US Domestic Deposits Tumble $60BN As Small Bank Loan Volumes Shrank Most Since SVB

Money-market funds saw a small outflow last week (surprisingly small given how close to Tax-Day we are), leaving them still near record highs over $6 Trillion (and the trend of increased deposits at banks has been accelerating)...

Source: Bloomberg

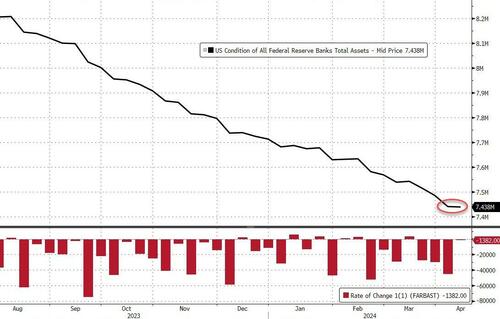

Interestingly, amid all the talk of tapering QT, The Fed balance sheet was basically unchanged last week (-$1.4BN)...

Source: Bloomberg

...as The Fed's (now expired) bank bailout facility saw another (the fourth) weekly decline (-$4BN), erasing much of the 'arb-driven flows' (blue shaded region) but leaving most of the 'oh-shit-we-have-hole-the-size-of-France-in-our-balance-sheet' flows still there ($126BN!!)....

Source: Bloomberg

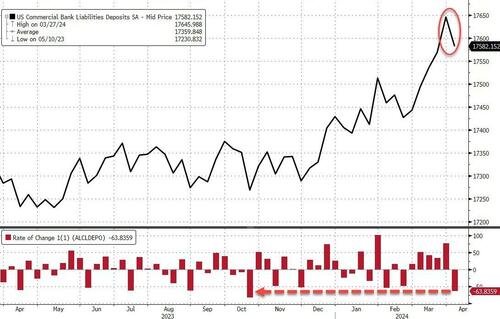

Meanwhile, at those banks, total seasonally-adjusted deposits fell by $63.8BN last week - after rising for five straight weeks. That was the biggest drop since October.

Source: Bloomberg

Now before you start on "well, this is tax-driven", we remind you these are 'seasonally-adjusted' data - so unless Tax Day changed suddenly, this is a notable decline (also remember this data is lagged by a week)...

Source: Bloomberg

On a non-seasonally-adjusted basis, deposits rose by a modest $16BN to their highest level since before the SVB crisis...

Source: Bloomberg

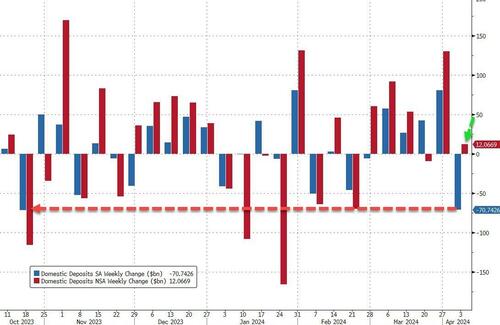

Excluding foreign deposits, Domestic deposits fell $70BN SA last week - the biggest weekly drop since October (Large banks -$67BN, Small banks -$3BN) while on an NSA basis, domestic deposits rose $12BN (Large banks -$6.8BN, Small banks +$18.8BN)...

Source: Bloomberg

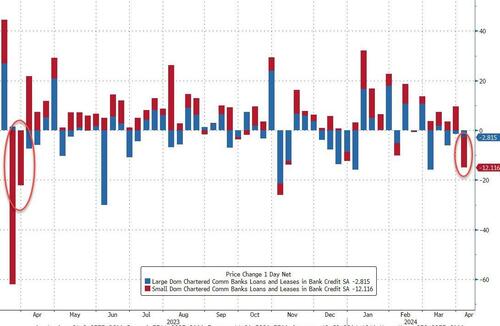

Loan volumes shrank significantly last week with Small Banks seeing volumes tumble $12BN - the most since the SVB crisis. Large banks also saw loan volumes shrink, by $2.8BN...

Source: Bloomberg

Bank reserves picked up last week - after diving the prior week - but still remain hugely divergent from US equity market cap...

Source: Bloomberg

Again we ask, which happens first? Banks start piling reserves back in or stocks collapse?

https://ift.tt/4CeUsDI

from ZeroHedge News https://ift.tt/4CeUsDI

via IFTTT

0 comments

Post a Comment