Protests Break Out As Chinese Cities Drown Under $10 Trillion In Debt, Fail To Make Payments

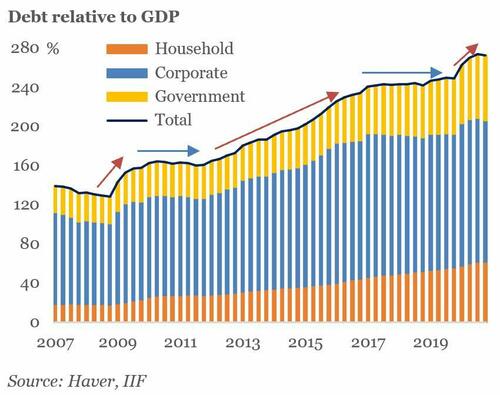

The last time we checked in on China's debt, the IIF calculated that it was just shy of 300% its GDP, a record high, and more than double where it was a decade ago. So to say that China has a debt problem isn't exactly a surprise.

What may surprise, however, is that as China has been busy trying to sweep all this massive, growth-crushing debt under the rug (yes, there is a reason why the Politburo's latest GDP target was a disappoint 5% and it begins with "d" and ends with "ebt"), it is starting to run out of hiding spaces and as the WSJ reports overnight, China's economy is "being weighed down by the colossal debts of its local governments, which swelled during the pandemic and are starting to come to a head" and nowhere is this more visible than at the city level.

Xi Jinping’s now defunct zero-Covid campaign buried cities under billions of dollars in unplanned expenditures for mass testing and lockdowns. At the same time, Beijing's crackdown on excessive property-market leverage led to a sharp drop in land sales, depriving cities of one of their biggest revenue sources.

As a result, the WSJ notes that according to S&P Global calculations, two-thirds of local governments are now in danger of breaching unofficial debt thresholds set by Beijing to signify severe funding stress, with their outstanding debt exceeding 120% of income last year.

About a third of China’s major cities are struggling to pay just the interest on debt they owe, according to a survey by Rhodium Group, a New York-based research firm. In one extreme case, in Lanzhou, the capital city of Gansu province, interest payments were the equivalent of 74% of fiscal revenue in 2021. This is rapidly approaching the infamous "Minsky Moment" now that debt has moved beyond "mere" Ponzi financing levels.

Making matters worse, big chunks of debt are coming due soon: according to research by Lianhe Ratings Global, a subsidiary of a large domestic rating agency, about 84% of the $84.2 billion in offshore debt owed by local government financing vehicles will mature between this year and 2025.

Still, as the WSJ, the main concern isn’t that cities will default and trigger a financial crisis - although that can certainly happen assuming Beijing let's them fail, which is unlikely - it is that cities will have to keep cutting spending, delay investments or take other actions to keep creditors at bay, impairing growth for years.

In Zhengzhou, home to a Foxconn assembly site for Apple’s iPhones, bus drivers say their salaries were cut in 2021 and haven’t been restored. Street sweepers report to work even though some say they haven’t been paid in months.

“Our salary isn’t high. Why does the country even owe us this kind of money?” said Xu Aiqiang, 67, as she swept a park on the west side of Zhengzhou. She said her company, a city contractor, hasn’t paid her monthly salary of around $320 for seven months. “Even if they aren’t paying me, I’m still keeping my areas clean, so I can see it for myself.”

At the same time, teachers in the southern megacity of Shenzhen are complaining on social media about sharp cuts in bonuses, an important pay component. In January, a heating company in the rust belt city of Hegang in northeastern China told residents to prepare for a cutoff in heat after the company failed to get subsidies from the local government.

As a result of these spending cuts, protests have broken out in recent weeks in cities such as Wuhan (best known for being the site of the infamous Covid lab leak), Dalian and Guangzhou over public healthcare system overhauls that have included cuts in medical benefits due in part to strained government finances.

In response to this growing social unrest, on Sunday, at annual meetings of China’s legislature in Beijing, Chinese policy makers offered only modest support for local governments, signaling they want to promote fiscal discipline. While fiscal transfers from central authorities to local governments, which Beijing provides annually, are set to increase to around $1.5 trillion this year, the 3.6% increase in 2023 is a far cry from last year’s 18% increase. Municipalities will be allowed to issue around $550 billion worth of local government special-purpose bonds this year, down from last year’s actual issuance of $580 billion.

