Mega-Cap Tech Melts-Up Moar Despite Powell Punch-In-The-Face & Regional Bank Rout

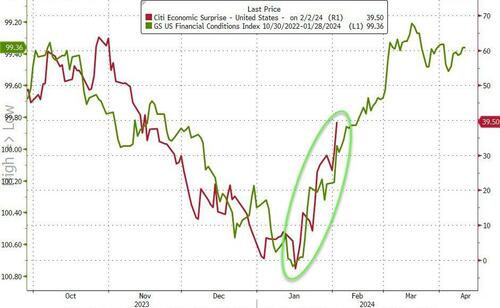

First things first, economic 'animal spirits' are back baby... and we know why (as we noted for months, the lagged effect of the massive loosening of financial conditions is now hitting and NOT doing The Fed's job)...

Source: Bloomberg

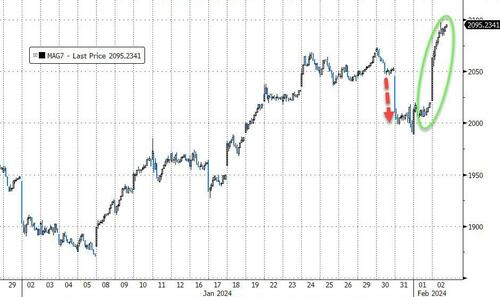

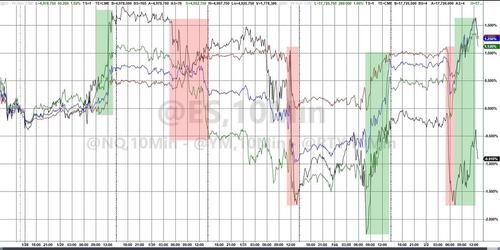

But, away from The Fed's Tyson-esque punch in the dove's face, it was all about 'The Magnificent 7' - the basket of 7 stocks soared to new highs this week...

Source: Bloomberg

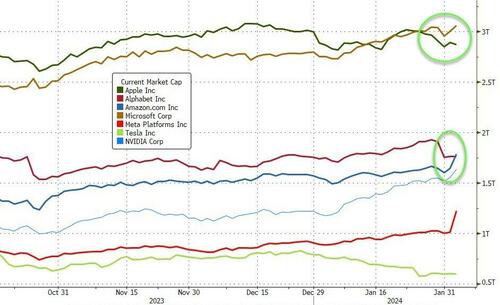

But the 7 is now 4...

Source: Bloomberg

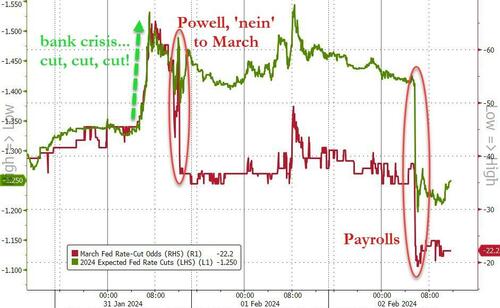

As job gains... and productivity gains... and AI... and stuff... trumped a hawkish Powell and anything-but-soft-landing/goldilocks jobs data - that sent rate-cut expectations lower...

Source: Bloomberg

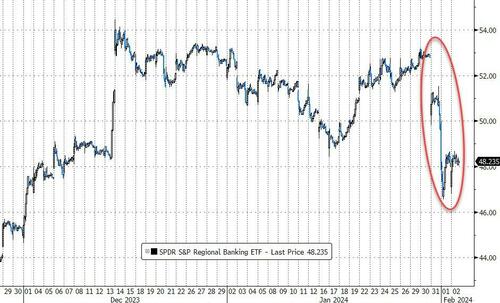

Meanwhile, the bank crisis is back as Regional banks suffered their worst week since May 2023...

Source: Bloomberg

As 'whack-a-mole' has begun again among the most levered...

Source: Bloomberg

But, away from the bank crisis (just ignore it, right), Apollo's Slok notes, there are several current themes in markets

1. Soft landing/Goldilocks priced in everywhere, but probability of hard or no landing is not zero

2. Supply of US Treasuries growing, and Treasury auctions are getting more and more attention

3. Extreme concentration in S&P 500 driven by growing AI bubble

4. China slowing driven by deflating housing bubble, falling exports, and demographic headwinds

5. Germany in trouble because of China slowdown, costly energy transition, and housing disinflation

By the end of this week, 1 is dead, 2 is serious, 3 is worse, 4 remains a problem, and 5 is even uglier.

But none of that matters to tech which soared for the 13th week in the last 14 as Nasdaq rallied 1.5% this week. Small Caps were only index of the majors to close red...

MSFT is now bigger than AAPL, and AMZN is now bigger than GOOGL...

