Will America's Trade Policy End Up Destroying The Dollar?

Authored by Alasdair Macleod via GoldMoney.com,

America’s tariffs against China are already showing signs of undermining the global economy and will create a funding crisis for the Federal Government when it leads to foreigners no longer buying US Treasury debt and selling down their existing dollar holdings. A subversive attempt by America to divert global portfolio investment from China by destabilising Hong Kong will force China into a Plan B to fund its infrastructure plans, which could involve actively selling down her dollar reserves and hastening the introduction of a new crypto-based trade settlement currency.

The US budget deficit will then be financed entirely by monetary inflation. Furthermore, the turn of the credit cycle, made more destructive by trade tariffs, is driving the global and US economy into a slump, further accelerating all indebted governments’ dependency on inflationary financing. The end result is America’s trade policies have been instrumental in hastening the end of the dollar as the world’s reserve currency, ultimately leading to its destruction.

Introduction

For almost two years President Trump has imposed various tariffs on imported Chinese goods. He advertised his tactics as hardball from a tough president who knows the art of the deal, taking his business acumen and applying it to foreign affairs. He even proudly described himself as a tariff man.

His opening gambit was to impose tariffs on some goods to get leverage over the Chinese, with the threat that if they didn’t cooperate, then further tariffs would be introduced. The Chinese declined to be cowed by threats, introducing tariffs themselves on US imports, particularly agricultural products, to bring pressure to bear in turn on President Trump.

Egged on by his trade adviser Peter Navarro and Commerce Secretary Wilbur Ross, Trump has continued to intensify his tariff policies, oblivious to the damage being done to the global economy. Putting aside Panglossian statistics, both America and China are now heading for a recession that is increasingly likely to deepen significantly. America’s consumer-driven economy is yet to reflect much of a slow-down, though producer countries dependent on either or both economies, such as Germany, are already descending into a manufacturing slump. China’s GDP is registering a growth rate of about 6%, low by Chinese standards, but being no more than a money total this is just a reflection of the quantity of money still being pumped into the Chinese economy by the authorities.

As the world descends into an economic contraction, it will not be reflected in government statistics, because all economies are having increasing quantities of fiat money pumped into them. Financial market participants naively believe that changes in GDP indicate an economy’s condition. If that was the case, the German economy in 1918-23 was an economic miracle and not the disaster history has led us to believe. The impoverishment of the masses, just like today’s reported impoverishment of Venezuelans and Zimbabweans must have been misreported, because nominal GDP was increasing ten or a hundredfold. Then there is the deflator. Ah, the deflator: a concoction by statisticians who appear to be under a government cosh to keep it as low as possible. That’s easy to deal with: introduce price controls across the board and use those official prices as a basis for the CPI. Infinite GDP growth is then assured.

That is the ultimate logic of perennial bulls and the errors should be obvious. At some stage, market participants beholden to the system will awaken to the lie that GDP, nominal or adjusted, has any statistical value, even in respectable jurisdictions. Banks will be rescued, and unemployment will rise, but GDP will continue to inflate - sorry, grow. The effect on prices so far has been subdued. At least, if you believe the official CPI version. Tariffs will end up blowing a hole in inflation targets while the global economy slumps and borrowing costs will then rise inexorably.

It’s time to discover why the America-China financial war and trade war will end up undermining the dollar.

US’s deep state strategy is stuck in the cold war era

Besides President Trump’s policy on tariffs, the permanent staff in the intelligence and military complexes are the driving force behind Cold War 2 against China and Russia. Russia has been in their sights since Yalta. Control of the Middle East along with Libya and Afghanistan have been key objectives. The Western alliance, comprising the US and its European handmaidens, has been focusing on oil, but at its root is the justification of US military spending. US taxpayers have been told that the Middle East, North Africa and more recently the Ukraine are important to stop Russia either dominating global energy supplies or pursuing territorial ambitions.

