Massive Short-Squeeze Sends Small Caps Soaring; Big-Tech Skids, Bitcoin & Black Gold Bid

Jobless claims just won't quit and were enough to send Treasury yields higher today after ARM and DIS earnings' blast-offs last night.

Rate-cut expectations drifted lower still (hawkish)...

Source: Bloomberg

But stocks hit a new record high...

Source: Bloomberg

The S&P 500 hit 5000.4 intraday...

Source: Bloomberg

...thanks to a miraculous sudden huge buy program in the last few seconds...

Source: Bloomberg

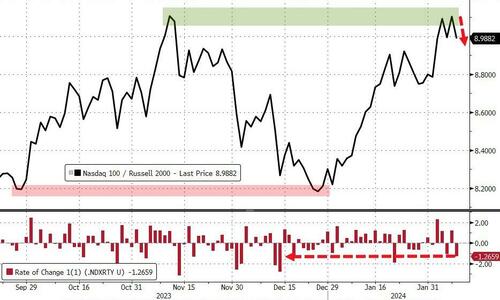

One thing of note, the S&P 500 is an new all-time high, while the Russell 2000 is still in a bear market...

Source: Bloomberg

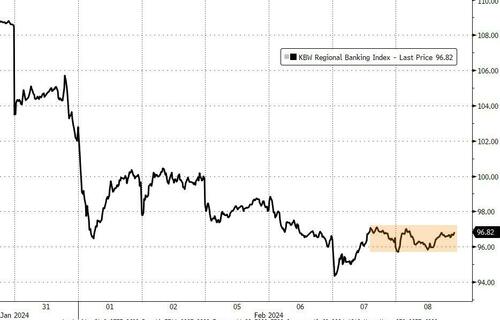

No, 'banking crisis 2.0' is not over. NYCB dumped today...

...and the overall Regional Bank index went sideways...

Source: Bloomberg

Today saw small caps rip higher while the rest of the majors trod water (at a very marginal new high for S&P)...

This was the second-best daily RTY-NDX outperformance in two months, which happened to occur at a critical resistance level...

Source: Bloomberg

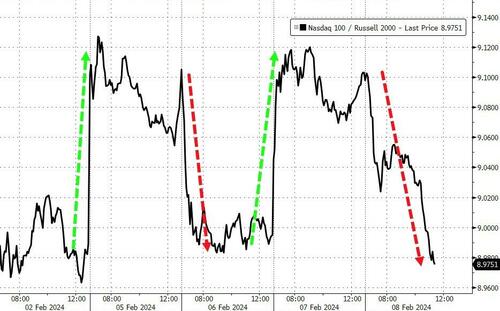

It's been quite a wild ride this week for the RTY-NDX pair - whipsawing from one side to the other... PRESUMABLY tomorrow brings a big Nasdaq outperformance day...

Source: Bloomberg

ARM was up 50% (yes 5...0)... lol

Source: Bloomberg

DIS rallied over 11% on the day, to one-year highs...

Source: Bloomberg

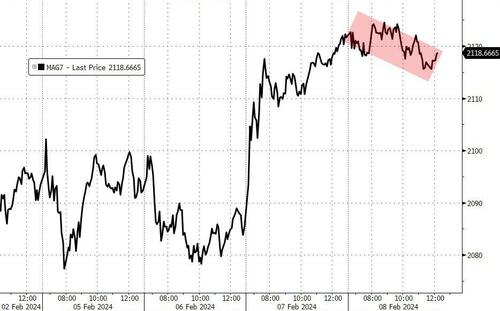

MAG7 stocks drifted very modestly lower on the day...

Source: Bloomberg

Amid a massive short-squeeze...

Source: Bloomberg

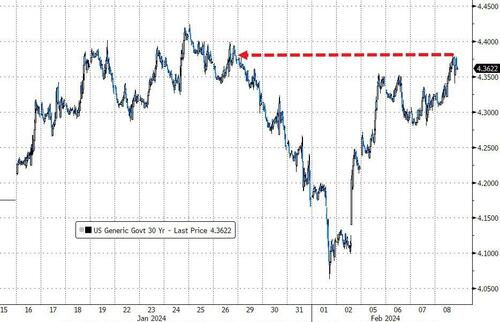

Treasury yields were higher on the day (despite a strong 30Y auction), with the belly (5-10Y) underperforming (2Y +2.5bps, 10Y +6bps, 30Y +4bps).

