Crypto And Liquidity

By Russell Clark of The Capital Flows and Asset Markets Substack

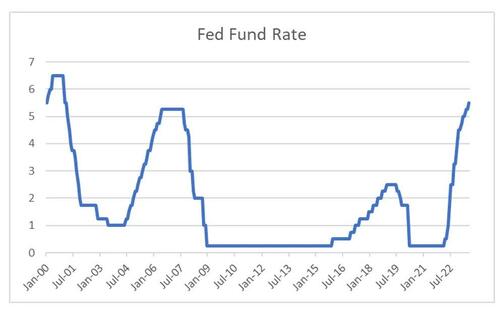

We have seen the fastest Federal Reserve hiking cycle in a generation. Interest rates have risen from near zero to over five percent in little over 16 months.

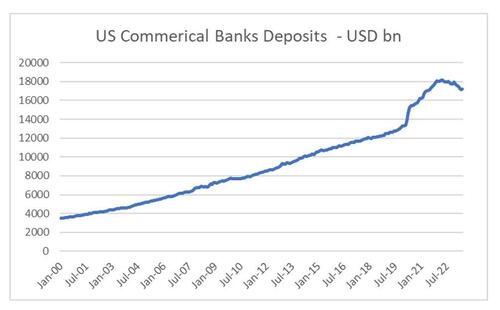

Such a quick increase has had unprecedented affect on bank deposits, leading to the collapse of Silicon Valley Bank this year.

But what effect has it had on cryptocurrencies?

Using data from www.coinmarketcap.com , we can see that the volume traded of bitcoin has fallen. Which would be in line with reduced liquidity.

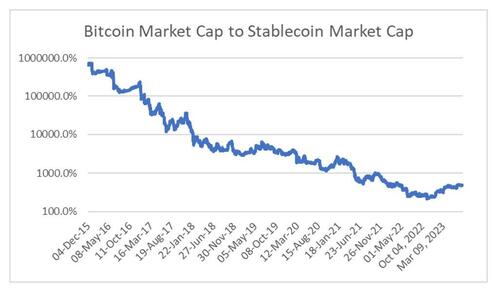

To get an idea of broader liquidity in the crypto space, I try and track the market capitalisation of the biggest stablecoins. There seems to be some sort of relationship, but an unstable one at best. The theories around stablecoin and bitcoin vary. One line of thinking is that stablecoin is a gateway to crypto, so surging stablecoin market cap points to more money entering the system. The other line of thinking is that when people are nervous about bitcoin price, they sell bitcoin and place the proceeds into stablecoin. The chart below does not really help to disentangle which theory is correct.

Another way to look at it is the size of stablecoin market capitalisation to bitcoin market cap. Here the relationship is more interesting, showing that stablecoin has grown faster than bitcoin. If this relationship holds, it would suggest bitcoin is overvalued relative to current stablecoin market cap.

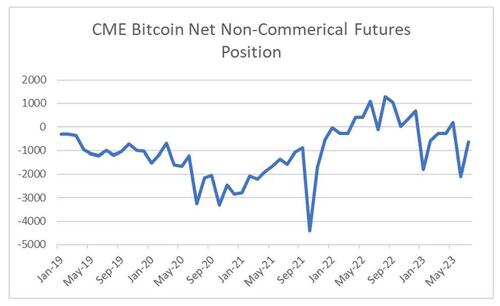

What could have caused bitcoin to rally without liquidity? Well positioning was very negative at the beginning of 2023. CME Bitcoin futures had moved back to negative bias at the beginning of 2023. Still negative today, but less so.

Also listed bitcoin play, Microstategy, saw its short interest rise to over 40% of shares outstanding, a level that in my experience suggests the risk of a short squeeze being very high, which is what has happened. The stock is up 175% this year, and short interest has fallen back to 28%.

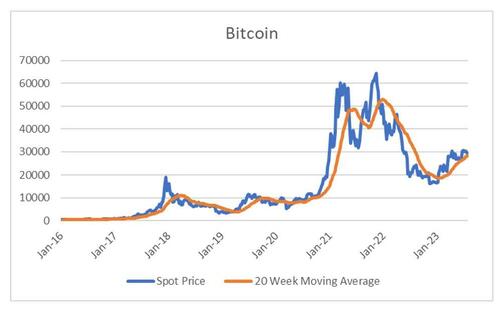

Liquidity driven and speculative assets are often driven by technical flows. Generally speaking, you want to be long bitcoin when 20 day weekly average is moving higher, and short when 20 day weekly average is moving lower. At the beginning of 2023, it was turning higher, but as of today, it is in no man’s land.

Putting it all together, bearish positioning was excessive at the beginning of the year, but positioning is much more neutral, and liquidity is still declining in this market. The outlook is bearish to me.

https://ift.tt/f4HtOId

from ZeroHedge News https://ift.tt/f4HtOId

via IFTTT

0 comments

Post a Comment