Russia’s military power is not as strong as projected by US military propagandists. It has excellent nuclear capability but an underequipped out-of-date military. Who can forget the sight of Russia’s one aircraft carrier, the Admiral Kuznetsov, chugging from the Baltic to the Mediterranean to come to Syria’s aid, breaking down and emitting clouds of black smoke, needing tugs to nurse it along? It is the naval equivalent of the ghastly Trabant motor car of the 1980s. The most egregious example of Russia’s non-nuclear might perhaps, but indicative, nonetheless.

The same is broadly true of Russia’s army. Its capability is limited, and American battle failures in the field are their own. Russia does not even try to punch above its weight, choosing to dance round the ring and tire out its opponent that way. Despite its superior equipment and battlefield technology, America usually then succumbs to its own errors.

As an adversary, China is in a different league to Russia altogether. At least America’s military complex knows not to take China on. Instead, more subversive tactics are deployed, and this is why Hong Kong has become the pressure point against China, destroying the investment link for international funds investing in Chinese infrastructure projects.

Logically, America should have accommodated China long ago, recognizing the dollar’s role as the supreme fiat currency would not then be challenged. But that would have led to the entire military complex being downsized over time: peace is not good for the war business. Without doubt it would have been economically beneficial for everyone other than the military. American corporations were happily running manufacturing operations in China and South East Asia as high-quality processors in their supply chains. Trump’s simple world, where China steals American jobs was never the case.

US Government’s developing funding crisis

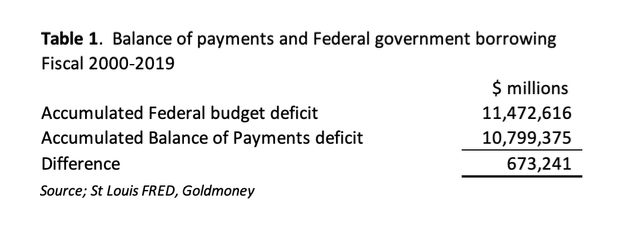

The statistics in Table 1 summarise America’s financial problem.

These figures tell us that since the turn of the millennium 94% of America’s accumulated budget deficit is covered by the accumulated balance of payments deficit. In other words, almost all the budget deficit is financed directly or indirectly by inward capital flows, and very little can be attributed to genuine demand for US Treasuries by America’s savers.

This result is to be expected, since it reflects an accounting identity at the national level. The accounting identity tells us that unless there is an increase in national savings, a budget deficit will be financed by capital arising from the trade deficit. We can also say the money to cover the budget deficit in the absence of capital inflows and an increase in savings can only be through monetary inflation. In other words, through the debasement of the currency substituting for genuine savings.

In practice, foreign-owned dollars do not all go into US Treasuries, and investment outflows must be taken into account as well. Since 2000, according to Treasury TIC figures these are approximately $9 trillion, while total investment inflows at about $16 trillion leaves us with net inflows of $7 trillion, implying that foreign-owned cash and deposits in the US banks will have expanded to fill the gap between investment flows and the total balance of payments deficit. And indeed, we find that these balances amount to $4.3 trillion, accounting almost entirely for the gap between net inflows and the accumulated budget deficit in Table 1.

Obviously, there are other flows involved, but they are not material to the point. In the absence of an increase in savings, a budget deficit will always lead to a balance of payments deficit. How it is covered, by a combination of net inward capital flows and monetary inflation is a separate, but important consideration to which we will return later.

Now that the US faces a recession, the budget deficit will rise due to lower than forecast tax receipts and higher than expected welfare costs. The deeper the recession, the greater the deficit, which before the recessionary effect is factored in was forecast by the Congressional Budget Office to be just over one trillion dollars for the current fiscal year, which is two months in. It will obviously be somewhat higher, requiring funding by a combination of inward capital flows and monetary expansion.

If the foreigners don’t play ball, funding the budget deficit will be entirely down to monetary inflation. Worse, if they reduce their dollar holdings, not only will monetary expansion have to make up the funding difference for the government, but it will also have to address net foreign sales of existing treasuries and other US dollar assets as well. At end-June 2018 the total value of those assets including those held before 2000 were recorded at $19.4 trillion, plus bank deposits and short-term assets of $4.3bn, taking the total to $23.7 trillion.[i] This is the same approximate size as the US Government’s total debt and slightly more than US GDP.