Source: Bloomberg

Even though the 30Y auction was solid, yields pushed up to two week highs...

Source: Bloomberg

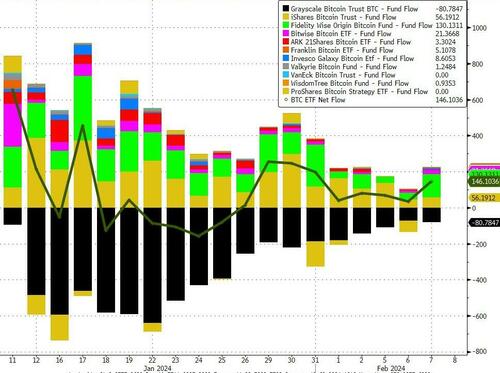

Bitcoin surged back above $45,000 today...

Source: Bloomberg

...after yet another strong day of net inflows to spot bitcoin ETFs...

Source: Bloomberg

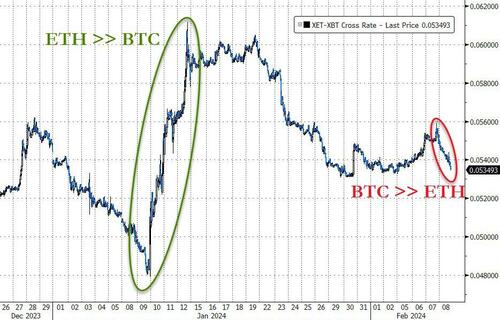

...and bitcoin notably outperformed ethereum today...

Source: Bloomberg

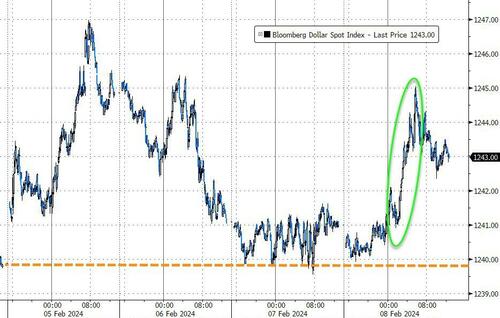

The dollar jumped higher on the strong claims data...

Source: Bloomberg

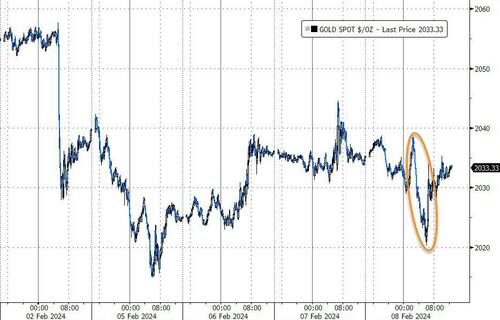

Gold ended the day practically unchanged (despite the dollar strength), after diving to $2020 and finding support...

Source: Bloomberg

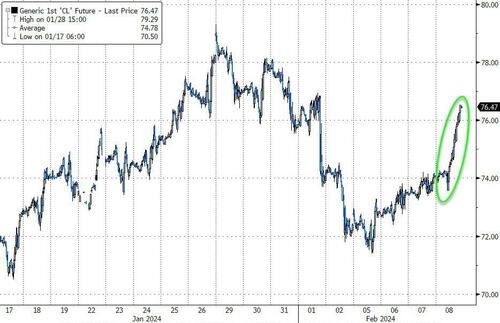

Oil prices surged today with WTI back above $76, erasing the drop at the end of last week...

Source: Bloomberg

Finally, all eyes remain on tomorrow's CPI revisions and next Tuesday's January CPI print. With S&P vol skews at near-record lows...

Source: Bloomberg

...what could go wrong?

https://ift.tt/i2m3UVO

from ZeroHedge News https://ift.tt/i2m3UVO

via IFTTT

0 comments

Post a Comment