A $20 Trillion Problem: More Than Half Of China's Banks Fail Central Bank Stress Test

In our latest look at the turmoil among China's small and medium banks, which included not only the recent bailouts and nationalizations of Baoshang Bank , Bank of Jinzhou, China's Heng Feng Bank, but also the two very troubling bank runs at China's Henan Yichuan Rural Commercial Bank at the start of the month, and then more recently at Yingkou Coastal Bank.

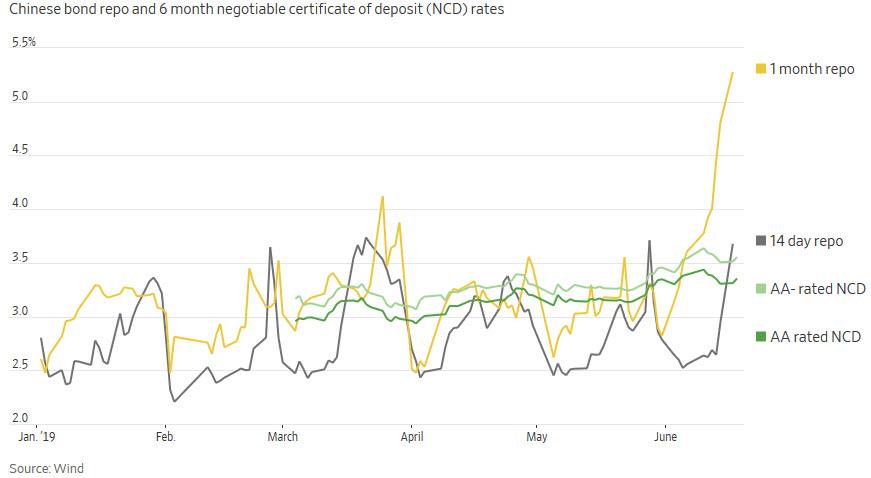

As we further explained, the reason why so many (for now) smaller Chinese banks have found themselves either getting bailed out or hit by bank runs, is that in a time when China's interbank/repo rates have surged amid growing counterparty concerns, increasingly more banks have been forced to rely almost entirely on deposits to fund themselves, forcing them to hike their deposit rates to keep their funding levels stable.

Meanwhile, cuts in key lending rates since August to stimulate up a slowing economy have only exacerbated net interest margin pressures on banks.

In other words, with less income from lending and without the full suite of funding options available to much larger peers, the interest rates that China’s legion of small banks may have to offer to attract deposits could further undermine their stability. The irony is that to preserve their critical deposit base, small banks have to hike deposit rates even higher to stand out, in the process sapping their own lifeblood and ensuring their self-destruction, or as we dubbed it earlier, China's own version of Europe's "doom loop."

Dai Zhifeng, a banking analyst with Zhongtai Securities, told Reuters the funding difficulties risked distorting small banks’ behavior, making failure even more likely: "Lacking core competitiveness, some of them have turned to high-risk, short-sighted operations," he said, adding that a liquidity crunch was possible at some institutions.

But for a nation with a $40 trillion financial system, double the size of US banks, and well over 4,000 small, medium and massive, state-owned banks, here please recall that the 4 largest banks in the world are now Chinese:

- ICBC: $4TN

- China Construction: $3.4TN

- Agri Bank of China: $3.3TN

- Bank of China: $3.1TN

... the question how many banks will fail in the near future, is especially relevant not only for China but for the entire world.

