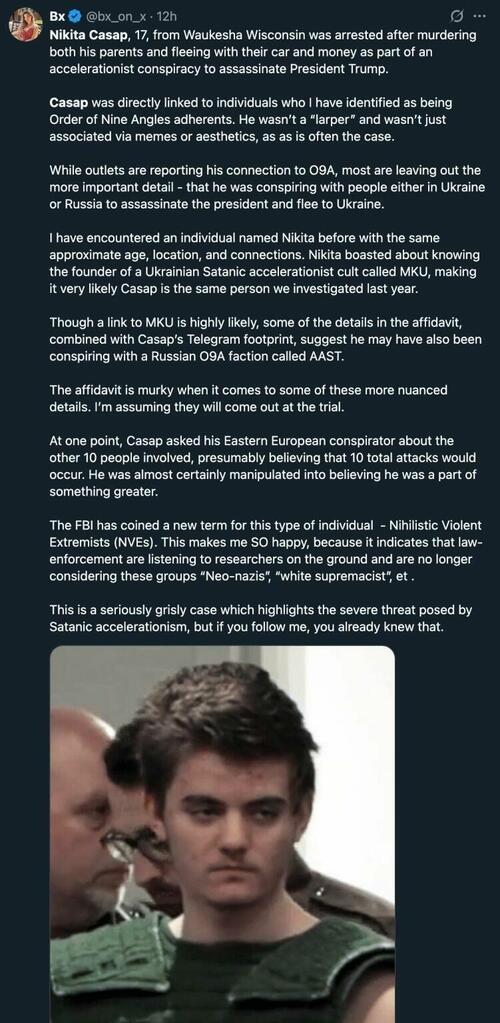

Wisconsin Man Who Killed Parents To Fund 'Satanic' Trump Assassination Attempt Sentenced

A Wisconsin teenager who murdered his parents and stole their money to fund his plan to kill President Trump with a bomb was sentenced to life in prison on Thursday.

Nikita Casap, 18, pleaded guilty in January to two counts of first-degree intentional homicide in the shooting deaths of his mother, Tatiana Casap, and his stepfather, Donald Mayer, last year. As part of a plea deal, prosecutors dropped seven other charges, including two counts of hiding a corpse and theft.

Investigators in the case say that Casap had put together a deranged fantasy whereby he would kill his own parents and use his inheritance to fund an assassination attempt on Trump - while simultaneously launching an anti-government insurgency.

He documented it in a manifesto titled “Accelerate the Collapse,” which was unveiled in a federal affidavit unsealed in the Eastern District of Wisconsin.

Referring to himself as “Awoken” and “accelerationist14,” the teenager detailed his plan to kill Trump, thereby igniting civil unrest all over the country.

Judge Ralph Ramirez of the Waukesha County Circuit Court debated whether to leave the door open to parole at some point - calling Casap's actions "horrific" and "inexplicable." He eventually handed down two life sentences with no chance at extended supervision, the term used for parole in Wisconsin.

"I choose to find he’s not eligible for extended release because I do not know … when and if and whether a profound and significant change can occur," Ramirez said.

As modernity.news wrote last April, Casap wrote of kicking off a race war, in order to “save the white race from Jewish control,” manufacturing bombs, and assassinating “Jewish politicians and billionaires.”

When authorities recovered messages from Casap’s devices, they discovered that he had gotten as far as communicating with international accomplices, seeking out how to acquire explosives and drone weaponization kits to deliver explosives and poisons, and was formulating an escape to Ukraine after completing “the job.”

Casap wrote that “There’ll never be a perfect revolutionary situation that springs up out of nowhere. We need to create a revolutionary situation ourselves. I do agree that only if terrorism is sustained over a period of time can it be effective.”

“In short, huge amounts of violence will be required,” he further declared, adding “Long past are the days when we can vote for a Hitler to save us. It is time we stop waiting. The best day to commit an attack is today, the next best is tomorrow.“

He further wrote, “It is time that we lead the way to the System collapse. Do absolutely anything you can that will lead to the collapse of America or any other country you live in. This is the only way that we can save the White race. White Revolution is the only solution.”

As this post further explains, Casap was also seemingly obsessed with the Satanic Order of Nine Angles:

According to WITI, investigators uncovered material on Casap's phone related to "The Order of Nine Angels" -- described by the FBI as a "satanic cult" with "strong anti-Judiac, anti-Christian and anti-Western ideologies" that claims to "incite chaos and violence."

Court documents also say Casap paid for, at least in part, "a drone and explosives to be used as a weapon of mass destruction to commit an attack." The warrant states Casap's alleged killings of his mother and stepfather "appeared to be an effort to obtain the financial means and autonomy necessary" to carry out the plan. -Fox11

The bodies of Casap’s parents were discovered on February 28 inside their home.

https://ift.tt/zBV8ygY

from ZeroHedge News https://ift.tt/zBV8ygY

via IFTTT