Gold Hits New Record Highs, Bonds Battered As Inflation Fears Reignite

The macro picture was not great for the doves today...

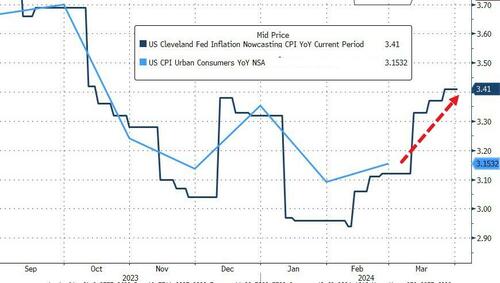

On a day dominated by the illiquidity of absent European markets still celebrating Easter, the Manufacturing survey headline data was mixed (ISM turned positve) but the prices components were very much not mixed - both signaling soaring costs and prices being passed on to consumers at the fastest pace in 18 months. As an aside, The Cleveland Fed's CPI NOWCAST is starting to accelerate meaningfully once again...

Source: Bloomberg

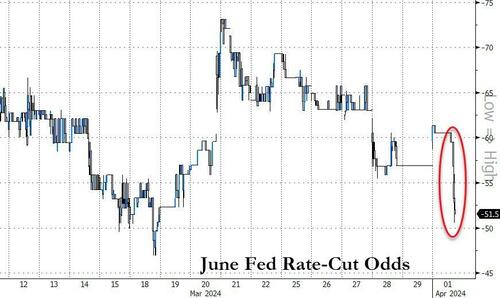

The one redeeming 'bad news' datapoint was an unexpected plunge in construction-spending (its second monthly decline in a row and the biggest MoM drop since Oct 2022) but the market was focused on the inflationary aspect of PMIs, sending June rate-cut odds back below 50%...

Source: Bloomberg

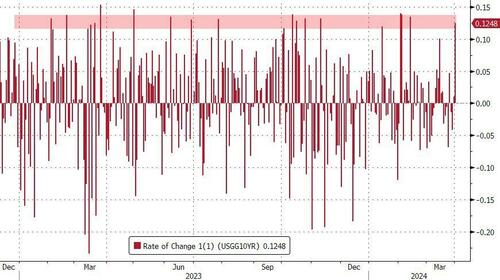

Bonds were battered today - again amid an illiquid market - with yields up 10-12bps

Source: Bloomberg

...that was among the worst (upward) yield moves for the long-end in the last 18 months...

Source: Bloomberg

...Pushing yields back up to the highs of the year...

Source: Bloomberg

And the higher yields actually hurt stocks (admittedly only a bit) for a change...

Source: Bloomberg

...with Small Caps and The Dow the worst performers. Futures all opened with decent upside on Sunday night (closed since Thursday pre-PCE), but only Nasdaq managed to cling to very modestly green on the day. A little late-day meltup put a little lipstiick on another wise pig of a day for most stocks...

Before we leave equity-land, we note that DJT took a tumble today, erasing its post-SPAC gains...

The dollar broke out of its recent range back near the highs of the year...

Source: Bloomberg

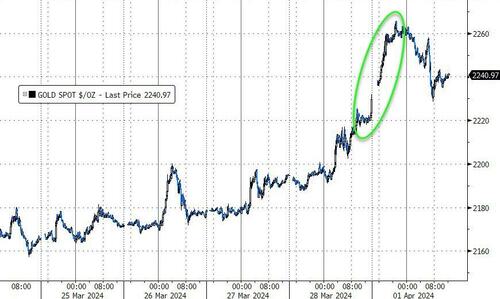

And while the dollar was stronger, gold managed to hold gains on the day, spiking to a new record high at $2265...

Source: Bloomberg

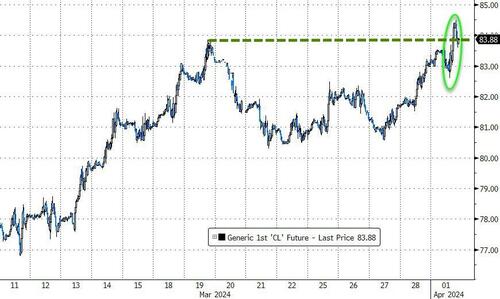

Israeli strikes in Iran and more drone strikes prompted oil prices to jump to new cycle highs (WTI $84.50) as geopolitical risk premia rise (highest since Oct 2023)...

Source: Bloomberg

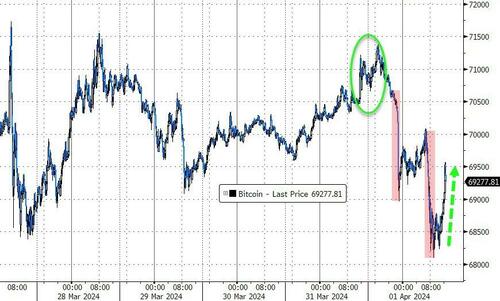

Bitcoin had another wild ride, surging up near record highs overnight, sliding intraday as Asia closed and as US equity markets opened, then bouncing back off $68,000...

Source: Bloomberg

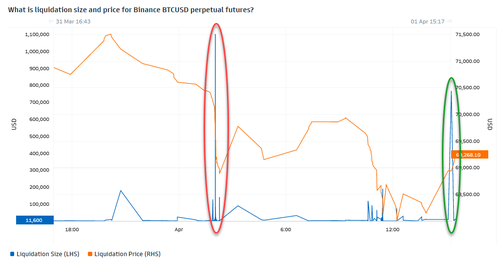

Perpetual futures were once again the driver of the downswsings (as we likely see the continued trend of dump in futs and pump in ETFs)...

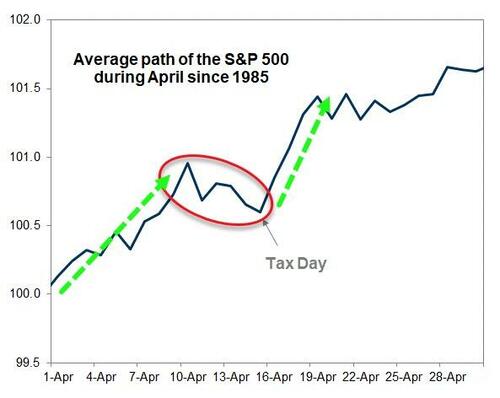

Finally, it's worth noting US Tax day is April 15th. As Goldman's John Flood noted earlier, seasonality will likely come into play here as the retail community tends to sell stocks into 4/15 to raise cash for these payments...

Source: Goldman Sachs

Post payments we have historically seen a bullish trend develop... So BTFD today, STFR on April 9th, then BTFD on April 17th...

https://ift.tt/42CnLd3

from ZeroHedge News https://ift.tt/42CnLd3

via IFTTT

0 comments

Post a Comment