Softbank Planning To Quadruple-Down On WeWork, FT

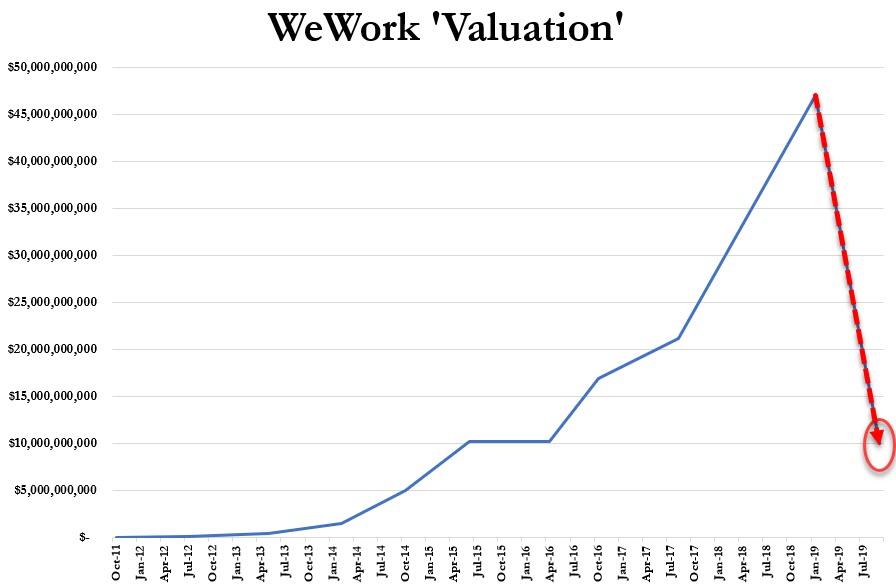

With billions already ploughed into the money-losing real estate company, and a combination of massive cash-burn and a $6bn loan contingent on its IPO, Softbank's Masa-san appears cornered into quadrupling down on the giant tech company's investment in Adam Neumann's 'creation'.

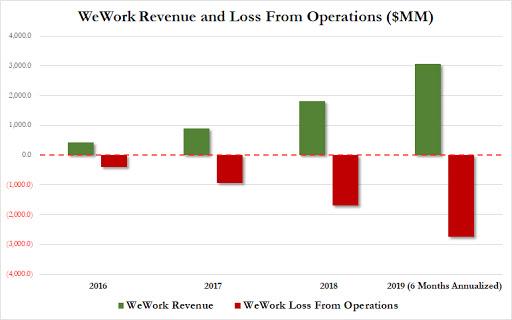

As a reminder, for every dollar WeWork earned in revenue last year, it lost roughly two.

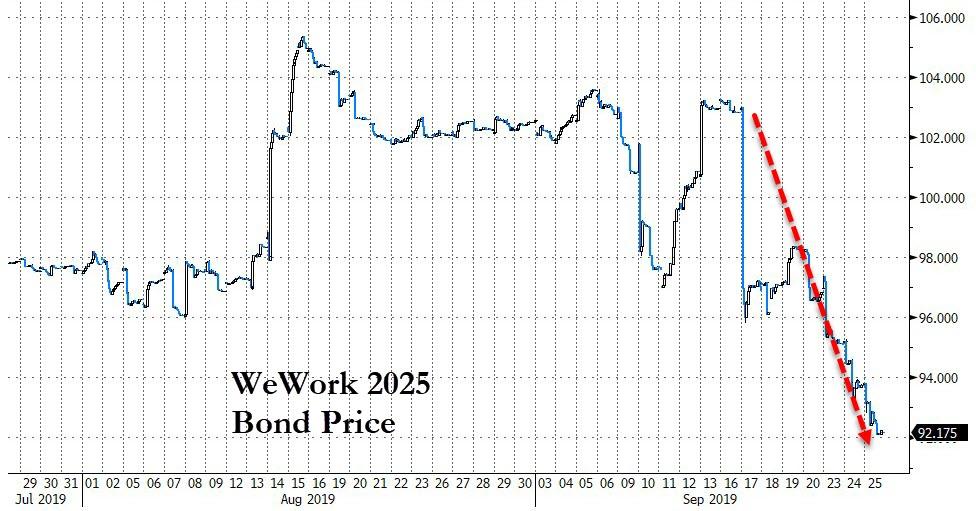

And as its IPO-contingent funding evaporates, bond market investors are getting anxious...

Source: Bloomberg

To the point where WeWork is riskier than Tesla, Ukraine, and South Africa...

Source: Bloomberg

However, there is hope. As The FT reports, SoftBank is in talks with WeWork to increase a $1.5bn investment the Japanese telecoms-to-technology group has agreed to put into the office leasing company next year, according to people briefed on the matter.

A recut deal would see SoftBank invest at least $2.5bn, but would reduce the price per share at which it acquires WeWork stock, giving it a larger stake in the lossmaking property group, the people said.

Critically, the equity investment from SoftBank could unlock additional financing options for WeWork, without which it could quite clearly be a zero (the group burnt through more than $2.5bn of cash in the first half of 2019).

It appears this future investment would be the fourth 10-figure money drop:

-

Aug 2017 - $1.3bn

-

Jan 2019 - $1bn

-

Jan 2019 - $5bn

-

Apr 2020 - $2.5bn

But who's counting?

https://ift.tt/2mGSy1P

from ZeroHedge News https://ift.tt/2mGSy1P

via IFTTT

0 comments

Post a Comment