Will foreigners sell US assets?

Naturally, dollar-based capital markets believe in the dollar and its hegemonic status. This extends to a belief that foreigners in financial trouble will always demand dollars and the more their trouble the greater their demand for dollars is likely to be. It is a mantra that ignores the fact that foreigners are up to their eyes in dollars already.

Look at it from China’s point of view. The bulk of her foreign reserves of $3.1 trillion are in dollars, with about one third of it in US Government debt. She is helping America to finance its military, which aims to contain and crush China. It’s rather like giving the school bully your baseball bat and inviting him to hit you with it. Furthermore, China’s military strategists have their own view of how America uses her currency’s hegemonic status, and it is not a casual one. They know, or think they know why America has stirred up Hong Kong, and that is to prevent global portfolio flows being invested in China, because America is desperate to have them instead.

It leaves China with a serious problem. She had expected inward global portfolio flows to help finance her infrastructure projects, and the Americans have effectively succeeded in closing down the Hong Kong Shanghai-connect link, through which foreign investment was to be directed. She is now in a position whereby she may have no alternative but to put her plans on hold or use her own dollar reserves to that end. Besides her US Treasury holdings, she is likely to have a further trillion or so in short-term instruments and bank deposits to draw on.

A decision to actively reduce her holdings of US Treasuries would not be taken lightly by China. The response from America would likely be an intensification of the financial war, perhaps including an emergency power to stop China selling her Treasury stock. If that happened, China would have no option but to respond, and a dollar crisis would almost certainly ensue. While outcomes with a rational opponent are theoretically predictable, President Trump’s actions and how they mesh with the deep state are less so, making the consequences of any action taken by China deeply unpredictable.

We shall have to wait to see how this next stage plays out. Meanwhile, the inflationary outlook in America is already deteriorating.

FMQ confirms a reacceleration of monetary inflation

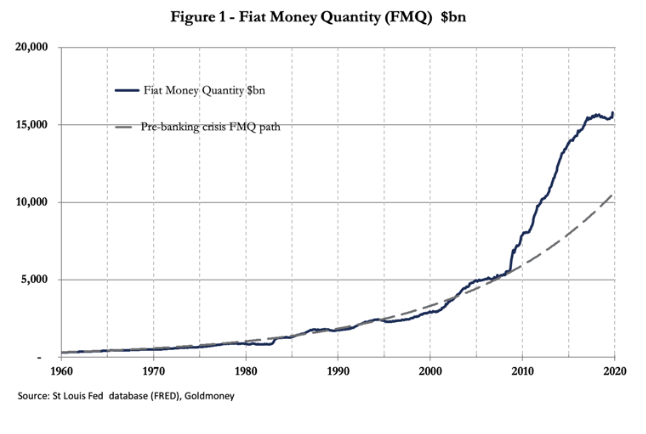

After pausing in its headlong growth since the Lehman crisis, the fiat money quantity surged into record territory at $15,812bn at the beginning of October (Figure 1).

FMQ is the sum of Austrian true money supply and bank reserves held at the Fed. The reason for its renewed growth is the Fed’s easing by injecting money into the system through its repurchase agreements. FMQ for the beginning of November is likely to be higher still.

Something is amiss systemically, which appears to require continual monetary injections to prevent a financial crisis. The US economy having been already flooded with money following Lehman, this development is deeply worrying and possibly marks a countdown to the next credit crisis.

Price inflation will get out of control

To independent analysts, it should be clear by now that the world is probably teetering on the edge of a cyclical credit crisis, which this time is coupled with the destructive synergy of trade tariffs. Equally, it is obvious that while central bankers and politicians suspect something is wrong, they are clueless about the forces involved, otherwise they would not have implemented monetary policies that led to the situation today.

In the short-term, as we saw with the Lehman crisis when a credit crisis hits, there will probably be a panic into safety. But for the eventual outcome we must look beyond any initial effect. America and its dollar are central to how events will evolve. As already shown in this article the dollar is over-owned by foreigners, relative to ownership of foreign currencies by Americans. The basis of both categories of ownership is commercial assumptions about current and future prospects for international trade. For this reason a slump will cause demand for all currencies to contract, which in the dollar’s case will need to net selling greater than any repatriation of capital from abroad. Even though most dollars are actually held by foreign governments and their agencies, their strategic reserve decisions are ultimately driven by economic factors.

