reported mostly solid results helping send the S&P to new 52 weeks highs just a few days ago (until the recent blow out in yields dented sentiment) investors are keenly looking to Amazon and Apple earnings after the close today to round out the picture for the resurgent market generals which could set the tone for the rest of 2023... or at least until the jobs report tomorrow morning.

As previewed earlier, Amazon is expected to post sales of $131.6 billion, up 9% from 2022, and EBIT of $5 billion (Amazon's own guidance is for revenue of $127-133b, EBIT of $2.0-5.5b). Investors will be focused on the AWS revenue which is expected to rise 10% to $21.7BN (bar a bit lower post MSFT Azure print) as well as commentary on July vs June growth, the Backlog, and, of course, A.I. contribution. Attention will also be directed to continued improvements in Retail Margins (e.g. beat high-end of EBIT guide).

Why is so much attention focused on AWS? Well, cost cuts by big corporate clients who are laying off workers or trying to optimize their technology spending after IT bills surged during the pandemic. There’s also the chance that cloud computing – invented in its modern form by AWS – is maturing. Many of the companies likely to unplug their servers and data centers in favor of rented computing power already have, the thinking goes.

Demand for applications related to generative artificial intelligence may ride to the rescue and boost AWS at some point, but chief rival Microsoft seems to think demand will ramp up slowly. Expect executives to face questions about this on the analyst call.

As a reminder, the last time Amazon reported earnings, the stock reacted pretty violently. Shares rose at first, on what looked like a decent quarter. Then, on the analyst call, CFO Brian Olsavsky said Amazon Web Services’ growth rate had slowed by 5 percentage points in 2Q.

Well, it doesn't look like the weakness stuck because moments ago Amazon reported results which blew away expectations, from the top to the bottom line, while also guiding well above sellside estimates. Here is what Amazon just reported:

- Q2 EPS 65c, up sharply from a 20c loss YoY, and smashing estimates of $0.35

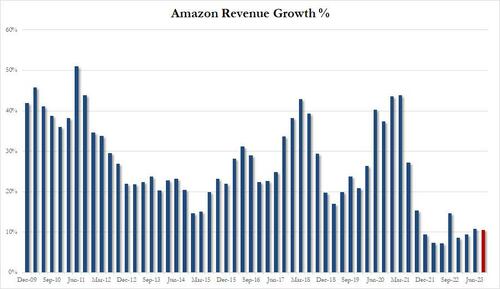

- Q2 Net sales $134.38 billion, +11% y/y, beating estimates of $131.63 billion

- Online stores net sales $52.97 billion, +4.2% y/y, beating estimates of $52.45 billion

- Physical Stores net sales $5.02 billion, +6.4% y/y, beating estimates of $4.96 billion

- Third-Party Seller Services net sales $32.33 billion, +18% y/y, beating estimates of $31.2 billion

- Subscription Services net sales $9.89 billion, +14% y/y, beating estimates of $9.79 billion

- North America net sales $82.55 billion, +11% y/y, beating estimates of $79.68 billion

- International net sales $29.70 billion, +9.7% y/y, beating estimates of $29.25 billion

- Third- party seller services net sales excluding F/X +18% vs. +13% y/y, beating estimates of +15%

- Subscription services net sales excluding F/X +14% vs. +14% y/y, missing estimates +14.5%

- AWS net sales $22.14 billion, +12% y/y, beating estimates of $21.71 billion

- Amazon Web Services net sales excluding F/X +12% vs. +33% y/y, beating estimates +9.48

- Operating income $7.68 billion vs. $3.32 billion y/y, smashing estimates of $4.72 billion

- Operating margin 5.7% vs. 2.7% y/y, beating estimates of 3.46%

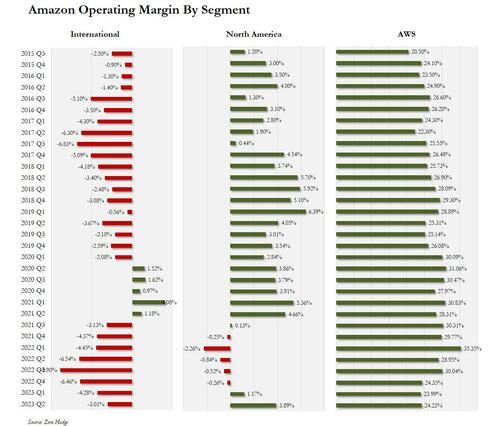

- North America operating margin +3.9% vs. -0.8% y/y, beating estimates of +2.03%

- International operating margin -3% vs. -6.5% y/y, beating estimates of -6.4%

- Fulfillment expense $21.31 billion, +4.7% y/y, missing estimates of $19.01 billion

- Seller unit mix 60% vs. 57% y/y, beating estimates of 58.3%

But while Amazon's earnings were stellar, it was its Q3 guidance that was truly blowout:

- The company sees net sales between $138.0 billion and $143.0 billion, or to grow between 9% and 13% compared with third quarter 2022; this is well above consensus estimates of $138.3BN

- Sees operating income between $5.5 billion and $8.5 billion, compared with $2.5 billion in third quarter 2022. and also beating consensus estimates of $5.41 billion.

