Tverberg: When The Economy Gets Squeezed By Too Little Energy

Authored by Gail Tverberg via Our Finite World blog,

Most people have a simple, but wrong, idea about how the world economy will respond to “not enough energy to go around.” They expect that oil prices will rise. With these higher prices, producers will be able to extract more fossil fuels so the system can go on as before. They also believe that wind turbines, solar panels and other so-called renewables can be made with these fossil fuels, perhaps extending the life of the system further.

The insight people tend to miss is the fact that the world’s economy is a physics-based, self-organizing system. Such economies grow for many years, but ultimately, they collapse. The underlying problem is that the population tends to grow too rapidly relative to the energy supplies necessary to support that population. History shows that such collapses take place over a period of years. The question becomes: What happens to an economy beginning its path toward full collapse?

One of the major uses for fossil fuel energy is to add complexity to the system. For example, roads, electricity transmission lines, and long-distance trade are forms of complexity that can be added to the economy using fossil fuels.

Figure 1. Chart by author pointing out that energy consumption and complexity are complementary. They operate in different directions. Complexity, itself, requires energy consumption, but its energy consumption is difficult to measure.

When energy per capita falls, it becomes increasingly difficult to maintain the complexity that has been put in place. It becomes too expensive to properly maintain roads, electrical services become increasingly intermittent, and trade is reduced. Long waits for replacement parts become common. These little problems build on one another to become bigger problems. Eventually, major parts of the world’s economy start failing completely.

When people forecast ever-rising energy prices, they miss the fact that market fossil fuel prices consider both oil producers and consumers. From the producer’s point of view, the price for oil needs to be high enough that new oil fields can be profitably developed. From the consumer’s point of view, the price of oil needs to be sufficiently low that food and other goods manufactured using oil products are affordable. In practice, oil prices tend to rise and fall, and rise again. On average, they don’t satisfy either the oil producers or the consumers. This dynamic tends to push the economy downward.

There are many other changes, as well, as fossil fuel energy per capita falls. Without enough energy products to go around, conflict tends to rise. Economic growth slows and turns to economic contraction, creating huge strains for the financial system. In this post, I will try to explain a few of the issues involved.

[1] What is complexity?

Complexity is anything that gives structure or organization to the overall economic system. It includes any form of government or laws. The educational system is part of complexity. International trade is part of complexity. The financial system, with its money and debt, is part of complexity. The electrical system, with all its transmission needs, is part of complexity. Roads, railroads, and pipelines are part of complexity. The internet system and cloud storage are part of complexity.

Wind turbines and solar panels are only possible because of complexity and the availability of fossil fuels. Storage systems for electricity, food, and fossil fuels are all part of complexity.

With all this complexity, plus the energy needed to support the complexity, the economy is structured in a very different way than it would be without fossil fuels. For example, without fossil fuels, a high percentage of workers would make a living by performing subsistence agriculture. Complexity, together with fossil fuels, allows the wide range of occupations that are available today.

[2] The big danger, as energy consumption per capita falls, is that the economy will start losing complexity. In fact, there is some evidence that loss of complexity has already begun.

In my most recent post, I mentioned that Professor Joseph Tainter, author of the book, The Collapse of Complex Societies, says that when energy supplies are inadequate, the resulting economic system will need to simplify–in other words, lose some of its complexity. In fact, we can see that such loss of complexity started happening as early as the Great Recession in 2008-2009.

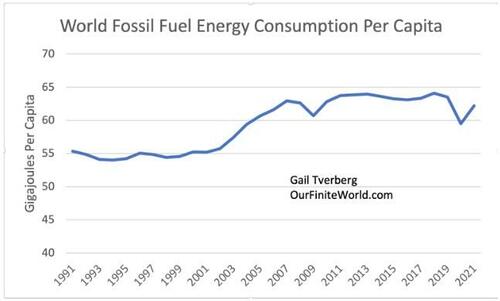

The world was on a fossil fuel energy consumption per capita plateau between 2007 and 2019. It now seems to be in danger of falling below this level. It fell in 2020, and only partially rebounded in 2021. When it tried to rebound further in 2022, it hit high price limits, reducing demand.

Figure 2. Fossil fuel energy consumption per capita based on data of BP’s 2022 Statistical Review of World Energy.

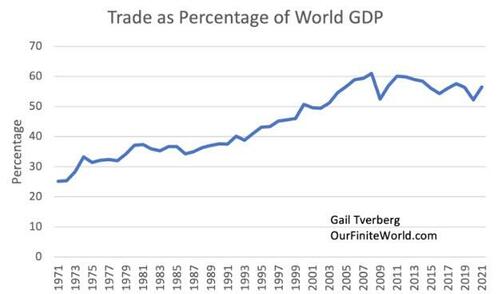

There was a big dip in energy consumption per capita in 2008-2009 when the economy encountered the Great Recession. If we compare Figure 2 and Figure 3, we see that the big drop in energy consumption is matched by a big drop in trade as a percentage of GDP. In fact, the drop in trade after the 2008-2009 recession never rebounded to the former level.

