Gold Hits Another New Record High But Bonds, Stocks, & Bitcoin Battered On 'Good' News

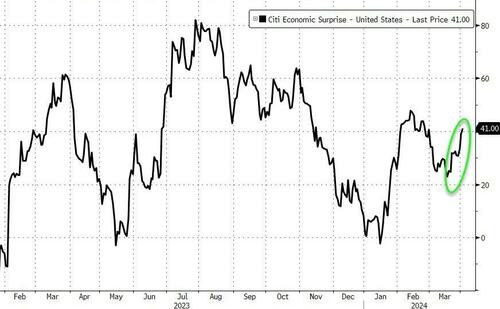

Mixed (well good) data this morning - in-line JOLTS (labor market shows no signs of cracking), stronger than expected Factory orders, but weaker than expected durable goods (final) and shipments data actually shrank in Feb (bad for GDP) - had no major impact on rate-cut expectations (which remain low - 67bps total cuts in 2024, 50% odds of June cut). US macro surprise data is picking up (and overnight saw European PMIs better than expected)...

Source: Bloomberg

But Fed's Mester sung from the same hymn-sheet as Waller and Bostic, saying that The Fed needs more time to make the 'cut' call:

“But I need to see more data to raise my confidence,” Mester said Tuesday in prepared remarks for an event at the Cleveland Fed.

“Some further monthly readings will give us a better sense of whether the disinflation process is stalling out or whether the start-of-the-year readings reflect a temporary detour on the downward path back to price stability.”

And then she explained her view of Fed asymmetry:

“At this point, I think the bigger risk would be to begin reducing the funds rate too early,” Mester said.

“And with labor markets and economic growth both being very solid, we do not need to take that risk.”

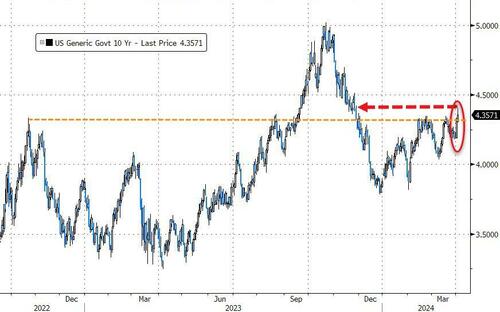

And while Mester's comments did not seem to be an immediate catalyst, yields kept rising overnight (on stronger EU PMIs?), especially at the long-end (2Y unch, 30Y +6bps) extending yesterday's bloodbathery...

Source: Bloomberg

The 10Y broke above its YTD highs to its highest since Nov 2023 (2nd biggest 2-day jump in yields since October)

Source: Bloomberg

...and steepening the yield curve (2s30s) significantly...

Source: Bloomberg

And stocks appeared to run out of momentum again overnight as yields rose during the European session with Small Caps extending losses in the US session. The last hour saw a mini buying spree which put a little lipstick on the day's pig. Small Caps were the biggest losers...

'Most Shorted' stocks were clubbed like a baby seal for the second day in a row... the biggest 2-day drop in the shortest stocks since November...

Source: Bloomberg

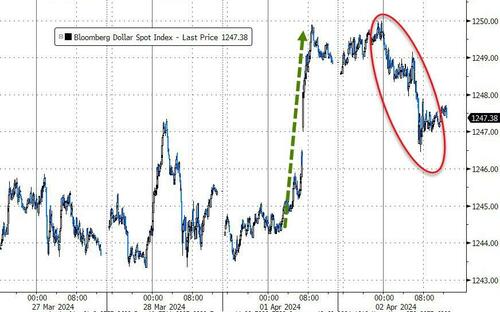

The dollar tumbled, erasing most of yesterday's gains...

Source: Bloomberg

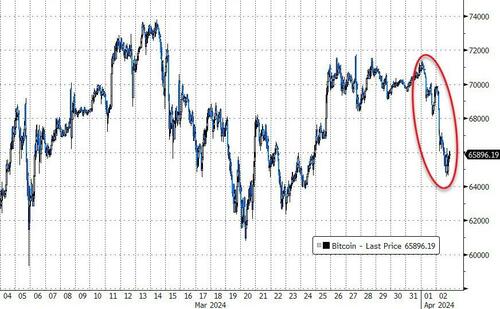

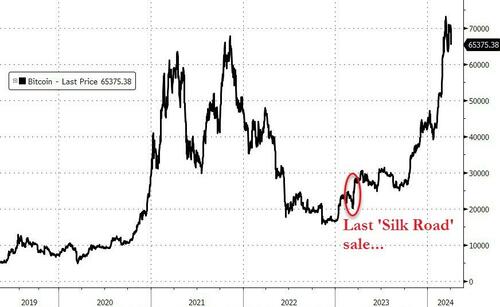

Bitcoin took a big tumble today, with reports that the alleged 'Silk Road' wallet moved 30,175 bitcoins to a Coinbase wallet (perhaps priming for a sale).

Source: Bloomberg

We note that the last time this wallet - in March 2023 - was a serious BTFD opportunity...

Source: Bloomberg

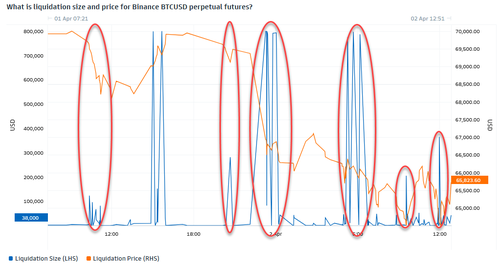

Also of note, the players in the perp futs market have been very active the last couple of days (all but one of the heavy volume surges were sells)...

Ethereum was worse... taking the ETH/BTC ratio down to its lowest since April 2021...

Source: Bloomberg

But while one 'alternative' currency is tumbling, another (older one) is rallying to new record highs... Spot Gold hit $2277 intraday - a new record high....

Source: Bloomberg

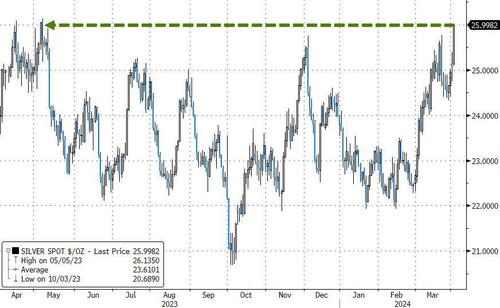

For a change, Silver outperformed gold today, with spot prices surging up to $26 for the first time since May 2023...

Source: Bloomberg

And Black Gold also surged up above $85 (WTI) - the highest since Oct 2023...

Source: Bloomberg

Finally, as growth expectations have stagnated somewhat over the past year (though the last week has seen some positive surprises), Citi's inflation-suprise index has resurged back to its highest since Dec 2022...

Source: Bloomberg

...we love the smell of stagflation in the morning... and gold is rising along with Fed policy-error-risk.

https://ift.tt/r1Uo9Kd

from ZeroHedge News https://ift.tt/r1Uo9Kd

via IFTTT

0 comments

Post a Comment