Stunning Collapse In Credit Card Debt Change As Average APR Hits New All-Time High

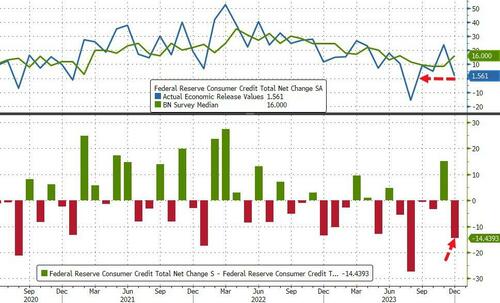

After several months of wild swings in US consumer debt, culminating with last month's explosion in credit card debt which was the 2nd biggest on record, in December households finally hit a brick wall because according to the latest consumer credit data published by the Federal Reserve moments ago, in the last month of 2023 total consumer debt rose by a paltry $1.561 billion, which was not only nearly a 90% miss to consensus estimates of $15.9 billion..

... but also a huge slowdown from November, tumbling by almost $22BN, the third biggest monthly drop since covid shut down the economy.

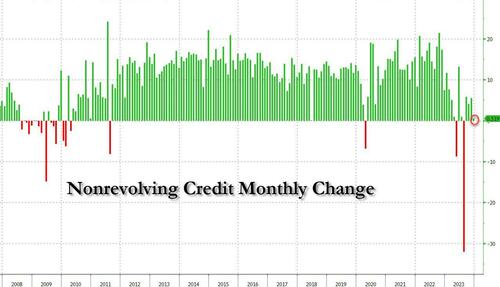

When looking into the details of the report, we find something remarkable: while non-revolving credit rose a tiny $0.5BN...

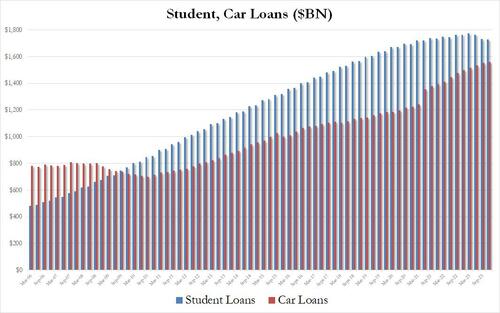

... which is to be expected in a time when student debt continues to shrink due to illegal debt discharges by the Biden admin (which is defying SCOTUS and continues to forgive billions in student loans) while auto loans are barely rising due to record interest rates...

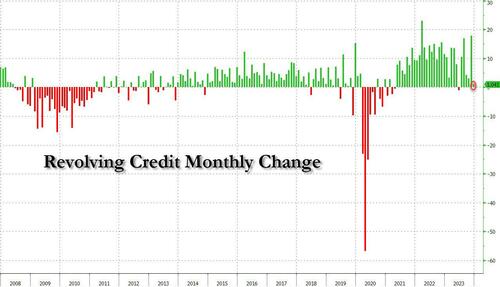

... what was the big shock in today's data was the absolute collapse in revolving credit, i.e., credit card debt, which in December collapsed from a $15.4BN increase in November - the second biggest on record - to just $1 bilion, the second smallest monthly increase with just the June 2023 contraction a greater outlier.

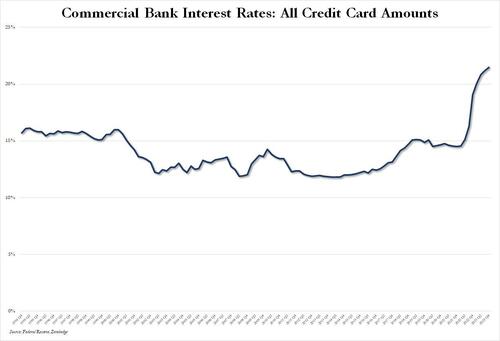

Last but not least, the slowdown in debt, and especially credit card debt, is hardly a surprise since as the Fed also reported that in Q4, the average rate across all commercial banks on all credit card amounts just hit a new record high of 21.47% despite the drop in rates observed in late 2023, which is a vivid reminders that while banks are happy to hike credit card rates, they rarely if ever cut them.

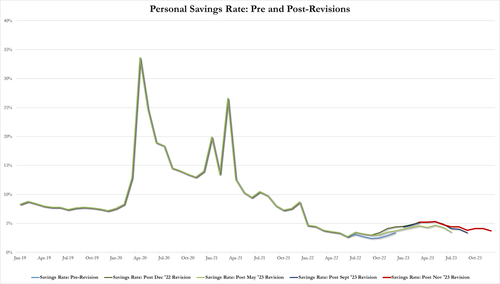

And with consumers increasingly reluctant to max out their credit cards due to record high rates, at a time when the personal savings rate in the US has collapsed from over 5% to 3.7% - the lowest since 2022 - in just a few months...

... it is now only a matter of time before US GDP prints deep negative now that that pillar supporting 70% of the US economy, consumer purchases, is about to crack... or it would if it wasn't an election year and every single economic data point is now gamed and politicized BS.

https://ift.tt/toPCqM8

from ZeroHedge News https://ift.tt/toPCqM8

via IFTTT

0 comments

Post a Comment