Commenting on the quarter, CEO Andy Jassy not only patted himself on the back, but also discussed AI as well, saying that “we continued lowering our cost to serve in our fulfillment network, while also providing Prime customers with the fastest delivery speeds we’ve ever recorded. Our AWS growth stabilized as customers started shifting from cost optimization to new workload deployment, and AWS has continued to add to its meaningful leadership position in the cloud with a slew of generative AI releases that make it much easier and more cost-effective for companies to train and run models (Trainium and Inferentia chips), customize Large Language Models to build generative AI applications and agents (Bedrock), and write code much more efficiently with CodeWhisperer. We’re also continuing to see strong demand for our advertising services as the team keeps innovating for brands, including the ramp up for Thursday Night Football with the ability for advertisers to tailor their spots by audience and create interactive experiences for consumers. We remain excited about what lies ahead for customers and the company.”

More importantly, Jassy is showing investors he can boost sales while also keeping a lid on costs simultaneously. The results are a good vindication of the cost-cutting measures he initiated last year.

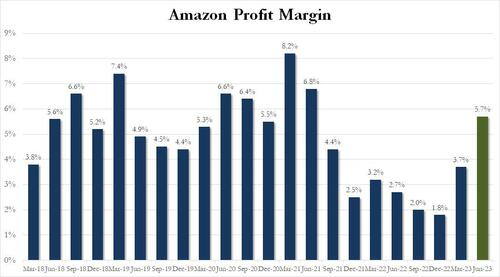

Digging into the numbers we find that operating margins soared to 5.7%, more than double the year ago number, and smashing consensus esttimates of 3.46%. So much for that earnings recession.

While the market was clearly happy with the overall profit margin, it also appeared quite happy with the profit margin breakdown where the AWS profit margin rebounded from the lowest since 2017. At the same time, international operating margin remained negative, with US online sales generated a surprisingly strong 3.89% profit margin, the highest since Q2 2021.

While some analysts expected Amazon Web Services growth to sink into the single digits - a significant slowdown for a business that was growing by more than 30% a year ago - that hasn’t happened and AWS sales beat expectations at $22.1 billion, up 12% from 2022. Operating income, $5.3 billion, exceeded analyst estimates, too. The big question here is whether AWS growth rates have bottomed out and whether management expects any acceleration in the second half of the year.

Besides AWS performance this quarter, the market was also focused the company's revenue forecast, which came in the very solid range of $138-$143BN (midline at $140.5BN), beating the $138.3BN expected. This would put the annual growth rate at 10.5%, just below this quarter's 10.8%.

What is notable here is that revenue grew faster than costs for a second consecutive quarter, which hasn’t happened since the company was still riding the pandemic’s online shopping boom in early 2021. As Bloomberg notes, signs of Amazon’s cost cuts are all over these results. Overall operating expenses climbed by 7%, the slowest growth since at least 2017. Sales and marketing costs rose just 6.5%, after years of hovering closer to 35%.

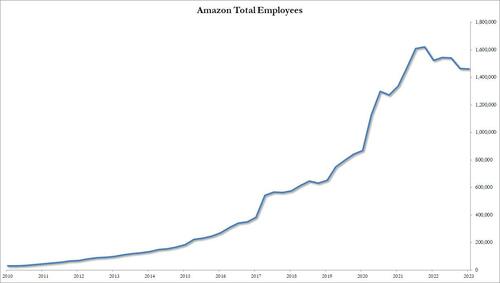

And speaking of cost cuts, Amazon’s headcount shrank by 4,000 people during the quarter. That’s a pretty modest decline for a company that employs 1.46 million workers, but it’s a third consecutive quarterly cut. That kind of consistent employee reduction hadn’t happened at Amazon since the company struggled through the Dotcom bust in 2001.

Also worth noting, Amazon said its Amazon Business unit, which lets commercial customers order office supplies and other items similar to household shopping, now has 6 million customers on track to spend about $35 billion a year.

Oh, and for those wondering, the phrase “generative AI” appears 12 times in the Amazon’s earnings release. Amazon also has 9 bullet point paragraphs explaining the work they did in AI in the quarter.

While it was self-evident thanks to the across the board beat and stellar guidance, Bloomberg Intelligence senior analyst Poonam Goyal said that Amazon’s report “looks good on all fronts" and added that "what caught by surprise was AWS, where sales came in ahead of expectations.”

The market agreed, and in kneejerk response to the stellar results and guidance, AMZN stock has spiked, surging about 6% after hours, and roughly where the option market straddle expected it to go:

And yet, beware the earnings call: last quarter we saw a similar spike higher only to see the stock tumble during the call when the company revealed surprising contemporaneous AWS weakness.

https://ift.tt/lNe7K9g

from ZeroHedge News https://ift.tt/lNe7K9g

via IFTTT

0 comments

Post a Comment