Leap-Of-Faith: Feb Favored Bitcoin-Bulls, Bond-Bears, AI-Advancers, & Anti-Obesity Advocates

Overall February was great for crypto, good for stocks, bad for bonds, and ugly for rate-cut doves.

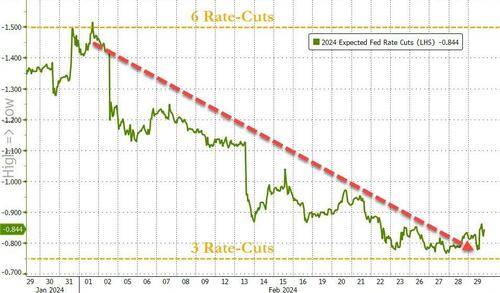

Endlessly hawkish FedSpeak (confirmed by the FOMC Minutes), and troublingly sticky inflation prints (hard and soft) sent 2024 rate-cut expectations reeling from over 6 cuts (154bps) at the start of the month to less than 4 cuts (84bps) at the end, as better-than-soft-landing data spoiled the "rescue-me" fantasy so many had for The Fed...

Source: Bloomberg

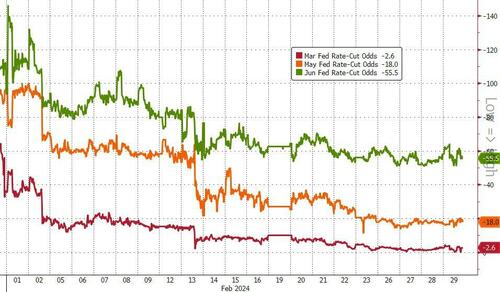

...and expectations for the start of rate-cuts is getting pushed further back with July now moist likely. Quite shift in February from 60% odds of a March-cut to basically 0 and a May-cut fully priced to just 18% now...

Source: Bloomberg

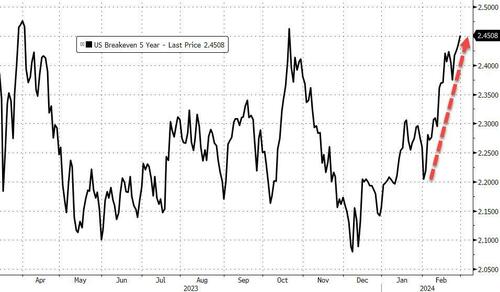

The market is suddenly aware that this disinflationary path may not be as easy as the world and their pet rabbit was hyping at the start of the year. Breakevens have soared higher this year with February pushing 5Y BEs back up near their highest since April 2023...

Source: Bloomberg

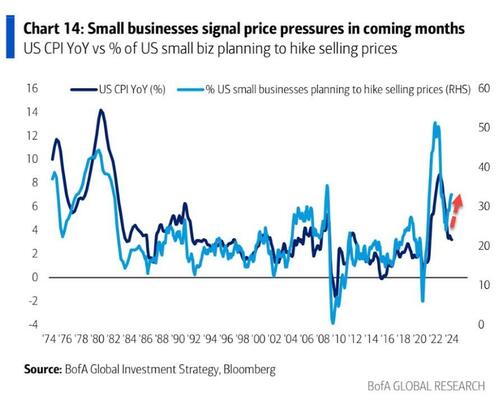

And small businesses are obviously price-gouging (well, that's what President Biden told us anyway)...

We are not amused...

But stocks didn't care...

Source: Bloomberg

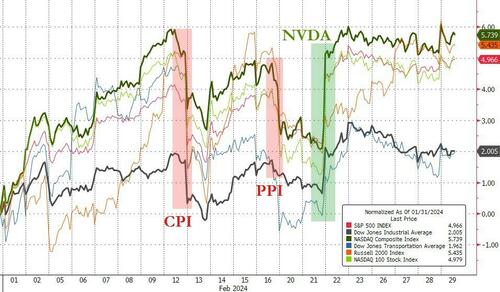

Inflation and AI (well CPI and NVDA) were all that mattered really... All the US Majors were higher in February, led by Nasdaq and S&P as The Dow lagged (but still closed Feb to the upside).

Source: Bloomberg

The algos did everything they could to close the Nasdaq Composite above 16,057 - its prior record closing high...

Fun fact:

When you're hot, you're hot.

— Bespoke (@bespokeinvest) February 29, 2024

Barring a 0.5% drop in the last 10 minutes of the trading day, this will be the first time in 10 years that the last trading day of February will be an up day for the S&P.

It will also be the first positive Leap Day since the year 2000... 🤔 pic.twitter.com/ZdPUxNxjSk

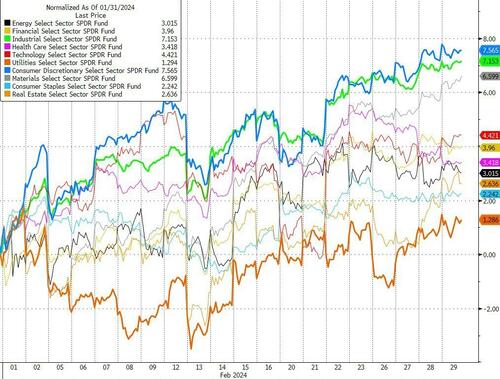

Consumer Discretionary and Industrial outperformed in February while Utes lagged (but closed higher on the month)...

Source: Bloomberg

But as Goldman's Chris Hussey explained, there is some heavy-lifting ahead if stocks are to withstand this:

"For now, markets have sided in favor of the better growth over the higher rates when considering stock valuations -- a product perhaps of just how much skepticism in the US growth trajectory remained a month-plus into 2024.