Figure 3. Trade as a percentage of world GDP, based on data of the World Bank.

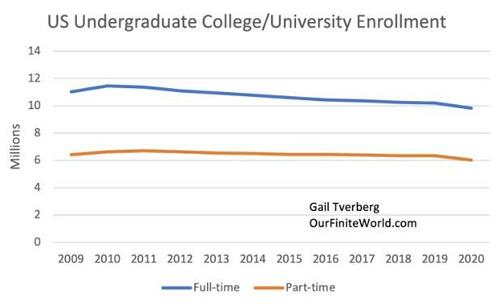

Another type of loss of complexity involves the drop in the recent number of college students. The number of students was rising rapidly between 1950 and 2010, so the downward trend represents a significant shift.

Figure 4. Total number of US full-time and part-time undergraduate college and university students, according to the National Center for Education Statistics.

The shutdowns of 2020 added further shifts toward less complexity. Broken supply lines became more of a problem. Empty shelves in stores became common, as did long waits for newly ordered appliances and replacement parts for cars. People stopped buying as many fancy clothes. Brick and mortar stores did less well financially. In person conferences became less popular.

We know that, in the past, economies that collapsed lost complexity. In some cases, tax revenue fell too low for governments to maintain their programs. Citizens became terribly unhappy with the poor level of government services being provided, and they overthrew the governmental system.

The US Department of Energy states that it will be necessary to double or triple the size of the US electric grid to accommodate the proposed level of clean energy, including EVs, by 2050. This is, of course, a kind of complexity. If we are already having difficulty with maintaining complexity, how do we expect to double or triple the size of the US electric grid? The rest of the world would likely need such an upgrade, as well. A huge increase in fossil fuel energy, as well as complexity, would be required.

[3] The world’s economy is a physics-based system, called a dissipative structure.

Energy products of the right kinds are needed to make goods and services. With shrinking per capita energy, there will likely not be enough goods and services produced to maintain consumption at the level citizens are used to. Without enough goods and services to go around, conflict tends to grow.

Instead of growing and experiencing economies of scale, businesses will find that they need to shrink back. This makes it difficult to repay debt with interest, among other things. Governments will likely need to cut back on programs. Some governmental organizations may fail completely.

To a significant extent, how these changes happen is related to the maximum power principle, postulated by ecologist Howard T. Odum. Even when some inputs are inadequate, self-organizing ecosystems try to maintain themselves, as best possible, with the reduced supplies. Odum said, “During self-organization, system designs develop and prevail that maximize power intake, energy transformation, and those uses that reinforce production and efficiency.” As I see the situation, the self-organizing economy tends to favor the parts of the economy that can best handle the energy shortfall that will be taking place.

In Sections [4], [5], and [6], we will see that this methodology seems to lead to a situation in which competition leads to different parts of the economy (energy producers and energy consumers) being alternately disadvantaged. This approach leads to a situation in which the human population declines more slowly than in either of the other possible outcomes:

-

Energy producers win, and high energy prices prevail – The real outcome would be that high prices for food and heat for homes would quickly kill off much of the world’s population because of lack of affordability.

-

Energy consumers always win, and low energy prices prevail – The real outcome would be that energy supplies would fall very rapidly because of inadequate prices. Population would fall quickly because of a lack of energy supplies (particularly diesel fuel) needed to maintain food supplies.

[4] Prices: Competition between producers and customers will lead to fossil fuel energy prices that alternately rise and fall as extraction limits are hit. In time, this pattern can be expected to lead to falling fossil fuel energy production.

Energy prices are set through competition between:

[a] The prices that consumers can afford to pay for end products whose costs are indirectly determined by fossil fuel prices. Food, transportation, and home heating costs are especially fossil fuel price sensitive. Poor people are the most quickly affected by rising fossil fuel prices.

[b] The prices that producers require to profitably produce these fuels. These prices have been rising rapidly because the easy-to-extract portions were removed earlier. For example, the Wall Street Journal is reporting, “Frackers Increase Spending but See Limited Gains.”

If fossil fuel prices rise, the indirect result is inflation in the cost of many goods and services. Consumers become unhappy when inflation affects their lifestyles. They may demand that politicians put price caps in place to somehow stop this inflation. They may encourage politicians to find ways to subsidize costs, so that the higher costs are transferred to a different part of the economy. At the same time, the producers need the high prices, to be able to fund the greater reinvestment necessary to maintain, and even raise, future fossil fuel energy production.