A few days earlier, Chinese Finance Minister Liu Kun played down financial strains faced by local officials, saying on Wednesday that the situation remained mostly stable last year and is expected to further improve this year as the economy recovers.

The good news is that Beijing still has plenty of fiscal room to intervene in individual cases if necessary to prevent major defaults, according to economists. Local governments can also sell off assets, if they can find buyers. However, the central government’s balance sheet isn’t strong enough to bail out every contingent liability in China, wrote Nicholas Borst, director of China research at Seafarer Capital Partners, a San Francisco-based investment firm, in a research paper on local debt released this month.

“Moreover, a one-off series of bailouts would increase moral hazards and not change the underlying dynamics that led to the problem in the first place,” he wrote, encapsulating the problem facing not just China but every western central bank.

That means local residents—especially civil servants—may see more salary cuts and reduced services, as well as fewer infrastructure investments to power growth and employment.

Similar to Europe's period of austerity, “the real cost of the debt won’t be a financial crisis but it’ll lead to many years of struggling to allocate the cost of that debt,” said Michael Pettis, a finance professor at Peking University.

Officially, China’s 31 provincial governments owe around $5.1 trillion, including bonds held by local and foreign investors. However, those figures don’t include a variety of off-balance-sheet debts typically raised through so-called local government financing vehicles, which have proliferated in recent years to fund infrastructure and other spending obligations. The debts from those vehicles are expected to reach nearly $10 trillion this year, according to the International Monetary Fund.

As the WSJ puts it in context, the debt from those vehicles is more than the combined government debt of Germany, France and Italy as of the third quarter of 2022.

Interest on the debts crowds out other spending. The Rhodium Group research found that interest costs accounted for at least a fifth of fiscal resources in 25 Chinese cities in 2021. Anything over 10% — the case in more than 100 cities—leads to “meaningful constraints,” Rhodium said.

As discussed before, local governments’ debt problems have been building since the global financial crisis. Many became addicted to launching projects—which juiced growth—and selling land and borrowing more to pay for all of it. In addition, China’s local governments must shoulder most of the costs of services such as public education and healthcare. Beijing restricts how they can raise money, compelling them to send most of what they collect in taxes to the central government, while limiting what they can borrow.

Zhengzhou, with nearly 13 million residents, has healthier finances than many other cities. Its streets are vibrant, with residents crowding eateries. Yet in the past three years, Zhengzhou’s fiscal revenue dropped by 14% on average each year while total debt grew by 14% annually. Its debt-to-fiscal income ratio rose to 178% in 2022, from 75% in 2019.

Another street sweeper told The Wall Street Journal he hasn’t been paid by his company, also a city contractor, since he joined nearly two months ago. Another two months’ worth of salary remains unpaid from his last job, at a local sanitation department. He said he was told the district government hasn’t sent his company the money to pay his salary, equivalent to around $370 a month.

“Sooner or later they’ll have to pay me,” he said as he kept picking up discarded tissue paper and dried leaves. He relies on his son, a truck driver, to assist him financially, he said.

In late February, a bus company in Shangqiu, a city about two hours’ drive from Zhengzhou with around 7 million residents, said it would suspend bus service starting March 1 due to a “lack of sufficient fiscal support” along with other factors. The decision was retracted after Shangqiu’s government apologized for “negative social impact.”

Similar scenarios have played out in at least three other cities, according to local media.

While some analysts believe the odds of a financial system meltdown are low, stress could spread if more local borrowers struggle to repay loans on time. In December, Zunyi Road and Bridge Engineering Construction Group, a local government financing vehicle based in Guizhou, one of China’s most indebted provinces, struck a deal with banks to get another 20 years to repay loans worth more than $2 billion. The deal raised fears that other banks could have to bear restructuring costs.

At the end of the day, the concern is that Beijing is unwilling to make changes that could put local government finances on a more stable footing, such as implementing a property tax to raise more funds, because doing so would be politically unpopular and could undermine central authorities’ control over localities. It would also lead to even more social upheaval and protests: the one thing Beijing is truly scared of.

https://ift.tt/otlzj0V

from ZeroHedge News https://ift.tt/otlzj0V

via IFTTT

0 comments

Post a Comment