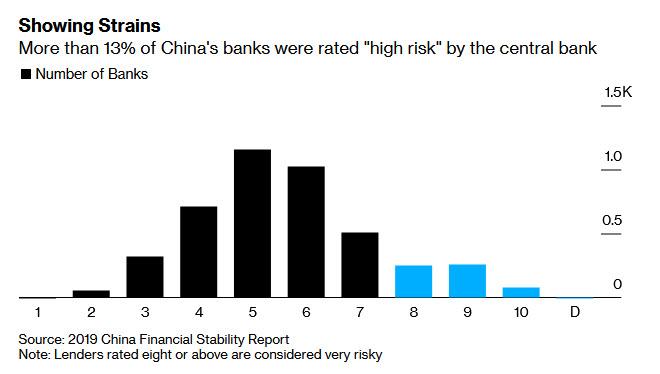

Luckily, we got an answer from none other than China's central bank, which on Monday said that China’s banking sector is "showing signs of strain", with more than 13% of 4,379 lenders now considered “high risk” by the central bank.

In other words, take the 5 banks listed above which either suffered a bank run and/or were bailed out or nationalized, and add to them over 500 which are about to suffer the same fate.

As Bloomberg reports, in the PBOC's its 2019 China Financial Stability Report, the high risk category contains 586 banks and financing firms, most of which are smaller rural institutions. The report also comically noted that one bank got a "D" grade this year, meaning it went bankrupt, was taken over or lost its license. No banks were named in the report.

And here is why the next global financial crisis will likely start in some backward Chinese province best known for its massively polluting coal plants, ghost cities and made up GDP data: while foreign and private banks are seen as relatively safe, more than one third of rural lenders were rated "high risk," or those which are near failure.

Additionally, some medium- and small-sized financial institutions received poor ratings because of the slowing economy, with small lenders more sensitive to swings in the economy.

What did the PBOC do with this doomsday list? As Bloomberg reports, the central bank notified each bank of its rating, and required some to increase capital, reduce bad loans, limit dividends and even change management. In short, trillions in Chinese bank (non performing) assets are about to mysteriously disappear off the books while hundreds of local banks scramble to inject liquidity in their balance sheets, effectively removing free liquidity from the interbank market.

Separately, the PBOC also stress tested 30 medium- and large-sized banks in the first half of 2019. In the base-case scenario, assuming GDP growth dropped to 5.3% - or well above where China's real GDP is now - nine out of 30 major banks failed and saw their capital adequacy ratio drop to 13.47% from 14.43%. In the worst-case scenario, assuming GDP growth of 4.15%, or less than 2% below the latest official GDP print, more than half of China's banks, or 17 out of the 30 major banks failed the test. So with the entire Chinese financial system roughly $40 trillion, this suggests that China now has a rather insurmountable $20 trillion problem on its hands.

Separately, a liquidity stress test at 1,171 banks, representing nearly three-quarters of China’s banking sector by assets, showed that 90 failed in the base-case and 159 in the worst-case scenario.

* * *

According to the central bank, it made progress in containing financial risks in the past year, but warned that some potential threats require more time to eliminate. Financial risks can “occur easily” and more frequently as the economy cools and the risk of a slowdown in global growth increases, it said, clearly offering a very non-subtle hint of what is coming.

Faced with this complex situation, the central bank said that it should “stay cool-headed” to keep a balance between economic growth and risk control. It also means that the PBOC is now trapped - on one hand it can't cut rates further as it will push even more small banks into insolvent as per the "doom loop" described earlier, on the other it can't hike rates as then the entire economy would slow, resulting in unprecedented devastation and tens of trillions in bank assets wiped out.

Next year marks the last year in a three-year campaign by policy makers to contain financial risks. The PBOC said it will “fine-tune” its policies to fit the economic situation, ensuring that they aren’t too tight or too loose according to Bloomberg. The general direction of containing financial risks will be unchanged, in other words, despite the clear signs that things are bad and getting worse by the day - yes, there were two bank runs in the past two weeks - after years if not decades without a single bank crisis - the PBOC will do what China has been so good at doing in the past decade when it comes to addressing the unprecedented risks associated with a 320% debt/GDP and a $40 trillion financial system.

https://ift.tt/2XUhD8a

from ZeroHedge News https://ift.tt/2XUhD8a

via IFTTT

0 comments

Post a Comment