The conflict between the high price producers need and the low prices that many consumers can afford is what leads to temporarily spiking energy prices. In fact, food prices tend to spike, too, since food is a kind of energy product for humans, and fossil fuel energy products (oil, especially) are used in growing and transporting the food products. In their book, Secular Cycles, researchers Peter Turchin and Sergey Nefedov report a pattern of spiking prices in their analysis of historical economies that eventually collapsed.

With oil prices spiking only temporarily, energy prices are, on average, too low for fossil fuel producers to afford adequate funds for reinvestment. Without adequate funds for reinvestment, production begins to fall. This is especially a problem as fields deplete, and funds needed for reinvestment rise to very high levels.

[5] Demand for Discretionary Goods and Services: Indirectly, demand for goods and services, especially in discretionary sectors of the economy, will also tend to get squeezed back by the rounds of inflation caused by spiking energy prices described in Item [4].

When customers are faced with higher prices because of spiking inflation rates, they will tend to reduce spending on discretionary items. For example, they will go out to eat less and spend less money at hair salons. They may travel less on vacation. Multiple generation families may move in together to save money. People will continue to buy food and beverages since these are essential.

Businesses in discretionary areas of the economy will be affected by this lower demand. They will buy fewer raw materials, including energy products, reducing the overall demand for energy products, and tending to pull energy prices down. These businesses may need to lay off workers and/or default on their debt. Laying off workers may further reduce demand for goods and services, pushing the economy toward recession, debt defaults, and thus lower energy prices.

We find that in some historical accounts of collapses, demand ultimately falls to close to zero. For example, see Revelation 18:11-13 regarding the fall of Babylon, and the lack of demand for goods, including the energy product of the day: slaves.

[6] Higher Interest Rates: Banks will respond to rounds of inflation described in Item [4] by demanding higher interest rates to offset the loss of buying power and the greater likelihood of default. These higher interest rates will have adverse impacts of their own on the economy.

If inflation becomes a problem, banks will want higher interest rates to try to offset the adverse impact of inflation on buying power. These higher interest rates will tend to reduce demand for goods that are often bought with debt, such as homes, cars, and new factories. As a result, the sale prices of these assets are likely to fall. Higher interest rates will tend to produce the same effect for many types of assets, including stocks and bonds. To make matters worse, defaults on loans may also rise, leading to write-offs for the organizations carrying these loans on their balance sheets. For example, the used car dealer Caravan is reported to be near bankruptcy because of issues related to falling used car prices, higher interest rates, and higher default rates on debt.

An even more serious problem with higher interest rates is the harm they do to the balance sheets of banks, insurance companies, and pension funds. If bonds were previously purchased at a lower interest rate, the value of the bonds is less at a higher interest rate. Accounting for these organizations can temporarily hide the problem if interest rates quickly revert to the lower level at which they were purchased. The real problem occurs if inflation is persistent, as it seems to be now, or if interest rates keep rising.

[7] A second major conflict (after the buyer/producer conflict in Item [4], [5], and [6]) is the conflict in how the output of goods and services should be split between returns to complexity and returns to basic production of necessary goods including food, water, and mineral resources such as fossil fuels, iron, nickel, copper, and lithium.

Growing complexity in many forms is something that we have come to value. For example, physicians now earn high wages in the US. People in top management positions in companies often earn very high wages. The top people in large companies that buy food from farmers earn high wages, but farmers producing cattle or growing crops don’t fare nearly as well.

As energy supply becomes more constrained, the huge chunks of output taken by those with advanced degrees and high positions within the large companies gets to be increasingly problematic. The high incomes of citizens in major cities contrasts with the low incomes in rural areas. Resentment among people living in rural areas grows when they compare themselves to how well people in urbanized areas are doing. People in rural areas talk about wanting to secede from the US and wanting to form their own country.

There are also differences among countries in how well their economies get rewarded for the goods and services they produce. The United States, the EU, and Japan have been able to get better rewards for the complex goods that they produce (such as banking services, high-tech medicine, and high-tech agricultural products) compared to Russia and the oil exporting countries of the Middle East. This is another source of conflict.

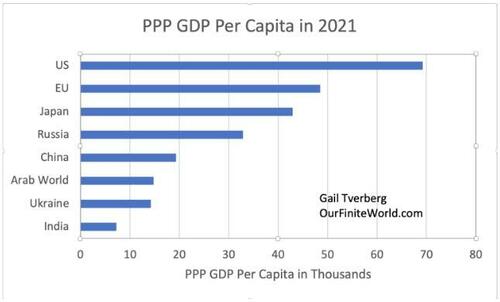

Comparing countries in terms of per capita GDP on a Purchasing Power Parity (PPP) basis, we find that the countries that focus on complexity have significantly higher PPP GDP per capita than the other areas listed. This creates resentment among countries with lower per-capita PPP GDP.

