China's August Rare Earth Exports To US Jump Amid Threat Of Export Ban

According to a new report from Reuters, China's exports of rare-earth magnets to the US in August jumped to the highest level in years, pointing to US firms scrambling to build stockpiles as China, the biggest rare-earth metals and alloys producer in the world, could slash flows of the minerals if the trade war continues to escalate into 2020.

New data from the General Administration of Customs of the People's Republic of China shows shipments of rare-earth magnets to the US rose 1.2% MoM to 452 tons. Exports to the US were 6.2% more than last year, and the highest monthly total since Jan. 2017.

Rare-earth exports to the US have been increasing since President Xi Jinping visited a magnet factory in May, with January to August shipments to the US up nearly 24% YoY to 2,984 tons.

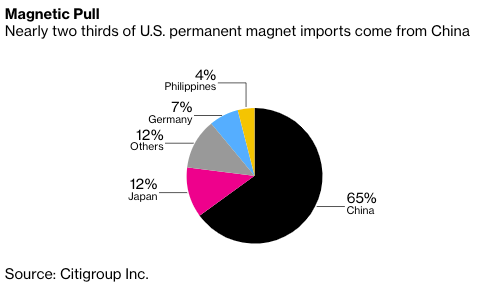

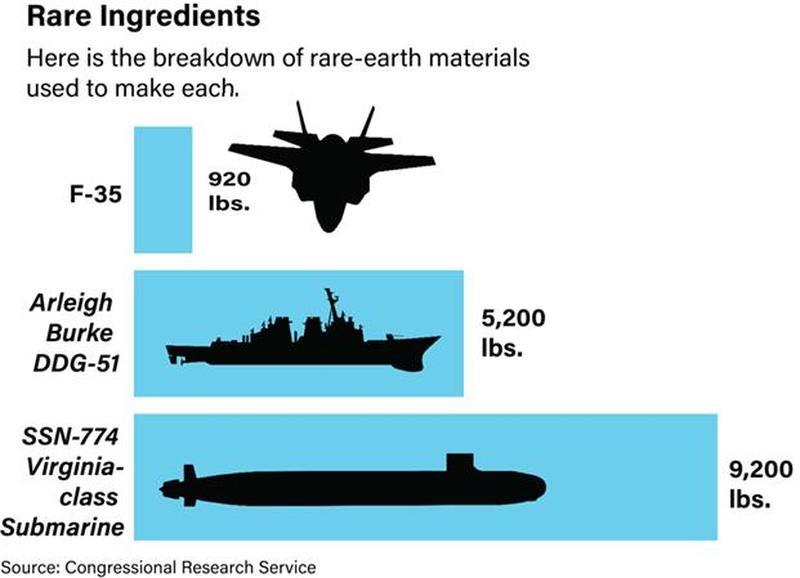

China accounts for 90% of the global production of rare-earth magnets. The minerals are used in everything from vacuum cleaners to automobiles and fighter jets, which suggests many US firms could be affected if China decides to block shipments of rare-earth magnets.

Bloomberg sourced a recent Citigroup report that said a Chinese ban on magnet exports to the US would become "manageable if ex-China processing gets built out swiftly."

Citigroup added: "The impact gets much more serious were a ban to extend into rare-earth fabricated products -- especially magnets and motors, or through third-party suppliers."

China has subliminally signaled its dominance of global rare-earths, could introduce a ban on exports to the US if a no-deal scenario plays out next month.

Based on what I know, China is seriously considering restricting rare earth exports to the US. China may also take other countermeasures in the future.

— Hu Xijin 胡锡进 (@HuXijin_GT) May 28, 2019

Recently, Commerce Secretary Wilbur Ross said that the US had declared "unprecedented action" to ensure rare-earth supply.

"The industrial value add at risk if this supply chain gets disrupted is tough to quantify but likely runs multiples higher," Citigroup said. "While Japan and others ex-China presumably have spare magnet capacity to divert more supply to the US, conversations with experts suggest the infrastructure and technical knowledge to respond quickly is very limited in scale."

Last month, we noted how Ellen Lord, the Under Secretary of Defense for Acquisition and Sustainment, recently met with Australian counterparts to quickly develop rare-earth mineral plants in Australia.

Lord's meeting comes after a series of threats made by the Chinese to block rare-earth mineral exports to the US, about 17 minerals in total, mostly used in fifth-generation fighter jets, M1 Abrams tank armor, radars, lasers, and engines.

She said the Pentagon is reviewing several options to partner on rare-earth projects, adding "one of the highest potential avenues is to work with Australia."

An Australian Defence spokeswoman told Reuters that discussions with the US on rare-earth minerals started in 2018 were continuing:

"Continuity and guarantee of supply of rare-earths and critical minerals is vital to a range of sectors, including defense. Cooperation with international partners is integral to this effort," the spokeswoman said.

To derisk and decrease reliance on China, the Pentagon also held talks with Canada and countries within Africa to develop rare-earth reserves.

But at the moment, surging exports of Chinese rare-earth magnets to the US exposes just how vulnerable the US is if China cuts off supply.

So Mr. President, do you really hold all the cards in the trade war?

https://ift.tt/2lE1Hbu

from ZeroHedge News https://ift.tt/2lE1Hbu

via IFTTT

0 comments

Post a Comment