Source: Bloomberg

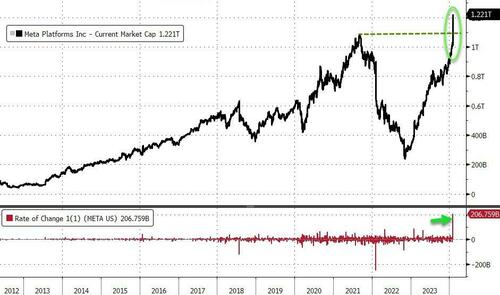

Today's gain for META is the biggest single-session market value addition, eclipsing the $190 billion gains made by AAPL and AMZN in 2022...

Source: Bloomberg

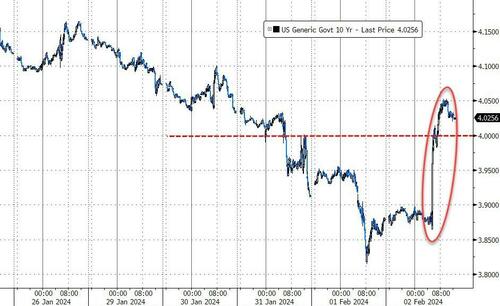

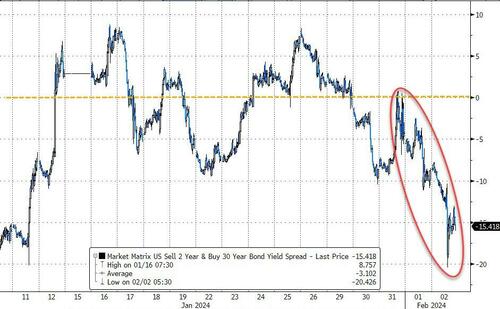

Treasury yields all exploded higher today, with the short-end underperforming (2Y +17bps, 30Y +10bps) leaving the 2Y the only part of the curve higher on the week...

Source: Bloomberg

With the 10Y Yield back above 4.00% by Friday's close...

Source: Bloomberg

And a big flattening of the yield cure (2s30s) back into inversion (erasing all the steepening from the Dec FOMC)...

Source: Bloomberg

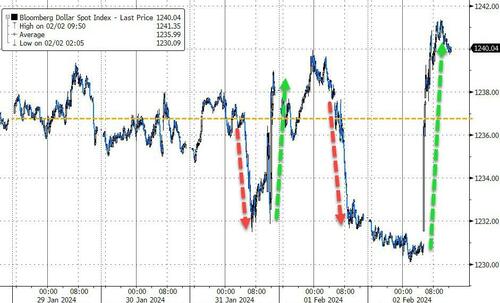

Thanks to a huge surge in the dollar today, the week ended green for the greenback...

Source: Bloomberg

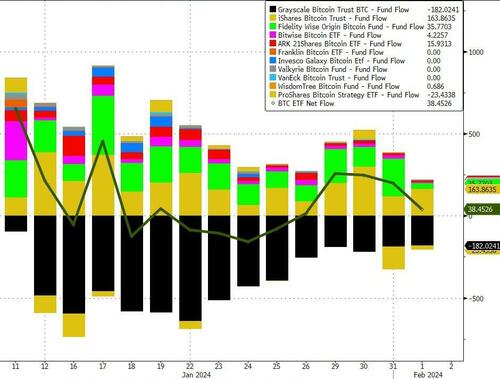

Bitcoin was higher on the week, chopping around the $43000 level...

Source: Bloomberg

Notably, Bitcoin ETFs have seen net inflows for the last 5 days...

Source: Bloomberg

Gold ended the week higher, despite a big drop today, erasing yesterday's gains...

Source: Bloomberg

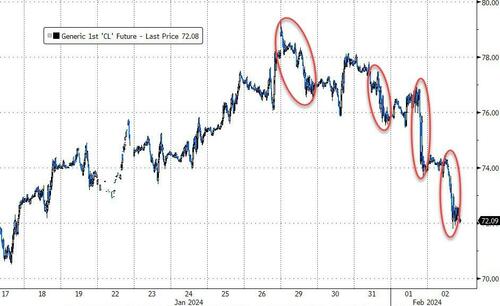

Oil prices ended the week lower (last week's outsized gain completely erased). This was the worst week for WTI since early October...

Source: Bloomberg

And finally, as one wise prognosticator noted.

Market is soaring because AI hasn't displaced any jobs.

Market is soaring because every tech company is betting AI will displace millions of jobs.

And so, 'you are here'...

Source: Bloomberg

...just remember, this didn't end well last time.

https://ift.tt/v7fHZ94

from ZeroHedge News https://ift.tt/v7fHZ94

via IFTTT

0 comments

Post a Comment