A Market Chart Or A Rorschach Test

By Peter Tchir of Academy Securities

A Market Chart or a Rorschach Test?

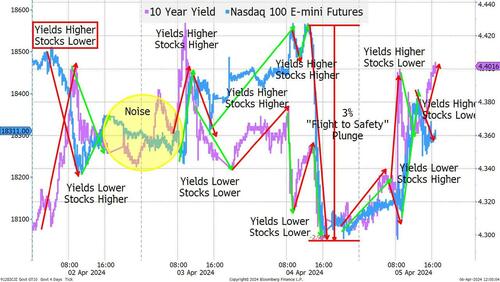

In one way, the week was quite simple. The S&P and Nasdaq dropped around 1% while 10-year yields popped 20 bps. Rate cut projections were slightly reduced and the likely start time was pushed back a touch. All seemingly “normal.” Then why the heck did we get a chart like this?

I’ve produced some ugly charts in the past, but this is in the running for the worst of all time. I thought about trying to fix it up, but then figured, after a week like this, why not go for the full Rorschach test?

There are three things that I see in this chart (I am a little bit scared about what a psychologist would make of my interpretation, but here goes):

-

There was no consistent narrative between stocks and bonds. At times we saw correlated moves, but then we saw just as many inversely correlated moves. Just like the Mag 7 is dead as a rule of thumb, the “bonds and stocks are correlated” rule of thumb might also need to be put away.

-

We had a legitimate “flight to safety” trade. The Nasdaq 100 was briefly down 3% from intraday high to intraday low (which had me feeling good about my fears that we could see 10% downside far more easily than 5% upside). The plunge in stock prices, accompanied by a rally in bonds, seemed to be spurred by fears about an imminent escalation by Iran. Since the initial fighting began last fall, this is the first time that I can really point to a moment where the geopolitical risk immediately and undoubtedly impacted markets significantly. I expect more geopolitical “shocks” in the coming days and weeks, so long as the market seems to by and large not be pricing in significant risk (the oil market is ahead of stocks and bonds on that). The rally in oil, which I expect to occur on any escalation or expansion, is why I don’t think that we will see a “true” flight to safety move, because I think that yields will come under inflationary pressure.

-

Liquidity is not deep. Whatever good mood I was in, after Thursday’s rapid decline, was undone. The day started fine, as overnight we reversed a little of Thursday’s move as nothing extraordinary happened with regards to Israel and Iran. Then payrolls beat the highest expectation (which I was leaning towards), and bond yields had the good sense to go higher (again, I think now that we’ve breached 4.4%, we go towards 4.6% on 10s). But stocks, after some early gyrations, decided to rally on the strength of the economy. Reasonable, but certainly bucking the theme that higher bond yields push stocks lower. At least that was how it worked until near the end of the day. From the trading on Thursday and Friday, with fairly large moves, I take away that there is very little depth to markets (and the day traders, 0DTE options, etc. are all amplifying moves).

That is what I get out of that messy chart!

What I Learned Last Week

I learned a few things:

-

Geopolitical Risk may be back, and it isn’t being priced in. See Saturday’s SITREP – Iran Prepares to Retaliate.

-

The economy, at least based on jobs, has the potential to surprise to the upside.

-

Earthquakes, even “minor” ones, are really disturbing!

-

Guest Hosting TV is difficult.

-

The U.S. seems to believe that we can come to some resolution with China on trade, where we get the trade and benefits that we want, while limiting their access to high tech and other things that we don’t want them to have. I just don’t see that happening as discussed Thursday on Bloomberg TV.

-

There seem to be far more bond bulls than bears, as we breach 4.4% (good news as a contrarian).

Bottom Line

I am still nervous about equity risk, and still doubt that we will get any overall rotation (Russell did far worse than the S&P 500 this week). Energy is my favorite sector as I think that there are many tailwinds, plus you get the geopolitical tail risk for “almost” free (since I don’t think much is being priced in yet).

I think that the 10-year is now moving into the 4.4% to 4.6% range. Maybe higher as the bulk of the move to this level has been due to diminished rate cut expectations, rather than an increase in risk premium. That should be coming, and I would like to see 2s vs 10s back to -20 or even closer to 0 than that.

Credit will likely remain dull. No obvious catalysts for a big widening in spreads, but it is also difficult to see a reason for anything more than a small pullback in spreads. I do owe readers a “rotation” report on private credit, which got delayed with the craziness of this week.

As Seargent Esterhaus liked to say, “let’s be careful out there” as the risks are mounting, and we’ve shown how susceptible we can be to them. On that note, please see the link to register for our Academy Securities Geopolitical and Macro Strategy Webinar on Tuesday April 9th at 1pm ET.

https://ift.tt/Xnq4V03

from ZeroHedge News https://ift.tt/Xnq4V03

via IFTTT

0 comments

Post a Comment