But as we move forward, the ability of this better growth narrative to continue to surprise to the upside may be critical to keeping stocks working (at least from a top-down standpoint)"

Anti-Obesity drug-related stocks massively outperformed In Feb...

Source: Bloomberg

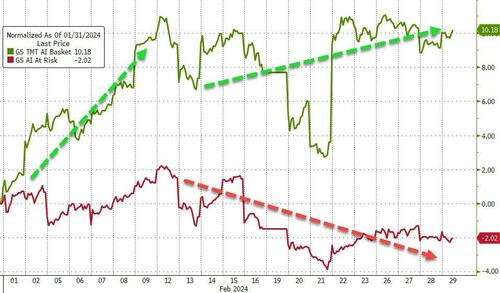

And while AI-related stocks also outperformed, they lagged the GLP-1 Analogs...

Source: Bloomberg

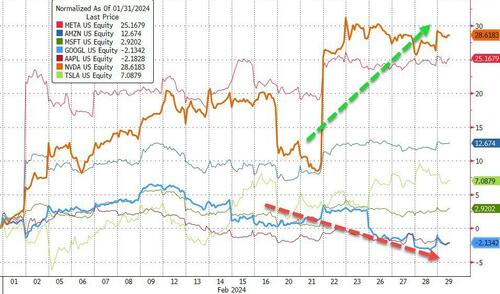

But AI didn't float all boats as while NVDA rose 29% in Feb, GOOGL dropped 2% as Gemini's launch was a massive woke embarrassment. AAPL was alos down 2% in Feb (abandoned its EV car idea after decades)...

Source: Bloomberg

MAG7 stocks overall were up over 7% on the month but really have gone nowhere since the initial thrust into the month...

Source: Bloomberg

MSFT overtook AAPL and remains the only $3TN market cap name while NVDA over took GOOGL and AMZN right up against $2TN market cap...

Source: Bloomberg

And all that exuberantly-added market cap means stocks are anything but cheap...

Source: Bloomberg

As rate-cut expectations fell and better-than-soft-landing data showed up (and stickier than expected inflation data), so bonds were battered in February with the short-end monkey-hammered over 40bps higher in yield while the long-end rose around 20bps...

Source: Bloomberg

Which means the yield curve (2s30s) is bear-flattening significantly...

Source: Bloomberg

The dollar was up for the second straight month in a row in Feb

Source: Bloomberg

It was a big month for crypto with Ethereum outperforming Bitcoin (+49% vs +45%)...

Source: Bloomberg

Bitcoin traded just shy of $64,000...

Source: Bloomberg

And Ethereum traded just shy of $3500...

Source: Bloomberg

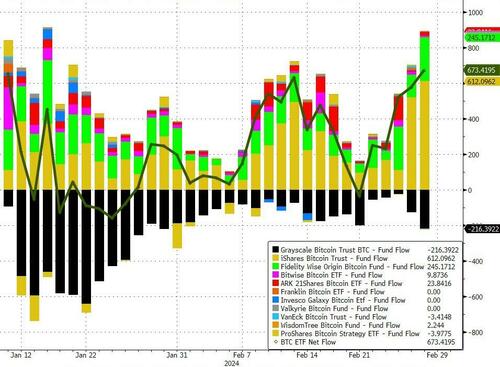

Flows into Bitcoin ETFs soared in February (+$5.9BN) with IBIT inflows dominating...

Source: Bloomberg

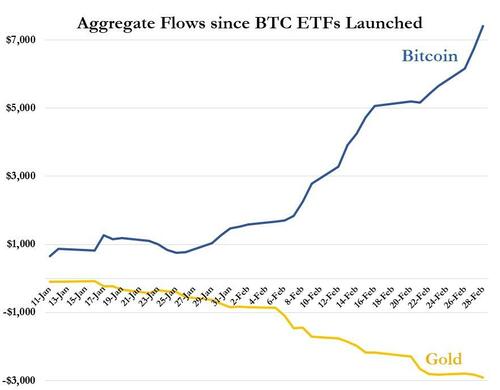

...and overall since inception, Bitcoin ETFs have seen +$7.4BN flows while Gold ETFs have seen $2.9BN outflows...

But, despite the outflows, gold managed to end February unchanged. Oil was up while NatGas was ugly...

Source: Bloomberg

Oil prices bounced off January's close four times this month, with WTI testing up to $79...

Source: Bloomberg

Finally, the better-than-expected macro data in February should not have been a surprise as we had been warning about the renaissance of 'animal spirits 2.0' due to the lagged effect of the massive loosening of financial conditions that occurred in Q4...

Source: Bloomberg

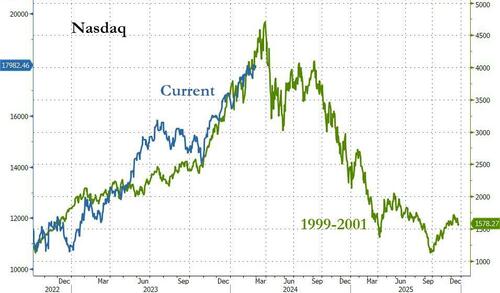

But, be careful, as that tailwind is set to run out right as the Ides of March strike, which would line up rather ominously with the dot-com peak analog...

Source: Bloomberg

Will The Fed allow a market crash in an election year? Or close to the election will The Fed wait for its first (completely apolitical) cut?

https://ift.tt/N16r3EV

from ZeroHedge News https://ift.tt/N16r3EV

via IFTTT

0 comments

Post a Comment