Assuming the global economic slump deepens over the next few years, at a time when the American budget deficit will be increasing rapidly foreigners will be sellers of dollars and underlying US assets, including US Treasuries. Unless private sector actors in America increase their propensity to save, the budget deficit will have to be financed instead entirely by inflationary means.

Broadly, other than intertemporal factors there are two ways in which monetary inflation can translate into higher prices: a relative desire to reduce possession of the currency relative to goods either by domestic users or by foreigners. The two preceding paragraphs describe why foreigners are likely to turn sellers for reasons of trade, to which we can add the further consideration that over the last year a combination of a rising dollar and falling US Treasury yields have been immensely profitable for them, an experience which might not be repeated next year. So, while domestic users may be slow to see the dollar’s purchasing power accelerate in its decline, the push to a weakening dollar is likely to come from abroad, at least initially.

All holders of dollars will find that their ownership of dollars relative to goods will be increasing rapidly, due to inflationary financing to cover a rising budget deficit. Instead of consumers and other economic actors associated with Main Street, the banks owe the bulk of their balances and deposits to other financial entities and foreigners. Therefore, the domestic monetary system is potentially more footloose than in the past. The risk to the Fed is that this deposit cohort is more likely to take its cue from factors such as the foreign exchanges, the price of gold and even cryptocurrencies, speeding up the fall in the dollar’s purchasing power once it begins to slide.

It is a long time since we have seen it, but when the smart money begins to view things negatively, everything the Fed does with monetary policy, or the executive does fiscally, leads to failure. A falling dollar leads to rising interest rates in the markets, and the government’s funding crisis will be laid bare for all to see. And with the Fed and the US Treasury staffed with neo-Keynesians, a policy reversal to stabilise the currency by making it sound will be the last thing that happens.

A world driven to trade isolationism

American trade policy under President Trump is isolationist and at odds with the role of a reserve currency. His mantra of “Make America Great Again” and his determination to build a wall on the Mexican border are testament to his thinking. If anything, America’s introspection towards Russia and China has strengthened their partnership as joint Asian hegemons. Their decision to progress their economies without America and its dollars was taken by America for them. Russia has already turned most of her dollars into gold and continues to do so. China’s plans to evolve her economy into a more consumer oriented one are underway, but she is still too dependent on export-oriented trade to disregard ties with her Western trading partners.

Consequently, China can be expected to accelerate plans for her vision of a consumer-driven middle class. In order to do so she will dispose of the dollar for trade purposes as much as possible. At the meeting of the BRICS nations in Brazil earlier this month, a common cryptocurrency was discussed, ostensibly to reduce currency volatility, but in reality, to eliminate the dollar as a common settlement medium between BRICS members.

So far, China has seen the redundancy of the dollar as a gradual evolutionary process. But America’s policy of diverting global portfolio flows from China is likely to lead to China drawing down on her foreign reserves, particularly her holdings of US dollars, to replace expected capital inflows. She will still be dependent on imports of raw materials, for which some dollars will be needed; but so long as she has a trade surplus, and she insists on her preferences for trade settlement by other means, China’s dollar requirements will be minimised.

China can probably weather the political consequences of a collapse in international trade, because for the population American aggression is clearly to blame. While China has had to amend its plans and is resisting precipitative action, there can be no doubt her determination to do away with the dollar is more urgent. Together with Russia, the other BRICS members and the Shanghai Cooperation Organisation as well as her trade counterparties in sub-Saharan Africa, China’s policies for trade settlement without the dollar will affect more than half the world’s population.

And when you get establishment figures in the Western banking system, such as Mark Carney, openly speculating at Jackson Hole last August about a replacement for the dollar in international trade, you know the dollar’s jig is finally up.

https://ift.tt/35Nf5v9

from ZeroHedge News https://ift.tt/35Nf5v9

via IFTTT