Dollar Soars As Debt-Ceiling Doubts Monkeyhammer Markets

Higher inflation expectations, weaker sentiment, regional bank crisis growing (deposit data after the bell today), and record high risks of a debt-ceiling event appeared to finally break through the sentiment shield in stocks this week as Washington does what it does best - nothing until the last second.

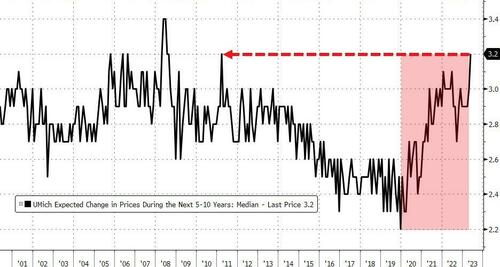

Despite nine Fed rate-hikes and sliding actual inflation and market expectations, UMich respondents haven't been this worried about inflation since 2008 (the red region is Biden's administration)...

Source: Bloomberg

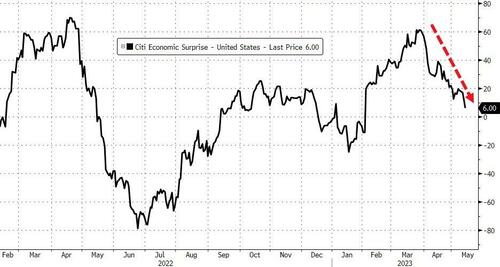

US Macro Surprise Index data tumbled to its weakest in 3 months...

Source: Bloomberg

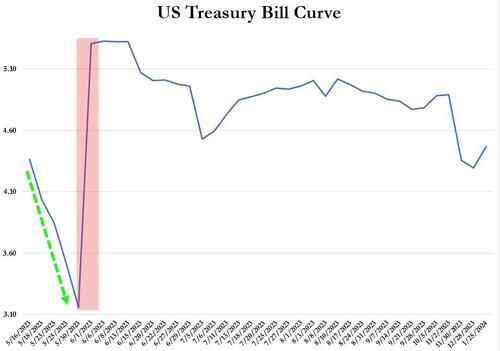

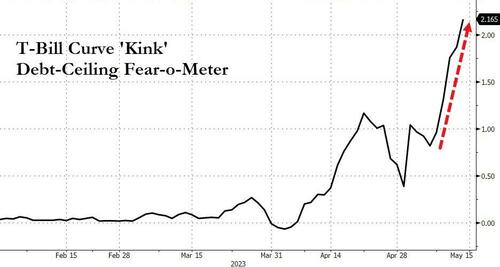

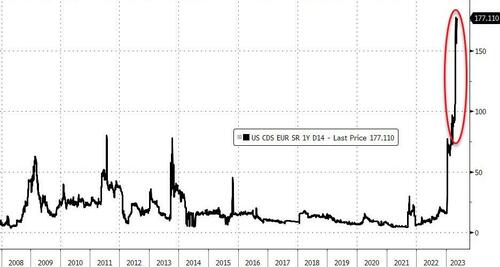

Event Risk #1 - Debt-Ceiling - is flashing bright red.

The T-Bill curve is fully bought in to Yellen's June 1st X-Date...

Sending the debt-ceiling fear-o-meter to cycle highs...

Source: Bloomberg

And USA sovereign risk to record highs (well above any prior episode)...

Source: Bloomberg

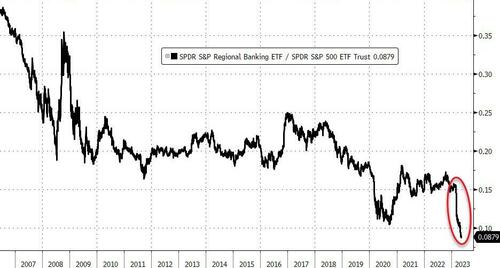

How about event risk #2 - regional bank crisis?

Usage of The Fed's backstop facility's surged last week (not a good sign) and PACW admitted 10% of its deposits left the building last week smashing regional bank stocks down hard off the squeeze highs (when everything was solved, remember)...

And in context to the broad market, regional bank stocks have never been lower...

And while the broad stock market have largely ignored these growing risks until now, this week saw an awakening across asset classes as everything was sold in favor the dollar safe haven.

A late day bounce pulled Nasdaq green on the week but The Dow and Small Caps lagged along with the S&P...

0-DTE traders defended S&P 4100...

Despite the equity weakness, bonds were also sold with the short-end underperforming on the week after selling today...

Source: Bloomberg

2Y Yield pushed back up to 4.00% today...

Source: Bloomberg

The dollar soared this week - its best week in 3 months

Source: Bloomberg

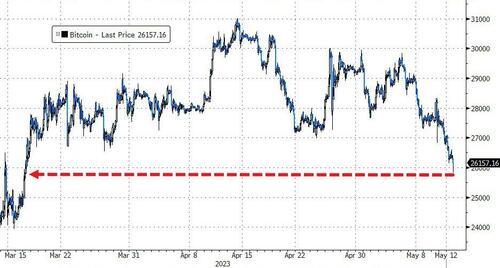

Bitcoin was battered back below $26,000 for its worst week since Nov '22...

Source: Bloomberg

Gold was down on the week with every bid punched in the face...

Oil fell for the 4th straight week with WTI briefly tagging a $69 handle...

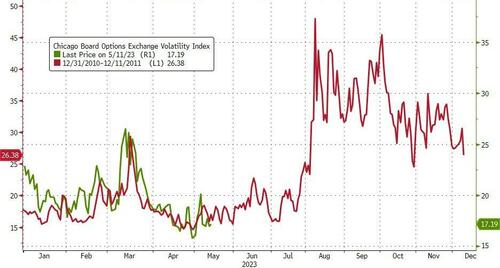

Finally, 2023 is starting to look a lot like 2011... can they hold out til August for the X-Date hammer to hit?

For the S&P...

Source: Bloomberg

And VIX...

Source: Bloomberg

And remember, the only way the market gets what it is hoping for from an absolute probability-weighted basis (i.e. imminent cuts), is if The Fed is forced into action by something really bad happening (and by bad we mean the market has collapsed - so the dovish implications of the forward curve can't happen unless the stock market crashes).

https://ift.tt/EjbcxfI

from ZeroHedge News https://ift.tt/EjbcxfI

via IFTTT

0 comments

Post a Comment