Figure 5. Average Purchasing Power Parity GDP Per Capita in 2021, in current US dollars, based on data from the World Bank.

Russia and the Arab World, with all their energy supplies, come out behind. Ukraine does particularly poorly.

The conflict between Russia and Ukraine is between two countries that are doing poorly on this metric. Ukraine is also much smaller than Russia. It appears that Russia is in a conflict with a competitor that it is likely to be able to defeat, unless NATO members, including the US, can give immense support to Ukraine. As I discuss in the next section, the industrial ability of the US and the EU is waning, making it difficult for such support to be available.

[8] As conflict becomes a major issue, which economy is largest and is best able to defend itself becomes more important.

Figure 6. Total (not per capita) PPP GDP for the US, EU, and China, based on data of the World Bank.

Back in 1990, the EU had a greater PPP GDP than did either the US or China. Now, the US is a little ahead of the EU. More importantly, China has come from way behind both the US and EU, and now is clearly ahead of both in PPP GDP.

We often hear that the US is the largest economy, but this is only true if GDP is measured in current US dollars. If differences in actual purchasing power are reflected, China is significantly ahead. China is also far ahead in total electricity production and in many types of industrial output, including cement, steel, and rare earth minerals.

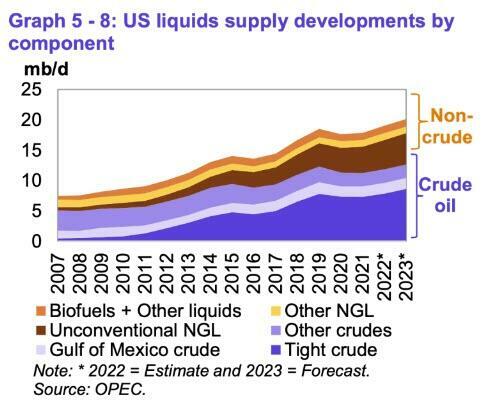

The conflict in Ukraine is now leading countries to take sides, with Russia and China on the same side, and the United States together with the EU on Ukraine’s side. While the US has many military bases around the world, its military capabilities have increasingly been stretched thin. The US is a major oil producer, but the mix of oil it produces is of lower and lower average quality, especially if obtaining diesel and jet fuel from it are top priorities.

Figure 7. Chart by OPEC, showing the mix of liquids that now make up US production. Even the “Tight crude” tends to be quite “light,” making it less suitable for producing diesel and jet fuel than conventional crude oil. Chart from OPEC’s February 2023 Monthly Oil Market Report.

Huge pressure is building now for China and Russia to trade in their own currencies, rather than the US dollar, putting pressure on the US financial system and its status as the reserve currency. It is also not clear whether the US would be able to fight on more than one front in a conventional war. A conflict with Iran has been mentioned as a possibility, as has a conflict with China over Taiwan. It is not at all clear that a conflict between NATO and China-Russia is winnable by the NATO forces, including the US.

It appears to me that, to save fuel, more regionalization of trade is necessary with the Asian countries being primary trading partners of each other, rather than the rest of the world. If such a regionalization takes place, the US will be at a disadvantage. It currently depends on supply lines stretching around the world for computers, cell phones, and other high-tech devices. Without these supply lines, the standards of living in the US and the EU would likely decline quickly.

[9] Clearly, the narratives that politicians and the news media tell citizens are under pressure. Even if they understand the true situation, politicians need a different narrative to tell voters and young people wondering about what career to pursue.

Every politician would like a “happily ever after” story to tell citizens. Fortunately, from the point of view of politicians, there are lots of economists and scientists who put together what I call “overly simple” models of the economy. With these overly simple models of the economy, there is no problem ahead. They believe the standard narrative about oil and other energy prices rising indefinitely, so there is no energy problem. Instead, our only problem is climate change and the need to transition to green energy.

The catch is that our ability to scale up green energy is just an illusion, built on the belief that complexity can scale up indefinitely without the use of fossil fuels.

We are left with a major problem: Our current complex economy is in danger of degrading remarkably in the next few years, but we have no replacement available. Even before then, we may need to do battle, in new ways, with other countries for the limited resources that are available.

https://ift.tt/ANcnoOp

from ZeroHedge News https://ift.tt/ANcnoOp

via IFTTT

0 comments

Post a Comment